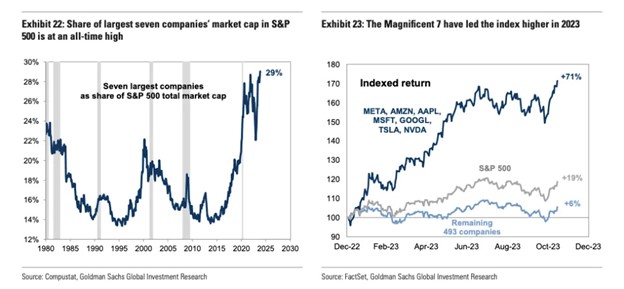

I’ll go ahead and start with what is probably the most stunning chart of 2023.

Check out the performance of the “Magnificent Seven” compared to the rest of the S&P 500 Index since the beginning of the year:

That’s right … the Mag 7 has done +71%, and the rest of the S&P 500 stocks have managed just 6%!

As you can see in the chart to the left, these seven stocks (META, AMZN, AAPL, MSFT, GOOGL, TSLA and NVDA) now account for nearly a third of the index’s total market capitalization.

These levels of concentration are unlike anything we’ve seen before — even the late ‘90s dot-com bubble doesn’t compare.

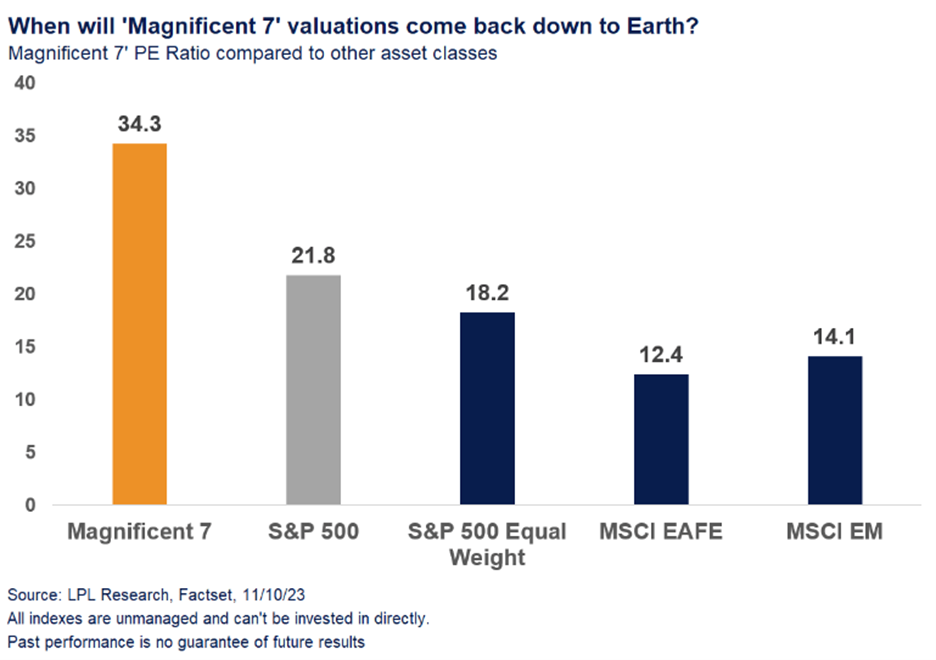

And it’s all happening because investors from all over the world keep chasing the same Big Tech higher and higher, to valuations that are now nearly twice the S&P 500’s equal weight average:

What do these valuations mean for your portfolio?

