Matt here again, stepping in for Adam as he enjoys some much-deserved time away with his family for the holiday week.

As I showed you yesterday, the Communication Services Select Sector SPDR Fund (XLC) led the broader market’s bullish run last week. So let’s take some time today to examine how both sectors look as a whole through the lens of Adam’s Green Zone Power Rating system and what individual factors stand out.

One of Adam’s fundamental factors, in particular, presents a great teaching moment about our six-factor approach.

Let’s start with our x-ray of the communications sector…

Communications Sector X-Ray

After leading the market with a 5% gain last week, I was curious to see how XLC has performed this year overall. Think of this as a mid-year check-up.

And what I found was encouraging for the second half of 2025. The sector is up 11.5% year-to-date, and what’s even better is that it’s up more than 25% since its April low following President Trump’s “Liberation Day” tariff announcement.

While that’s pretty much tracking the S&P 500’s performance since April, which gained roughly 24%, it’s a good sign that the sector isn’t lagging behind.

This means that we should definitely look closer at XLC for opportunities to beat the market.

To do that, let’s start with our standard sector “x-ray,” where we run all of XLC’s holdings through the Green Zone Power Rating system to see how bullish or bearish the sector is overall.

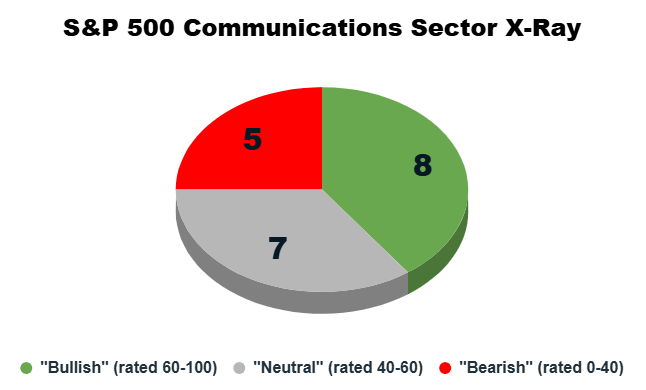

Each of XLC’s 20 holdings falls into one of three buckets in Adam’s system:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

You can see the breakdown in the pie chart below:

While XLC isn’t quite as heavily weighted to the “Bullish” side as Adam showed you with the utilities sector (XLU) last week, it’s still encouraging to see that only five (25%) of S&P 500 communications stocks rate “Bearish.”

This means that we have a much better chance of finding individual stocks that will either beat the broader market or at least track its broad performance over the next 12 months.

That’s great news when we’re in the middle of a strong bull market like the one we’re in currently.

Now, let’s examine individual Green Zone Power Rating factors to determine what is driving this positive trend.

Quality Is a Driving Factor

Pardon the pun in the headline above. I couldn’t help myself…

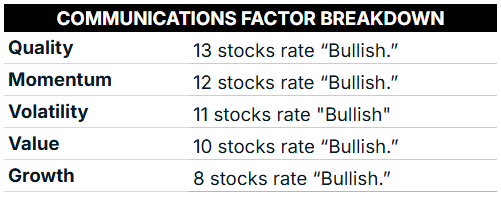

However, as you’ll see in the table below, more than half of the communications sector stocks we screened rate “Bullish” on our system’s Quality factor. That tells me that these are healthy businesses with strong balance sheets.

Looking at the numbers overall, XLC could broadly be defined as a group of strong businesses … with stocks trading at a slight premium and steadily climbing higher (solid Momentum, Volatility and Value ratings).

Just don’t expect gangbuster growth since less than half (40%) rate well on that factor.

With that as a preface, I wanted to look more closely at Quality since it tops the list above, and I’ll do that by examining one of the submetrics that we are constantly tracking: return on equity (ROE).

ROE measures how much profit a company generates from every dollar of shareholder equity. It shows how efficiently a company uses shareholder equity to turn profits.

The higher a company’s ROE, the more profit from shareholder equity it generates.

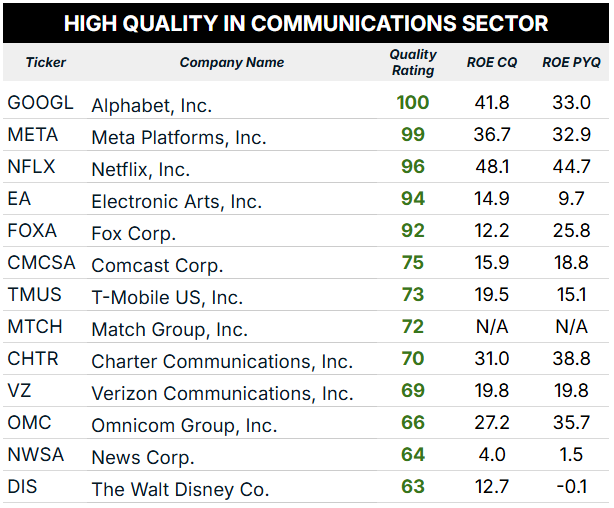

In the chart below, you’ll find each stock’s bullish Quality rating, its current quarter’s ROE and its ROE from that same quarter a year ago:

What you are looking for here are companies that have grown their ROE over time, and the ones that rate especially well on the Green Zone Power Ratings Quality factor have done that.

Just look at the three big names at the top of this list: Alphabet Inc. (GOOGL), Meta Platforms Inc. (META) and Netflix Inc. (NFLX). These companies get an enormous amount of shareholder investment.

The fact that they are turning those investment dollars into more profit speaks to the strong financial health of each company … and the potential for future growth.

Looking a little further down the list, Match Group Inc. (MTCH) doesn’t have a current ROE, and that’s because the company has more liabilities than assets. Its higher Quality rating is based on other submetrics, like return on assets (13.2% versus an industry average of -10%) and net margin (15.8% compared to the industry average of -11.8%).

That’s my deep dive into our Green Zone Power Rating system for today. If you’d like to look up any of these stocks to see how they stack up overall in Adam’s system, click here to see how you can join Green Zone Fortunes and gain unlimited access now.

Otherwise, have a great Tuesday. I’ll be back tomorrow with more…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets