Last week, the materials sector (XLB) led the charge during a strong week for the market as a whole.

But as I was running the screens for today’s sector “x-ray” using my Green Zone Power Rating system, I noticed a somewhat troublesome trend.

My goal today is to help us find an answer to one question:

Should you be looking at the materials sector for your next bullish stock to buy?

Here’s what I found…

Broad Materials Sector (XLB) Looks Bearish

One of the goals of my sector x-ray is to get a gauge on how trustworthy a recent rally truly is.

We’ve seen it happen plenty of times …a sector will have a nice week, gaining a couple of percentage points, only to reverse course as investors hop on the opportunity to sell after a solid short-term pop.

It’s still too early to know if last week’s outperformance from the materials sector falls into this category, but today’s analysis isn’t a great sign.

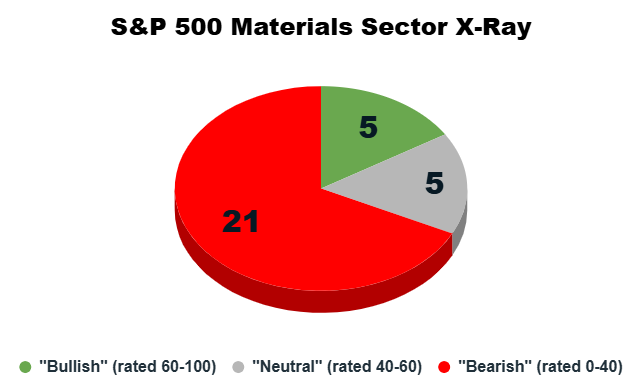

As always, stocks within the sector can broadly be categorized into one of three buckets in my Green Zone Power Rating system:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

Looking at the 31 materials sector stocks currently rate Bullish, Bearish or Neutral, you can see what I’m talking about.

Check it out…

With 21 stocks (two-thirds of the sector) rating “Bearish” in my system, this tells me we have to be much more selective with materials stocks if we’re looking to beat the S&P 500.

But as I showed you yesterday, there are stocks that boast “Bullish” or even “Strong Bullish” Green Zone Power Ratings. My system is just signaling that now isn’t the time to be buying the entire sector.

Let’s take a closer look at individual factors to see if we notice any trends…

Value + Momentum in the Materials Sector (XLB)

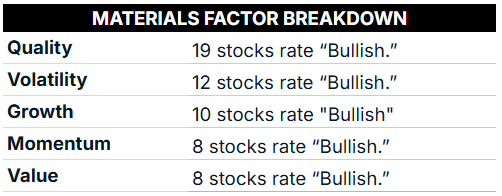

Here’s how S&P 500 materials stocks look on five of my six individual factors. I’ve cut Size from the list, as always, since all of these stocks have larger market caps, and thus, low ratings on that factor. It just comes with the territory of being included in a “large-cap” index:

I would broadly define the materials sector as this: A sector with high-quality businesses, with stocks trading at “cheap” valuations, but also lacking positive price momentum.

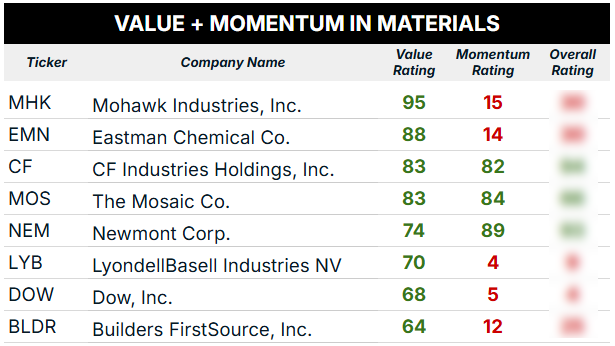

With that as a focus, I pulled the eight stocks in the sector that boast “bullish” Value factor ratings. You’ll see below how those stocks rate on my Momentum factor as well.

While I’ve blurred the overall rating for these stocks, you can see the troubling trend below, according to my Green Zone Power Rating system:

Of the eight stocks that rate highly on Value, only three rate highly on Momentum as well.

So-called “value stocks” have had a rough go for years as investors gravitate toward high-growth instead, even if they’re expensive. The five stocks above that rate 15 or worse on my Momentum factor are perfect examples of this phenomenon. Investors are simply willing to take the risk on stocks trading at incredibly high (and unsustainable) valuations if it means the price of the stock is going higher.

But even this quick scan of the materials sector reveals three stocks that are trading at dirt-cheap valuations and have positive price momentum.

CF Industries Holdings Inc. (CF), The Mosaic Co. (MOS) and Newmont Corp. (NEM) are all up more than 36% over the last 12 months, easily beating the broader S&P 500’s 11.7% gain during that same period.

And this is precisely why I designed Green Zone Power Ratings with six factors in mind. With a more balanced approach, you can find stocks with strong momentum and solid underlying businesses — that aren’t trading at a ridiculous premium.

If you aren’t already using my system to screen for these six factors, go ahead and click here to see how you can join thousands of other investors in my flagship Green Zone Fortunes investing service. By joining, you’ll also gain access to our model portfolio that is chock-full of stocks with well-rounded ratings for today’s market conditions.

That’s a wrap for today. Matt Clark will be back tomorrow with a deep dive into consumer trends amid Amazon’s yearly Prime Day sale.

To good profits,

Editor, What My System Says Today