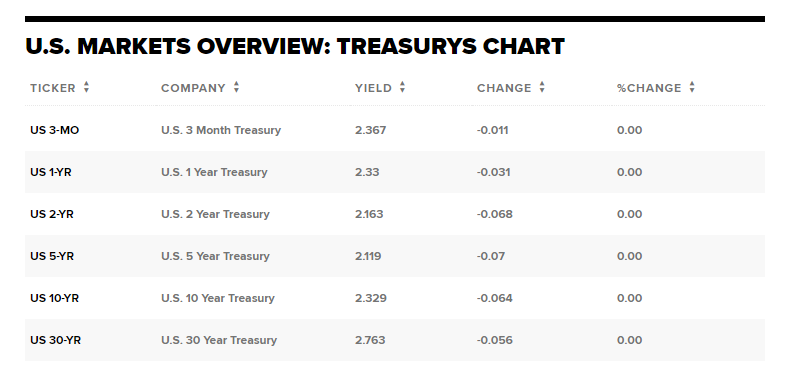

The yield on the 10-Year Treasury note dipped to its lowest level since 2017 on Thursday as Wall Street appears to be digging in for a trade war between the U.S. and China that now appears will last for the foreseeable future.

The yield on the benchmark 10-year Treasury note — which moves inversely to price — dipped to 2.361%. The yield on the 30-year Treasury bond also dipped lower to 2.785% after falling all the way to 2.773%, its lowest level since Jan. 2, 2018, when it fell to 2.744%.

As trade tensions continue to escalate as the U.S. increased tariffs on $200 billion worth of Chinese goods from 10% to 25% on May 10 and threatened to hit another $300 billion worth of Chinese imports with 25% tariffs.

China also has taken a stronger tone of late.

“If the U.S. would like to keep on negotiating it should, with sincerity, adjust its wrong actions,” Beijing’s U.S. Ministry of Commerce spokesman Gao Feng said. “Only then can talks continue.”

As the rhetoric continues to heat up, investors are hunkering down.

“The Treasury market is trading higher this morning as the apparent differences between the U.S. and China is quickly morphing from a trade issue to an all-out trade war,” Raymond James’ head of fixed income capital markets wrote in a note Thursday, according to CNBC. “The tariffs are increasing, and the rhetoric has reached a feverish pace. This back-and-forth is beginning to convince economists that we could not only engage in a trade war with China, but it could last for longer than most expect.”

Per CNBC

Wednesday’s release of the minutes from the last meeting of the Federal Reserve also showed central bank officials agree to keep patient in regards to interest rate hikes, and that current policy will likely remain in place “for some time.”