The consumer staples sector has broadly struggled since the Trump administration announced reciprocal tariffs in April.

Other corners of the market have suffered setbacks, but the threat of higher prices has hit consumer staples particularly hard.

The sector was the weakest performer of all 11 S&P 500 sectors last week (as Adam illustrated in yesterday’s edition).

Today, I’ll share an analysis of the broader sector; however, rather than focus on the bad, I’ll also show you some bright spots using Adam’s Green Zone Power Rating system.

Let’s forge ahead with a reading of the sector as a whole…

Consumer Staples Sector X-Ray

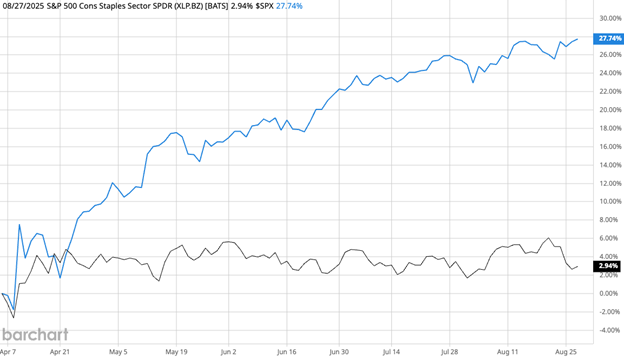

Before I get to the breakdown of the sector, it’s important to illustrate just how the consumer staples sector of the market is struggling.

Since announcing tariffs in April 2025, the SPDR Consumer Staples Sector ETF (XLP) — the gray line in the chart below —has only gained 3%, compared to the S&P 500’s 28% march upward.

XLP Only Up 3% Since Reciprocal Tariff Announcement

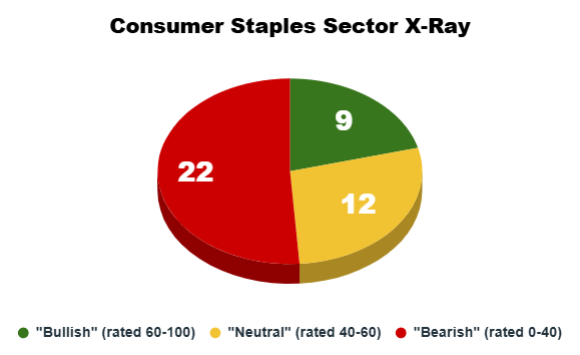

That likely explains the breakdown between “Bearish,” “Neutral,” and “Bullish” stocks when I ran an x-ray of the ETF through Adam’s Green Zone Power Rating system:

More than half the stocks (22) are rated “Bearish,” while 12 are rated “Neutral.” Just nine stocks we rate in the sector have a “Bullish” rating.

While half of the sector rating “Bearish” sounds daunting, look at it from the other side of the coin. Half may be “Bearish,” but the other half gives us opportunities to locate stocks that will pace, or beat the performance of the S&P 500 over the next 12 months.

The challenge there (and the reason why Adam created the Green Zone Power Rating system) is knowing where to look.

So, we’ll go a step further and analyze the sector’s individual factor ratings to see what direction the system points us…

Look Where Others Aren’t

Given that half the sector is rated “Bearish,” it would be easy to write off the consumer staples sector (it seems Wall Street is already doing that).

However, doing so would risk missing potentially strong stocks by painting all stocks in the sector with the same paintbrush.

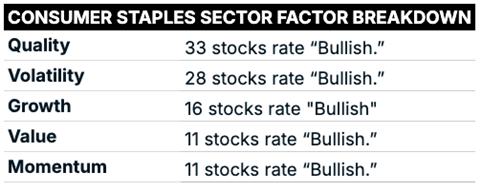

As Adam does every week here in What My System Says Today, I looked at each stock through the lens of our individual Green Zone Power Rating factors.

Here’s a list of how many consumer staples stocks rate “Bullish” on each of five of our six factors:

There are many high-quality stocks (those with strong returns on assets, equity and investment, along with good margins) in the sector. Many stocks have also posted good EPS and revenue growth.

What stands out to me is that 28 stocks are rated “Bullish” on Volatility — meaning they have relatively low volatility — and 11 stocks are rated “Bullish” on Momentum.

That’s somewhat surprising considering the sector as a whole has only gained 3% since President Trump’s Liberation Day announcement in April.

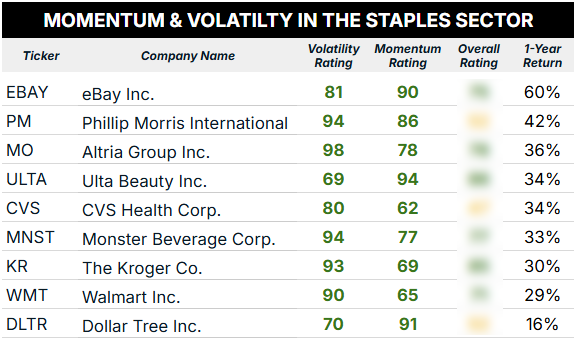

So, the next step in my analysis was to find stocks in the sector that rated “Bullish” on both Volatility and Momentum. This will lead us to stocks in an uptrend with minimal downside.

To test this, I included the total 1-year return for each stock that made the cut:

All nine of these stocks score 60 or above on both Momentum and Volatility. Additionally, all of them have returned at least 16% over the last 12 months. For comparison, the S&P 500 has gained 16% over the same period, so these stocks at least match that performance.

The hypothesis that stocks rating high on both factors are standouts in the sector proves mostly true, as all but three of them have a “Bullish” overall rating on Adam’s system. That means a majority of the stocks on the list should at least track the S&P 500’s performance.

By not dismissing the sector as dead on arrival, we can use the Green Zone Power Rating system to identify outperforming stocks — sort of a “diamonds in the rough” mindset.

You can look up any of these stocks now by joining Green Zone Fortunes and gaining unlimited access to Adam’s system. Click here to find out how to do just that.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets