Inflation talk at most cocktail parties follows a certain pattern…

People don’t just stand around and wax philosophical about the Consumer Price Index (CPI), Federal Reserve benchmark interest rates or the weakness of the U.S. dollar.

However, we do talk about the higher prices of groceries and just about everything else we shop for.

Well, companies look at inflation the same way.

The more expensive things are at the grocery store, the less money you have left over in your bank account.

For companies, increased costs due to inflation mean squeezed profit margins. Price increases might shrink a company’s customer base… causing it to lose money.

That’s why it was no surprise to discover this nugget of information related to this quarterly earnings season:

In all, 228 S&P 500 companies mentioned the word “inflation” during their quarterly earnings calls. That’s been the norm over the last four quarters.

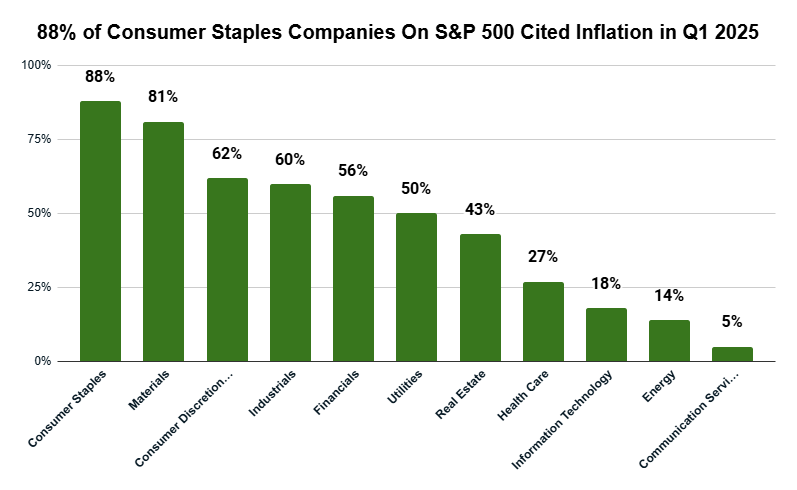

The consumer staples sector led the pack in the first quarter, with 88% of companies mentioning it.

This is because inflation means higher production costs leading to diminished consumer purchasing power and demand … all the things that drive consumer staple companies.

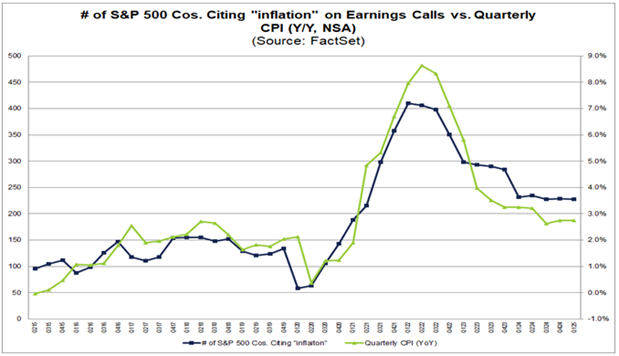

It’s led to situations like we see in the chart below…

This chart shows the correlation between the quarterly year-over-year change in CPI — the measure of change in the prices we pay for goods and services — and the number of S&P 500 companies citing “inflation” on their earnings calls.

When CPI is up, inflation citations are up. Conversely, when CPI is down, so are the number of companies mentioning inflation.

Now, let’s look at the earnings report from a company I kept my eye on last week.

Kroger Continues Earnings Trend

Last week, I mentioned watching out for The Kroger Co. (KR) and its earnings report.

The Cincinnati-based grocery chain had beaten analysts’ earnings expectations for 16 straight quarters.

Now, you can make it 17 after Kroger reported earnings of $1.49 per share, beating consensus estimates of $1.45.

Its revenue was reported at $45.12 billion, below expectations of $45.28 billion, and slightly down from the $45.3 billion the company reported in the same quarter last year.

I was also interested in how Kroger’s management would respond to questions about ongoing inflation and its impact on customer sales.

The company reaffirmed its full-year EPS guidance of $4.60 to $4.80 with CFO David Kennerly noting that “the macroeconomic environment remains uncertain, and as a result, other elements of our guidance remain unchanged.”

So it looks like Kroger is in “wait and see” mode.

Let’s now look ahead to next week…

“Bullish” Stocks to Watch

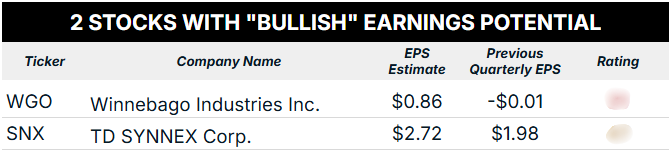

Let’s analyze companies expected to beat their previous quarter’s earnings and, thus, potentially trade higher if those expectations are met … or even exceeded.

For this screen, stocks must meet four criteria:

- The stock is covered by 10 or more analysts.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

Here are the two companies that made the list:

The company of interest on this list is Winnebago Industries Inc. (WGO).

This is an Iowa-based manufacturer of recreational vehicles (RVs) and light-to-medium utility vehicles.

According to the RV Industry Association, total RV shipments in the first quarter of 2025 were 97,848. This includes both motorhomes and towable trailers.

That’s a 13.9% increase from the same quarter a year ago, despite inflationary and tariff pressures on the industry.

This increase should have a positive impact on Winnebago’s revenue and EPS numbers for the quarter.

WGO stock has been in a steady decline over the last 12 months, falling 41% while the consumer vehicles and parts industry has climbed 54%.

It will be interesting to see if an increase in revenue and earnings propel WGO out of “Bearish” territory on Adam’s Green Zone Power Rating system.

Moving over to the “bearish” side…

As we are nearing the end of the earnings season, our screen did not turn up any companies. This is either because not enough analysts cover the companies that are reporting, or none of the companies reporting next week have an estimate lower than the previous quarter.

Nonetheless, I’ll see if anything interesting turns up and report back next Friday.

That’s all from me today. I hope you all have a great weekend!

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets