Once in a while, you stumble across a question that you were thinking but hadn’t asked:

why would anyone buy a 10-year bond yielding 1.5% when the inflation rate is > 4% ?

— StockCats (@StockCats) June 28, 2021

They have a point. Who in their right mind would tie up perfectly good capital at a yield that low? At 1.5%, the “risk-free return” of government bonds turns into return-free risk when taking inflation into account.

I have an answer to that question.

To start, I don’t think there are many flesh-and-blood investors buying bonds at that yield. I certainly don’t know any. The buyers are almost all institutional investors that buy because their mandate says they have to. If you run a large pension fund or a bond mutual fund, avoiding bonds is next to impossible.

You won’t find me taking major positions in bonds at current prices. Sure, I might buy them as a short-term tactical trade. But the yield isn’t high enough to justify tying up long-term capital.

We can, however, glean some information off of the action in the bond market.

Bond Markets Bet on Lower Inflation

Investors have been preoccupied with the inflation outlook this year. We see it in the real economy, as the prices of everything from chicken legs to McMansions has soared this year.

The Federal Reserve insists these price surges are a “transient” effect of the post-COVID economic reopening. The central bank believes prices will stabilize once we get through supply disruptions and the pent-up demand subsides.

I’m still skeptical.

But this is interesting … the bond market seems to agree with the Fed. A yield of 1.5% is actually -3.5% once you adjust for inflation running at 5%. That suggests investors buying bonds at those prices don’t think the inflation is here to stay. If inflation calms down, those yields will look a lot better.

You can also look at the pricing of Treasury Inflation-Protected Securities, better known as TIPS. These are government bonds adjusted for inflation.

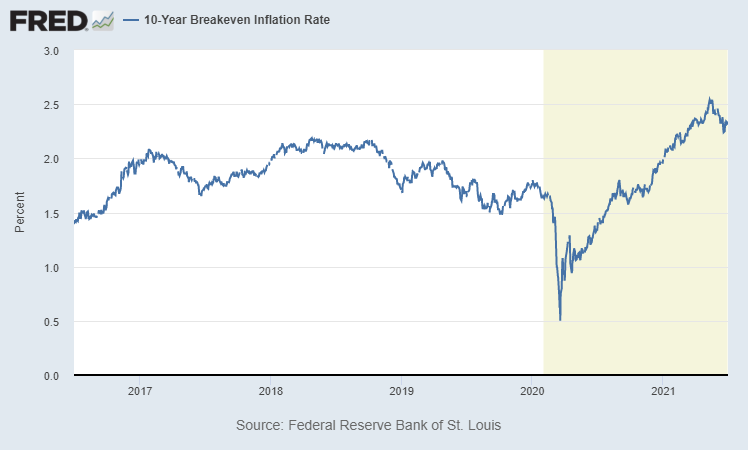

By comparing TIPS yields to regular bonds of similar maturity, you can calculate a “breakeven” inflation rate. Well, at today’s yields, the market is suggesting that the breakeven rate is about 2.3%. In plain English, this means the bond market is pricing in inflation of about 2.3% per year over the next 10 years.

10-Year Outlook for Inflation Doesn’t Look So Bad

We’ll see about that. A decade is a long time, and a lot can happen between now and then.

There is a historical precedent for tame inflation even during a time of rampant money printing and large budget deficits. Japan has suffered from deflation, or falling prices, for the better part of 30 years. And this is despite having the most experimental monetary policy and largest budget deficits of any advanced economy.

Inflation Outlook: Hedges Never Hurt

All the same, I think it only makes sense to have a few inflation hedges in the portfolio. Chief investment strategist Adam O’Dell and I have been bullish on gold for the past year and have even added a few gold miners to our portfolio in Green Zone Fortunes. We’ve also been adding infrastructure investments and other stocks that tend to do well during inflationary times.

We’re not ideological about it, and we have plenty of stocks in the portfolio that are less sensitive to inflation. But these inflation-proof sectors rate particularly highly in our Green Zone rating system, so we’re following the money.

There’s always a bull market in something, and we believe that genomics and DNA-based medicine may be the single biggest opportunity of the next decade. To learn more about the technology that Adam calls “Imperium,” click here.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.