I was driving into work earlier this week and I wondered: “Where is everyone?”

I-95 lacked its usual Death Race vibes, and I even managed to trim 10 minutes off my normal commute.

Then it struck me… Summer vacation season is here!

And America is ready to get out of town if Memorial Day weekend is any indication.

The Transportation Security Administration reported it screened 12.4 million airport travelers over the long weekend — 200,000 more than it did in 2019 before the pandemic.

That tells me we’re in for a busy travel season, even as recession warnings loom.

With that theme in mind, I turned to Adam O’Dell’s proprietary Green Zone Power Ratings system to see how some travel-related stocks stack up.

Let’s get into it…

Try Out My Process

I have access to some incredible minds and investment tools due to the nature of my work.

But my goal here in Stock Power Daily is to show you how easy our system is to try out for yourself.

With that in mind, I used two different methods to pick the stocks I’m featuring today.

For the first, I landed on American Airlines Group Inc. (Nasdaq: AAL) because I wanted to look at a popular airline stock, and AAL just released earnings for the first quarter.

For the other two, I dove into the Consumer Discretionary Select Sector SPDR ETF (NYSE: XLY). After plugging some tickers into our Green Zone Power Ratings system, I decided to look closer at Booking Holdings Inc. (Nasdaq: BKNG) and O’Reilly Automotive Inc. (Nasdaq: ORLY).

BKNG is fairly obvious considering Booking Holdings has become an industry leader in online travel services.

To see why I landed on O’Reilly, read on…

If you want to look up other tickers from XLY or otherwise, just go to our homepage and use our search function or look for this button in the top right corner:

Then, type in a ticker or company name and you’re off to the races!

Let’s get into it…

How 3 Travel Stocks Rate as Summer 2023 Kicks Off

As I mentioned above, American Airlines posted first-quarter numbers earlier this week. And things look solid for AAL as we enter a busy travel season:

- Net income for the first three months of the year was $10 million, or $0.02 per share. In the first quarter of 2022, AAL posted a $1.6 billion loss!

- Revenues increased by 37% compared to the same period a year ago, which was in line with analyst estimates.

- Operating income came in at $459 million, 131% higher than the first quarter of 2022.

On top of solid past performance, executives are projecting adjusted earnings per share to be on the higher end of expectations during the second quarter.

All of this points to AAL being a good stock to invest in now, right?

Not by Green Zone Power Ratings standards…

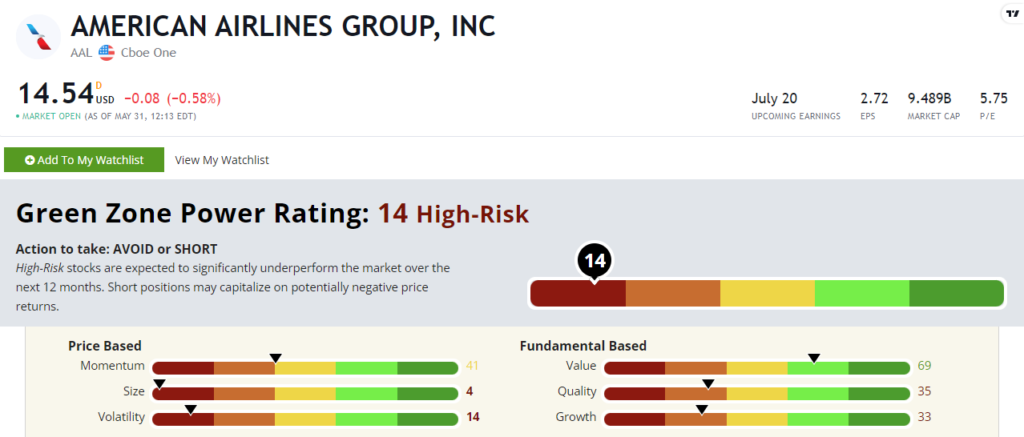

AAL scores a “High-Risk” 14 out of 100 on our system. Stocks in this category are set to significantly underperform the broader market over the next 12 months.

I want to focus on American’s volatility score of 14 and middling momentum at 41.

Over the last 12 months, AAL has lost more than 17% of its value, but the stock has also gained almost 14% since 2023 started. But if you look at its stock chart, you can see that volatility in action:

That’s not the steady price rise we like to see in stocks.

I am curious to see if AAL’s Green Zone Power Ratings improve after a busy summer season, but our system says this is one travel stock to avoid right now.

Booking Holdings Looks Better

You can have an entire vacation planned and paid for in just a few clicks now thanks to the internet.

But we’re almost too spoiled for choice now between Kayak, VRBO, Airbnb, Priceline, Expedia and countless other sites.

Booking Holdings boasts a portfolio of 11 travel brands that cover everything from reserving cheap flights and rental cars, to making restaurant reservations once at your destination.

But does this broad strategy make BKNG a solid travel stock for today’s market?

