It’s Black Friday!

Maybe you’ve already returned from your early morning scrum to secure the doorbuster deal on that Keurig for Nonna. Or maybe you’re sipping your coffee now, bracing for the madness that awaits you at Target later.

You could be like me … with nothing on your docket but leftovers, naps to digest said leftovers and endless scrolling through Amazon deals while A Christmas Story plays in the background.

With the convenience of online shopping, Black Friday doesn’t quite boast the same frenzy that it used to. Why pummel a random stranger for that Furby when you can just click a couple of buttons and it’ll show up on your doorstep?

Now retailers start sales early and extend them well beyond the holiday weekend just to secure whatever profits they can.

And with certain retailers already warning of a weaker holiday season ahead, I wanted to see how some of these retail stocks looked in Adam O’Dell’s proprietary Green Zone Power Ratings system.

Let’s start with a classic stock for this time of year…

The Big M

Nothing says Thanksgiving like Macy’s.

I’m sure most of you have fond memories of taking in the parade on TV while delicious smells of stuffing and gravy waft through your house.

And the mega retail chain has something to be happy about heading into the busy holiday season. It just posted a solid earnings beat, with earnings per share coming in at $0.21 versus zero cents expected. It brought in more revenue than analysts expected as well.

Investors pushed M shares 6% higher following the beat, which is a solid gain!

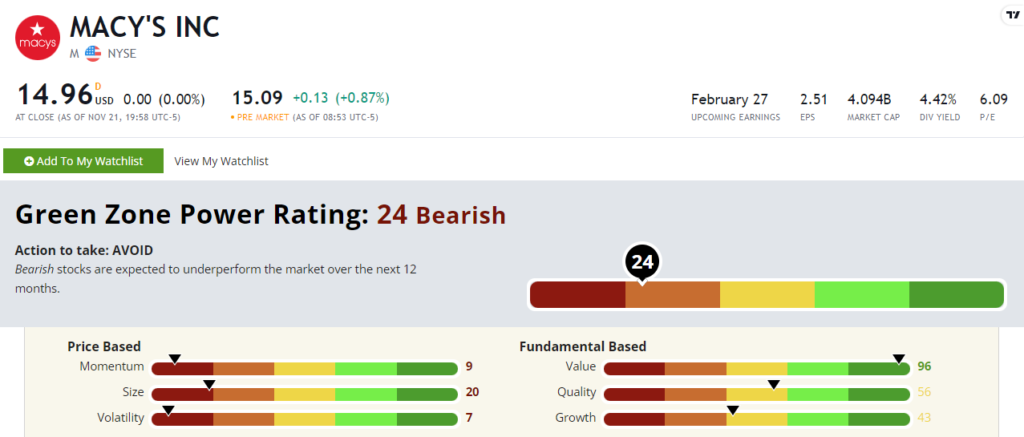

But after running Macy’s Inc. (NYSE: M) through Green Zone Power Ratings, you may want to hold off on adding shares now.

Macy’s stock rates a “Bearish” 24 out of 100 within Adam’s system. That means it’s expected to underperform the broader market over the next 12 months.

Macy’s price-based factor ratings really drag it down. It rates a 9 on Momentum, which makes sense considering its stock has lost 34% of its value over the last year alone.

And M is still a large stock with a $4 billion market cap. Don’t expect a small-cap bump here.

While I’ll always make time to catch some of the Thanksgiving parade, our system is telling me to steer clear of Macy’s stock for now.

Let’s turn to the digital side of the holiday sales.

AMZN Is Just OK

Amazon is the king of e-commerce, and I don’t think anyone is taking the crown soon — at least not in the U.S.

I know that many will opt to skip the lines and potential bargain brawls in favor of quality shopping from the comfort of the couch during Black Friday and Cyber Monday. I’ll be one of them.

But how does Amazon.com Inc.’s (Nasdaq: AMZN) stock look as a potential buy?

Green Zone Power Ratings shows it may be best to wait it out a bit longer.

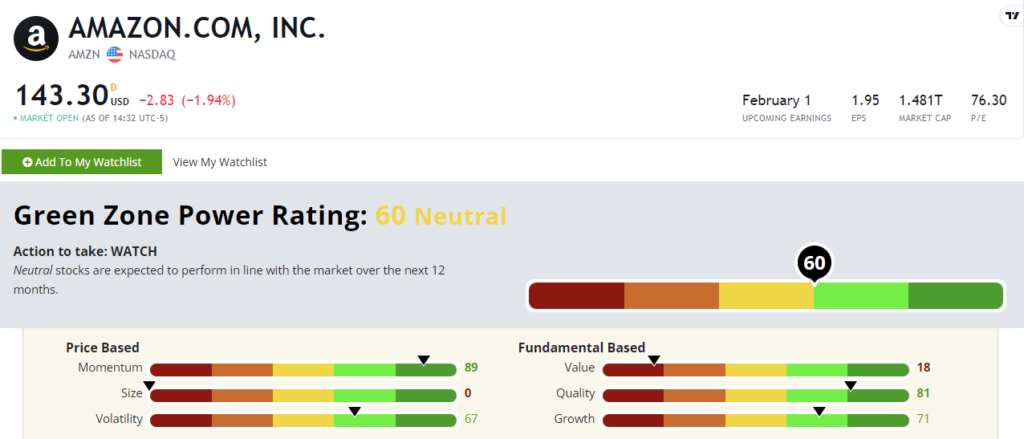

AMZN’s Green Zone Power Ratings in November 2023.

AMZN rates a “Neutral” 60 out of 100 in Adam’s system. Stocks within this category are slated to perform in line with the broader market over the next year.

Amazon is one of the largest companies around with a $1.5 trillion market cap. Investors are also willing to buy AMZN shares at a premium because they know that the share price will continue to grow. But that knocks AMZN’s Value rating down to 18.

But otherwise, Amazon stock has been a strong performer in 2023. It’s up 67% year to date, which shows why it rates an 89 on Momentum.

Amazon has been one of the main drivers of this year’s rally, and it sports solid Green Zone Power Ratings. Our system shows AMZN should continue its solid run as holiday shoppers opt for the couch instead of crowds.

A Different Profit Season

While Black Friday and Cyber Monday kick off a busy shopping season, Chief Market Technician Mike Carr is tracking a different profit season.

November and December are prime times for the dynamic media sector. This is just 1 of 15 profit seasons Mike tracks each year, and he’s using groundbreaking AI technology to identify the top stock for each season.

He just added his latest recommendation to the model portfolio. If you want to gain access to that trade now, click here.

Until next time,

Chad Stone

Managing Editor, Money & Markets