Let’s find out…

A Dangerous New Herd

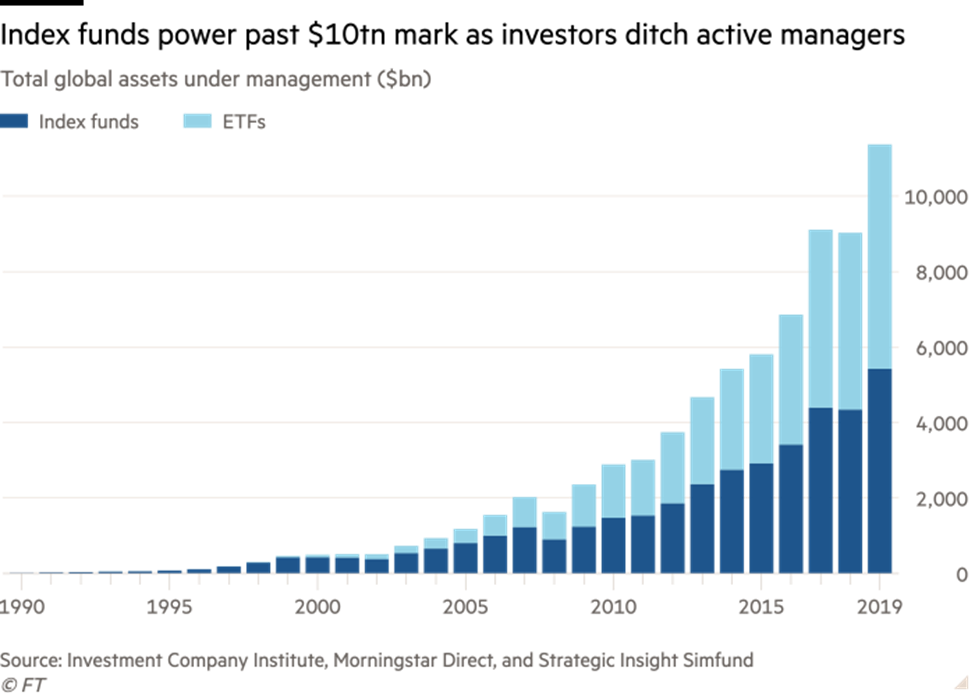

Since the beginning of the 21st century, index investing has exploded in popularity.

Some investors were eager to ditch their asset managers and mutual funds, so they switched over to so-called passive exchange-traded funds (ETFs).

Others preferred the simplicity and perceived safety of buying a whole stock index instead of picking a single ticker.

Regardless of their reasons, investors had poured more than $10 trillion into index funds by 2020, and they’ve only become more popular since:

ETFs and index funds are designed to be a simple, turnkey way of diversifying a portfolio.

The oldest ETF, the SPDR S&P 500 ETF (NYSE: SPY), does exactly what it says on the box. It gives investors direct exposure to the S&P 500 for just $0.09 of every $100 investment.

As far as fees are concerned, that’s a steal!

And it’s hard to argue with the performance. Since it launched in 1993, SPY has returned investors nearly 950% as of this writing.

That’s why I’m not here to argue against SPY.

No, really, I have nothing bad to say about broad-based ETFs like SPY, QQQ for the Nasdaq 100 or IWM for the Russell 2000.

But due to the sheer scale of index investing today, these funds have a material impact on the market.

Because when you buy shares in an ETF like SPY, the fund’s managers then use the proceeds of your investment to buy shares of various S&P 500 stocks. To reflect the index’s performance, that means buying increasingly larger quantities of shares in the Magnificent Seven.

This action is automatic. Index fund managers don’t think, they don’t worry about price to earnings (P/E). They just buy the shares they’re obligated to buy.

And since 30% of the S&P 500 comes down to the performance of these seven stocks, the index goes up.

So investors plow even more money into index funds as a result.

There’s even a special index fund for the Magnificent Seven stocks themselves — Roundhill Magnificent Seven ETF (Nasdaq: MAGS).

I’ve long advocated taking a look under the hood when you buy an ETF, and this ongoing consolidation is yet another great reason to know what you’re buying.

Price Matters

The Magnificent Seven aren’t bad companies.

Far from it. They’re actually great companies — market leaders with many competitive advantages.

Which is exactly why we’re seeing this level of concentration.

But in the words of Howard Marks: “It’s not what you buy, it’s the price that makes the investment.”

And if you buy SPY at today’s prices, you’re essentially buying into these seven stocks at an average P/E of 34.

That’s just not ideal for me.

And it’s something you should keep in mind if you’re investing any new capital in index funds at today’s valuations.

Nasdaq is already taking action to address extreme levels of consolidation in its own Nasdaq 100 Index.

In July of this year, it reduced the weighting for the same seven stocks from 56% down to 44%.

As I explained at the time, leadership at the Nasdaq exchange became concerned that its group of 100 stocks looked like a list of seven … plus 93 laggards.

This rebalance created something of a “soft ceiling” for the biggest of Big Tech. If the stocks rise too quickly in relative value compared to the smaller-cap names in the index, the Nasdaq will rein them in.

What this says to me, most essentially, is that the arbiters of one of the most widely invested index funds in the world want to give smaller companies a chance to catch up.

That’s significant.

It’s a signal to us as investors to “think small” and find quality investments that won’t be subject to institutional-level downsizing.

Next week, I’ll show you exactly how to do that — and how to find your new favorite small-cap investment in 10 minutes or less…

To good profits,

Adam O’Dell

Chief Investment Strategist