Clint Lee here, Chartered Financial Analyst and Chartered Market Technician at The Bauman Letter and Alpha Stock Alert.

Amid the stock market volatility this year, the staff at Money and Markets has reached out to me on a number of occasions to make sense of the uncertainty.

As the recovery picks up pace, they invited me to talk again about the best investment opportunities I see for the rest of this year.

So today I’m bringing you just that. I wanted to share two exchange-traded funds in particular that I’ve identified as great plays right now.

This is what I do alongside Banyan Hill Publishing economist Ted Bauman day in and day out, not just with our Bauman Letter and Alpha Stock Alert services, but also with our Bauman Daily series, a free newsletter you can check out here.

My Top 2 Sectors With ETFs to Buy Now

As my colleague Ted has talked about extensively, the rally up to this point has been driven by liquidity and sentiment … essentially faith.

And while there’s a role for speculative plays as earnings reports roll in — fundamentals still matter.

But even as we get a clearer picture of corporate earnings for the second quarter, there are some data points that tell us what sectors and companies are already experiencing a rebound. Not just riding sentiment, but in terms of real-world earnings.

To that point, I’ve identified two sectors that are seeing a sustainable recovery in demand.

Tap Into Profits From Massive Tailwinds

There’s one sector we’ve looked at since the depth of the stock market decline as a deep value play … and that is homebuilders.

Now we see increasing signs of strength in this space to the point that it’s turning into a growth opportunity. Here’s why.

There were two big catalysts already in place before the pandemic hit:

- Demographics: Millennials are the largest demographic, and they’re just now hitting the prime age to buy their first home.

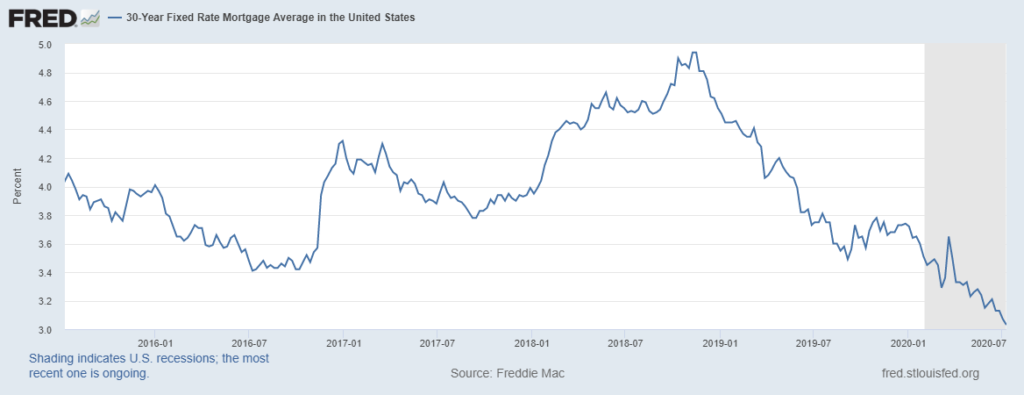

- Interest rates: Mortgage rates were already near record lows before the pandemic. Fed stimulus has now pushed rates to their lowest level ever, as you can see from this chart:

And we have some metrics we follow that show these trends are affecting homebuilders.

One of them is the price of lumber, for which homebuilders are a key source of demand.

Lumber prices plunged at the end of March, and then stalled in April and May through the height of the COVID-19 crisis.

But just look at that march upward in June and July:

In fact, one homebuilder stock we hold in our Alpha Stock Alert service announced that June sales were the best ever.

Sure, part of that is due to pent up demand, and a sharp rebound from the lockdowns was expected. But this is clearly a sector that has gone from offering deep value to now offering a growth opportunity with those trends I mentioned as a tailwind.

The ETF I recommend in the homebuilding sector is iShares U.S. Home Construction ETF (BATS: ITB).

An ETF for COVID-19 Rebound and Geopolitical Tensions

Chipmakers took a hit at the outset of the crisis due to concerns about consumer and industrial end markets.

But the sector has seen a complete turnaround.

There’s been a huge surge in demand, as you can see from this jump in revenue for the world’s largest foundry chipmaker, Taiwan Semiconductor Manufacturing Corp. (NYSE: TSM).

![]()

We’ve also heard rumors that one of the semiconductor stocks we hold in the Alpha Stock Alert sent a letter to customers warning of delivery delays due to demand across multiple end markets.

To get exposure to the semiconductor sector in your portfolio, you can buy the VanEck Vectors Semiconductor ETF (Nasdaq: SMH).

For a deeper dive into Ted and my take on the broader market, along with opportunities he sees for the rest of the year, watch our YouTube video from earlier this week on this very subject. And be sure to check out the Bauman Daily channel for our biweekly takes on the market.

In the semiconductor space, one more thing I need to add is something I wrote about several days ago, and that’s geopolitical tensions and the impact the pandemic has had on supply chains in general.

There’s one U.S. chipmaker that could be a huge beneficiary from policies that aim to shore up American leadership in the industry. So be sure to check out that article.

The market has been range bound to some extent since early June, with the S&P 500 index staying above the 3000-point mark, but bouncing off of a bit of a resistance level. But whether we see that breakout to new highs in the coming weeks or not, these sectors are poised to offer great gains for the rest of the year.

Best regards,

Clint Lee

Research Analyst, The Bauman Letter