It’s nearly July — and that means another earnings season is right around the corner…

So far this year, stocks have proven robust enough to withstand President Trump’s transformative agenda.

But I’ve spotted two major “canaries in the coal mine” in the economic data that are pointing towards a slowdown in the near-term.

Click below to watch today’s episode of Moneyball Economics for the full story:

Video transcript:

Welcome to Moneyball Economics. I’m Andrew Zatlin and June’s almost up…

That means we’ve got another earning season right around the corner. My expectations for this earning season, well, not so ebullient. I actually think we’re going to see a little bit of a market correction, even though we’ve just regained our all-time high. I just don’t think that some of the bad economic news has been priced in. I think stocks are a little bit highly valued, shall we say.

There’s not a lot of upside here, and in fact, I think there’s going to be some bad news surprises that are going to lead to some stock pullback end of the day. I don’t know if you want to get defensive. I don’t know if you just want to be less aggressive or maybe underweight certain sectors, but I’m not seeing a lot of rosy economic signals right now, and that suggests to me that companies are going to be more defensive posturing.

There’s not going to be a lot of upside guarantees being put out there. So let me share with you what I’m seeing in the economy by sharing with you two data points. One coming from the corporate world and the other coming from households, and they’re not independent, right?

There’s a lot of interplay between what companies do and what households do. For example. At the end of the day, a company’s revenues are really driven by consumer spending ultimately, and also household spend, primarily based on what they expect to get in their paychecks, which in turn is driven by if a company’s doing well and they’re giving raises and bonuses and so forth. So there’s a big feedback loop.

When things start to go down, we get into a negative feedback loop, and I think that we are kind of close to an inflection point on that level, and I want to talk about that. We’re not there yet, but we are at that point where stepping on the gas is done. We’re not quite hitting the brakes, but when we get to this place, when a company is economically not growing, when the revenues are just basically stagnating, they’ve got to deliver to Wall Street profits. They got to do it one way or the other.

So to keep those earnings going, they start looking at the bottom line. They start laying off people, they start trimming, investing, spending, trying to find ways to get more efficient, as they call it. And that is what’s going on.

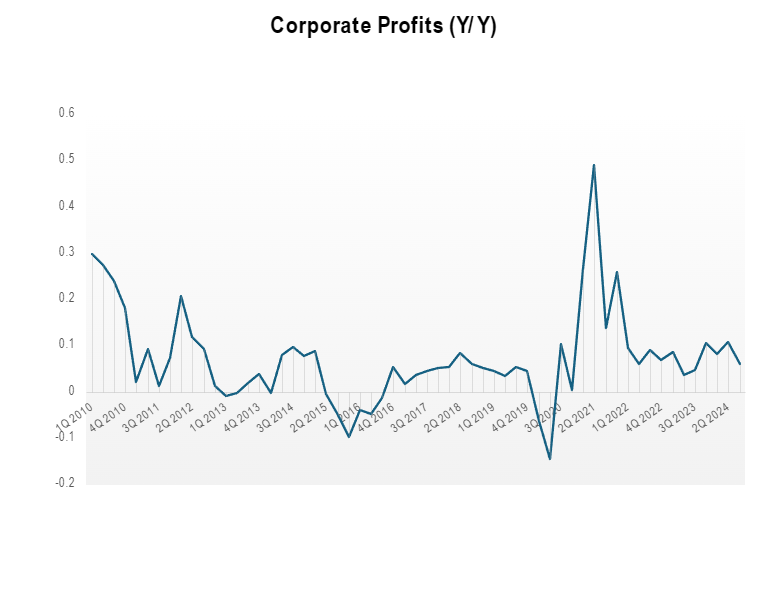

And so let me start with what’s going on in the corporate world with one data point. It’s corporate profits. Corporate profits, very basic, comes out every quarter from the government. And what you’ll notice is corporate profits are pretty good historically. Right now, they’re looking fine:

They’re just slower than they were in past years. If you go back to say, last year, early last year, 2024, wow, corporate profits were double digit growth, fantastic. But over the course of the year, things slowed down. And so when we get to the fourth quarter, all of sudden things really slow down.

And when companies see that business is slowing down as evidenced by their profit growth, well, they’ve got two choices. They look at the top line, what can they do to make more sales? And they look at the bottom line. How did they get more operationally efficient?