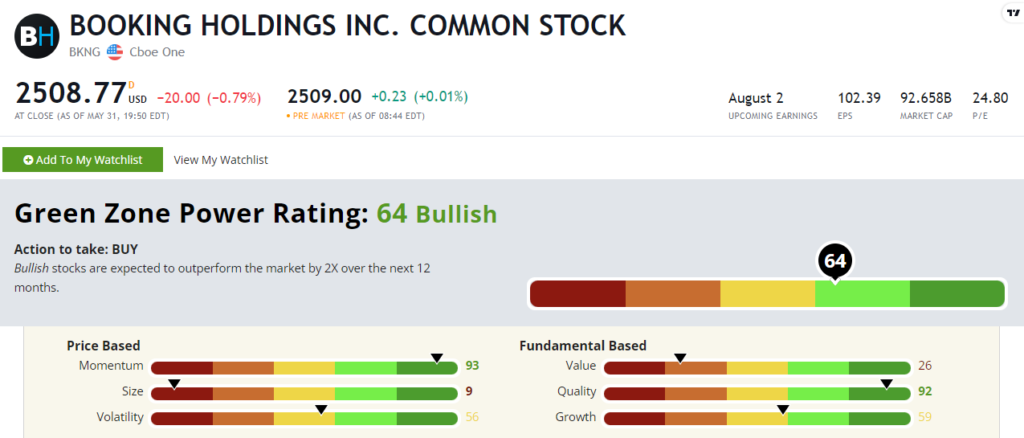

Green Zone Power Ratings thinks so, as Booking Holdings stock rates a “Bullish” 64 out of 100. That means this stock is expected to outperform the broader market by 2X over the next year.

That diversified portfolio has helped Booking maintain more total assets compared to debt ($25.2 billion in assets versus $24.1 billion in total liabilities). That’s why it boasts a strong 92 out of 100 on our quality factor.

And its momentum is crushing the market. BKNG’s share price is up 24% year to date. The broader S&P 500 has gained 9% over the same time.

I realize Booking stock is not cheap at around $2,500 per share, but many brokerages let you buy fractional shares now. And this stock has potential as the 2023 summer travel season ramps up, according to Green Zone Power Ratings.

O’Reilly Auto: A Different Travel Stock Play

When you think of travel stocks, O’Reilly Automotive may not top your list.

But as someone who owns two 2007 Hondas and is considering some summer weekend road trips, I started thinking outside of the box.

With how expensive flights are these days, many families are going to hit the road. And that means car repairs.

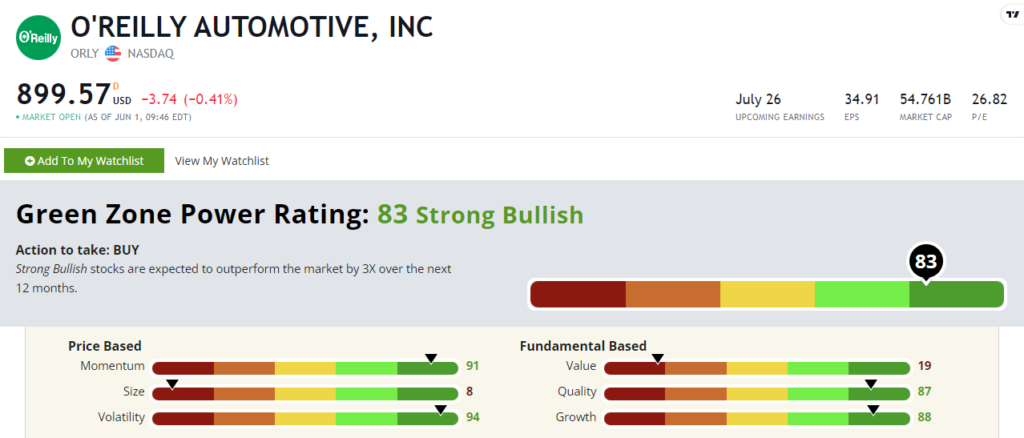

ORLY is another pricey stock at around $900 per share, but its “Strong Bullish” 83 out of 100 rating is too good to ignore. For reference, Strong Bullish stocks are expected to crush the market by 3X over the next 12 months.

It scores an 87 or above on momentum, volatility, quality and growth!

On that last factor, ORLY posted 12% year-over-year revenue growth of $3.7 billion in the first quarter of 2023. Net income also increased 7% to $516 million for the quarter.

Looking at its strong momentum and low volatility (reflected by a high volatility score in our system), ORLY has gained more than 41% over the last 12 months — and it’s been a nice steady climb. That’s better than Tesla, Apple and Amazon!

If you’re looking for a different way to play the travel stock trend this summer, ORLY looks like a solid choice in Green Zone Power Ratings.

That’s it for me this week…

What do you think about these Green Zone Power Ratings stock highlights? Is there a particular sector or theme you want to me look into? Email Feedback@MoneyandMarkets.com with your thoughts. I’d love to hear from you!

Until next time,

Chad Stone

Managing Editor, Money & Markets