The health care sector has led the pack in two of the last three weeks, a fantastic sign for a sector that has been one of only a few laggards in this bull market.

Zooming out, the broad Health Care Selector Sector SPDR Fund (XLV) is still down 11.4% since August 2024, while the S&P 500 has gained almost 15%.

Clearly, there’s still plenty of ground to make up…

So let’s dig in and see how much has changed in the health care sector based on my Green Zone Power Rating system, including how things look based on arguably the most popular individual factor in my system.

Health Care Sector Leans a Little More Bearish

The health care sector once again beat out the 10 other major market sectors last week. It’s the second time this has happened in the last three weeks.

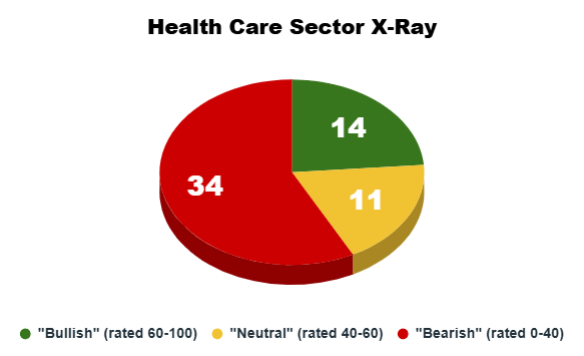

Let’s run my Green Zone Power Rating x-ray to see what has changed in the general make-up of “Bullish,” “Neutral,” and “Bearish” stocks.

Here’s how things looked two weeks ago for the broader health care sector:

- 14 stocks rated Bullish (60 – 100 overall rating).

- 13 stocks rated Neutral (40 – 60).

- 32 stocks rated Bearish (0 – 40).

Not much has changed since July 29, and that’s not a huge surprise given that my system is based on holding stocks for the long run:

While the total number of “Bullish” stocks has stayed the same, we have two fewer “Neutral” stocks and two more “Bearish” stocks.

With the sector looking more “Bearish” overall, this confirms my idea that investing broadly in the sector with an exchange-traded fund (ETF) is not the best option right now.

We’re seeing even more separation from those 14 “Bullish” stocks and the much larger batch of “Bearish” tickers, which tells me that investors are gravitating toward those winning stocks and leaving the stragglers behind.

I’ll reiterate my takeaway from two weeks ago here:

This initial “x-ray” is a great starting point. It tells us that there is opportunity in the health care sector, but not broadly … and we’re going to have to pull up our sleeves to find it.

And one factor should highlight the stocks that are riding that positive price momentum now…

Momentum in the Health Care Sector

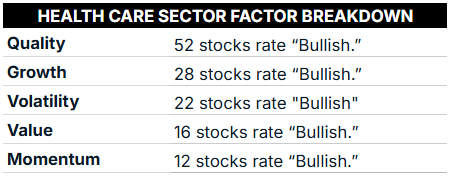

Looking at my individual Green Zone Power Rating factor ratings for the health care sector, and again, not much has changed since running the numbers two weeks ago:

We have the same number of stocks with “Bullish” Quality and Volatility. Again, I’ll reiterate that the health care sector is brimming with high-quality stocks. To read more about it, check out my piece from two weeks ago here.

We have 28 stocks with “Bullish” Growth, compared to 26 on our last screen. To go along with that shift, we have two fewer stocks that rate “Bullish” on Value. That small change shows my system’s adaptability in action! As investors buy into stocks with strong growth, we see lower Value ratings (i.e., more expensive valuations) as their prices increase.

Lastly, we have one fewer stock that rates “Bullish” on my Momentum factor. Let’s see what we can learn from those 12 tickers…

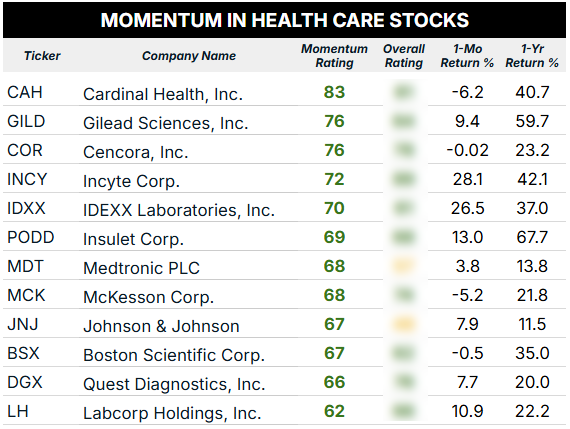

The table below shows those 12 stocks and how they rate on my Momentum factor, as well as their one-month and one-year returns. I’ve blurred the overall ratings, but I can tell you that 10 out of 12 rate “Bullish” or “Strong Bullish” overall.

If you want to run these tickers through my system to see the full ratings picture, click here to see how you can gain unlimited access to Green Zone Power Ratings with a Green Zone Fortunes subscription.

Looking at the one-year returns, all 12 of these stocks have gained, while 10 of the 12 have handily beaten the S&P 500’s 14.5% gain over that time frame. Over the last month, there are a couple of stocks (INCY and IDXX) that have absolutely crushed the broader market’s 2.2% gain.

I will point out that these are relatively low Momentum ratings overall. Only one stock, Cardinal Health Inc. (CAH), boasts a “Strong Bullish” 80+ score on the factor.

This isn’t a bad thing, of course! We’re looking for “bullish” momentum, and when combined with strong ratings on my other factors, a stock can ride that momentum higher for months and years ahead.

But these lower ratings point to that “cautious optimism” in the health care sector overall.

To good profits,

Editor, What My System Says Today