Well, in this case, revenue growth started to slow down in the fourth quarter. And so that’s why we heard all these layoffs going on, Hey, we’ve got to trim the fat a little bit, get that extra penny on the earnings per share.

And that’s what we saw in the first quarter.

All of a sudden hiring — which was just running at about 200,000 per month of payroll growth — suddenly felt to barely a hundred thousand. They hit the brakes.

And did it work? Well, unfortunately, not really. It might’ve slowed the pain, meaning that profit growth continued at a pretty decent level, but you would expect it to grow even better if you laid off all these people. And so we got to the second quarter, and again, as we know from the April and May payrolls again starting to see some sluggishness, which means companies are not yet feeling as profitable as they want to be.

Obviously they have reasons, right? Tariffs might be coming down the pipeline, which is going to make their cost even harder to deal with, meaning that their margins are going to get squeezed and compressed and they’ve got to do another cycle of efficiency growth because tada revenues, again, not really growing.

And that’s what we want to look at.

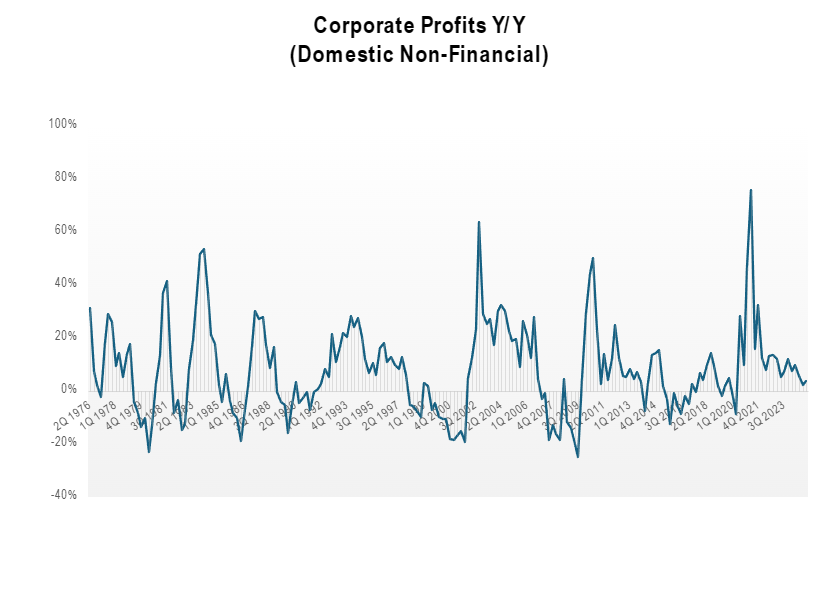

We are talking about corporate profits overall, when really what we should be talking about is a subcategory, which is domestic non-financial corporate profits. Now, that sounds a little bit kooky, but it isn’t. It’s the bulk of American profits for American companies.

When we talk about domestic, we’re talking about the US economy, right? We’re not talking about how much money Apple is making out in China. We’re talking about things that affect the US stock market based on activity in the us. And then we want to look at non-financial companies because let’s face it, Goldman Sachs might be making a gazillion dollars because the market’s up or a bank might be doing really well because of interest rates moving up since last year, whatever the case, they don’t really drive a lot of the underlying economy.

So if we want to know what’s going on with the underlying economy, how that’s going to affect basically the bulk of American spending, let’s look at domestic non-financial profitability.

And what we see, it’s very different:

Profits are not, yeah, good. Wow, bad.

Remember I mentioned last year we had double digit profit growth. When we look at this category, it’s the same, but when we got to the fourth quarter, it collapsed. It rolled over the cliff. In other words, financial performance and overseas performance was masking what was really going on in the US economy, and that is companies here, they weren’t that profitable.

It fell to under 3% profitability from double digits that they had seen just a few quarters prior. That’s why we suddenly see all this economic shuttering, and it did not improve in the first quarter, and I don’t think it improved in the second quarter either based on what we were seeing with tariff scares. Okay?

Fast forward, what I’m saying is businesses are not healthy. They are not getting that top line growth.

