Hey, it’s Matt. Welcome to your Friday earnings edition of What My System Says Today.

We’ll start by examining how one of the most widely used phrases in the English language these days relates to earnings.

I’m talking about AI, of course!

Since the public release of ChatGPT in 2022, artificial intelligence (AI) has soared in popularity.

Globally, 378 million people use AI daily, nearly triple the number of people using AI daily in 2020.

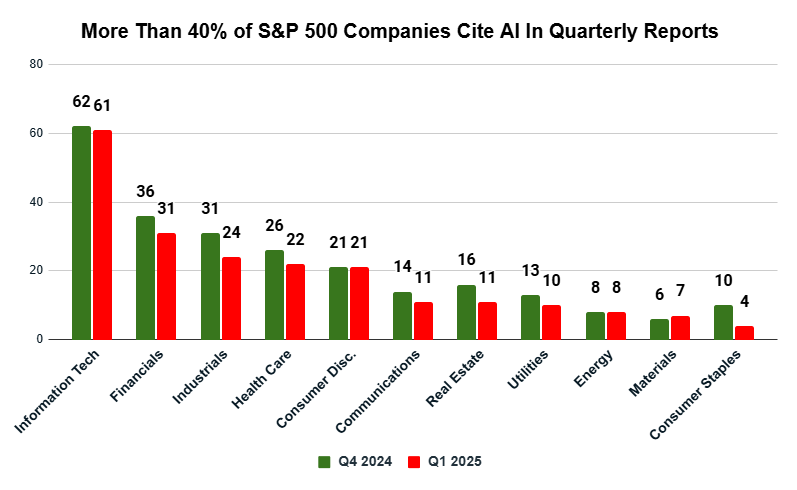

Companies in the S&P 500 continue to cite AI in their quarterly reports. In fact, more than 40% used the term AI at least once in their first-quarter 2025 earnings calls.

The surprising thing is that the number is actually down from the previous quarter:

The number of S&P 500 companies citing AI in quarterly conference calls dropped 14% from Q4 2024; however, this is the fifth consecutive quarter in which at least 200 companies used the term on those calls.

Eight of the 11 sectors of the benchmark recorded a quarter-over-quarter decrease. However, it’s important to note that the fourth quarter of 2024 had the highest number of S&P 500 companies using the term AI of any other quarter going back a decade.

The point is that AI remains a dominating trend, not just in our day-to-day lives, but also for some of the largest companies in the U.S.

Now, let’s recap one of the earnings reports I had my eye on this week…

CASY Earnings Top Estimates

Last week, I mentioned keeping a close eye on Casey’s General Stores Inc.’s (CASY) earnings.

I was surprised that the company made the lists of potentially “bearish” earnings because its inside and gasoline sales were expected to increase.

Well, I was right to be surprised. And it goes to show that our screens aren’t going to nail it 100% of the time.

In its earnings report, Casey’s posted quarterly earnings of $2.63 per share, surpassing analysts’ estimates of $1.97. This was actually an increase over its previous quarter’s earnings of $2.33.

As I thought, total inside sales climbed 12.4% year over year, and its gross margin jumped 100 basis points to 23.2%.

Casey’s did see a 14.5% increase in operating expenses due to the addition of 264 more stores and its acquisition costs from buying Fikes Wholesale.

However, not even the largest acquisition in the company’s history could dampen a robust quarterly result.

CASY continues to rate strong on Momentum, Volatility, Quality and Growth on Adam’s proprietary Green Zone Power Rating system. (To look up CASY’s complete ratings — as well as the rating on thousands of other tickers — click here to see how you can gain unlimited access to Adam’s system now).

Now, let’s jump into “bullish” and “bearish” earnings for next week…

“Bullish” Stocks to Watch

We’ll start our analysis with companies expected to beat their previous quarter’s earnings and, thus, potentially trade higher if those expectations are met … or even exceeded.

For this screen, stocks must meet four criteria:

- The stock is covered by 10 or more analysts.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

Since we’ve reached the tail end of earnings season, the total number of companies reporting is much shorter than even two weeks ago.

Here are the two companies that made the list:

We’ll focus on retail grocery chain, The Kroger Co. (KR).

The Cincinnati-based company recorded more than $147 billion in sales, excluding fuel, in all of 2024… a 1.5% year-over-year increase.

Its gross margin for the fourth quarter of 2024 jumped to 22.7%… up from 22.3% the quarter before.

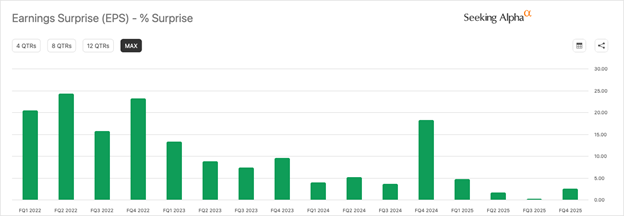

In doing some research, I found that Kroger has a solid track record of beating consensus expectations for earnings:

The company has beaten earnings expectations in each of the last 16 quarters, which is a pretty remarkable trend.

Grocery stores have been particularly hard hit by inflation, as the price of everything from eggs to a gallon of milk has gone up sharply over the last two years.

I am interested in seeing how the company’s management responds to questions about rising prices in the future and how they might impact sales.

I’m also keen to see how another potential earnings beat factors into Kroger’s already “Strong Bullish” rating on the Green Zone Power Rating system.

Let’s close things out today with a look at “bearish” earnings potentials for next week…

“Bearish” Earnings to Watch

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

Our screen turned up one familiar name:

Lennar Corp. (LEN) started as a small Miami-based homebuilder in 1954 and has expanded its operations to 22 states, mainly in the southern U.S.

In 2024, the company increased its total revenue from $32.6 billion to $33.9 billion, thanks to an increase in home sales.

However, higher costs for materials and labor may crimp Lennar’s growth.

Although the difference between its earnings estimate and the previous quarter may seem marginal, cost increases could have a long-term impact on the company’s bottom line.

I would watch what management says about those cost increases and how they plan to deal with their potential impact.

It will also be interesting to see how even a slight earnings miss could impact a stock already in “Bearish” territory on Adam’s Green Zone Power Rating system.

That’s all from me today. I hope you all have a great weekend!

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets