Just two weeks ago, I noted how no “New Bulls” from the broader S&P 500 passed my screen.

Of course, it wasn’t an issue as 30 stocks outside the index did.

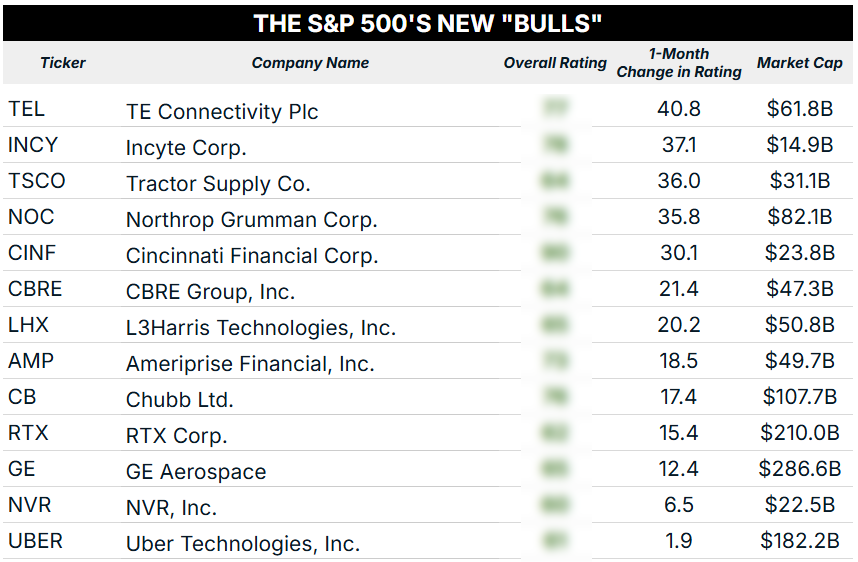

It’s funny how things can change so rapidly … because, after running the numbers this week, we have 14 S&P 500 stocks that cleared the “Bullish” 60+ threshold within my Green Zone Power Rating system.

And there’s a fantastic trend I’ve spotted in most of the stocks on this week’s list.

Let’s get right to it!

Some BIG Ratings Moves

Sometimes, when analyzing stocks or market trends, the insights are nuanced, requiring some extra time and brain power to make those meaningful connections that can translate into market-beating opportunities.

Other times, like this week, the data is glaringly obvious … like the McDonald’s “Golden Arches” spotted from a mile away as your stomach grumbles on a late-night interstate drive.

Before we get to that, a quick refresher of how stocks land on my “New Bulls” list every Thursday:

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”).

- The stock must have been rated less than 60 for each of the last four weeks.

And here are the 14 S&P 500 stocks that passed my screen this week:

There are some subtle trends here, like a heavier representation of financial stocks, as well as aerospace and defense stocks. (More on that in a second.)

But what really stood out to me at first glance is that these are some huge one-month ratings moves!

Of the 14 stocks above, 12 stocks (85%) had double-digit improvements to their overall rating over the last four weeks. Five of these tickers improved by 30+ ratings points!

And we’re talking about stocks with massive market caps … stocks that take an outsized vote of confidence from investors to really move the needle. The smallest company on this list is NVR Inc. (NVR), and it still boasts a $22.5 billion market cap.

It speaks to the strength of the current bull market. Investors are confident that the bullish trend will continue, and they’re putting money to work.

Now, let’s close out today’s analysis with a brief look at the aerospace and defense industry…

The Defense Spending Mega Trend

Of the stocks that passed this week’s “New Bulls” screen, four are within the aerospace and defense industry: NOC, LHX, RTX and GE.

With global tensions simmering and President Trump signing off on his “One Big Beautiful Bill”, which includes an increase of $150 billion in U.S. defense spending, it’s clear that investors are looking for the companies that will be awarded the lion’s share of these new government contracts.

My Green Zone Power Rating system has pointed to four strong candidates this week. But I’ve actually been tracking the defense mega trend for a while now…

One of the top-performing stocks currently in my Green Zone Fortunes model portfolio is a defense stock with an artificial intelligence twist. It’s currently showing open gains of almost 600% since adding it to the portfolio in March 2024.

Just yesterday, I sent out the latest monthly issue of my flagship premium newsletter. Inside this July issue, I’m recommending another stock in the aerospace and defense industry. It currently rates “Strong Bullish” in my Green Zone Power Rating system, which none of the four stocks above can boast.

If you’re curious to learn more, click here to see how you can join me in Green Zone Fortunes now. You’ll gain access to that brand-new monthly issue, my complete model portfolio, and unlimited access to look up thousands of stock ratings (including the 14 above).

I can’t wait to see you there!

To good profits,

Editor, What My System Says Today