And so in order to drive their profit growth, they’re desperate, they’re scrambling, and that’s not a good sign because if they are not getting top line growth and no matter what they’re doing, they’re not getting that bottom line ease that they’re basically, their margins are getting compressed. And then you throw things like tariffs on top of this. I see a lot of companies coming out in a couple of weeks and announcing some bad news.

Now what they’re going to probably do is combine that bad news with layoff announcements or other kind of moves that may be interpreted by the stock market as a positive, especially if we start to get some momentum rate cuts, whatever. But it all points to a slowing of the economy. I just don’t know if the market has really priced that in effectively.

Now, let’s turn to what’s going on in the household…

And here again, we’ve got some concern. We talk about basically generic consumer spending. This is an interesting data point. I love it. It is coming out of the TSA. The TSA is the security organization at airports, and it is a daily tracker of how many people got on an airplane in the United States. Very cool, right? What you’ll see in this data is since January every month that has gone by, the number of people traveling compared to same month prior year.

Last year has been going down until in May, it contracted, and then it’s contracted even more in June. What does that mean? Well, it means that starting in May, all of a sudden there are fewer people out there traveling on airplanes. And then you get to June, even fewer. And this isn’t just a few people, we’re talking half a million, fewer people were traveling in that month compared to the prior month.

So let’s take a minute here. If you are American Airlines and you’ve got half a million fewer people coming on your planes, are you going to be out chasing down a lot more pilots? If you’ve got fewer people in the airports, how many more, I don’t know, restaurant workers are you going to hire? And so on and so forth. And that’s just getting on a plane.

See what’s driving this is really, we’ve got three components that are coming together. One is why did it start in May? Because we have Trump coming on board pushing ice, and now we’re starting to see that some international tourism is staying offshore. A lot of people are a little bit worried about coming here. At the same time, we might be seeing some people afraid to leave the United States on planes because they might not come back. So we’ve got the ICE factor.

We also have the DOGE factor. A lot of the pushback on government spending has hit travel and entertainment. A lot of government workers, federal workers have been told, reduce your travel. So that’s a second hit. And the third is it’s consumers. Look, a lot of people are not traveling because they just don’t have the money. And again, it’s on the margin.

It’s only, say, 1% going on 2% in the month of June versus last year, but that’s still 2% of your population not going out and having fun. Remember when we’re talking about tourism, it’s not just the plane travel. We’ve got hotels not being booked, restaurants not staffing up and entertainment and on and on and on. So the US consumer spending still healthy, still at a high level, but it is pulling back. And when we’re talking about economic growth, we know companies aren’t necessarily seeing it.

And so they’re scrambling for profitability via reducing, getting their bet margins up there by reducing staff. And now we’ve got American consumers starting to pull back again, this is not going back to the march April. Angst and anxiety, uncertainty, tariffs.

What’s going on? We’re talking June. And on top of that, remember that June travel, which is basically the beginning of post schools are closed. Everyone’s going on holiday travel. This was booked earlier in the year. So in fact, this 2% drop that we’re seeing in June, that was a determination made a couple of months prior, which means things are only going to get worse as the summer goes along.

I am saying that the US economy is slowing down in a broad-based fashion, not just where the tariffs are impacting things, but we now have households starting to say, gee, I can’t spend as much.

That’s a problem.

And again, that could be related to the stock market crashing, people getting nervous and the stock market’s back and it will pick up. But guess what we’re talking about just a couple of weeks away when companies start announcing things. So any pickup that’s future right now, a company’s going to come out and say, we are working hard to achieve the profits that we guaranteed. And it’s a fight. It’s not easy. It’s not a slam dunk.

There are sectors that are going to be immune from this.

The growth sectors, obviously defense industry, they’re just going crazy. But are car companies going to be doing well? Maybe there was a pull in of cars, but overall, what I’m saying is there are a lot of companies out there, a lot of sectors out there that are going to get hit by a drop in consumer spending and by the tariffs a lot of manufacturing sector.

So I’m a little less overall ebullient, a little more selective. Like I said, I like the defense industry. I like nuclear. There are a couple of other places where I’m at that I like semiconductors because at the end of the day, it’s the 21st century equivalent of oil and steel from the industrial revolution. You’re going to need it no matter what, but just be careful.

As we get to earning season, I want you to know that we are in it to win it. Zatlin out.

Andrew Zatlin

Editor, Moneyball Economics