Congress passed the CHIPS and Science Act in 2022, in hopes of making America a more competitive semiconductor manufacturer.

The controversial measure allotted a massive $52.7 billion for American semiconductor research, development, manufacturing and workforce development.

Washington’s goal in passing the CHIPS Act was to steer American companies toward buying American-made chips rather than going off-shore to Southeast Asia.

The data shows there have already been some clear winners of this taxpayer funding (more on that in a moment).

From an investment perspective, if a company receives an infusion of government cash to expand operations, that’s attractive and should bolster the share price… if the company is public.

However, I’ve done some research into the three biggest winners from the CHIPS and Science Act and found that isn’t actually the case.

In short, Wall Street doesn’t love every chip manufacturer.

And once you’ve taken a closer look at where the CHIPS Act money is going, you get a clearer picture of each company’s prospects headed into 2025…

Some States Win Big While Others, Not So Much

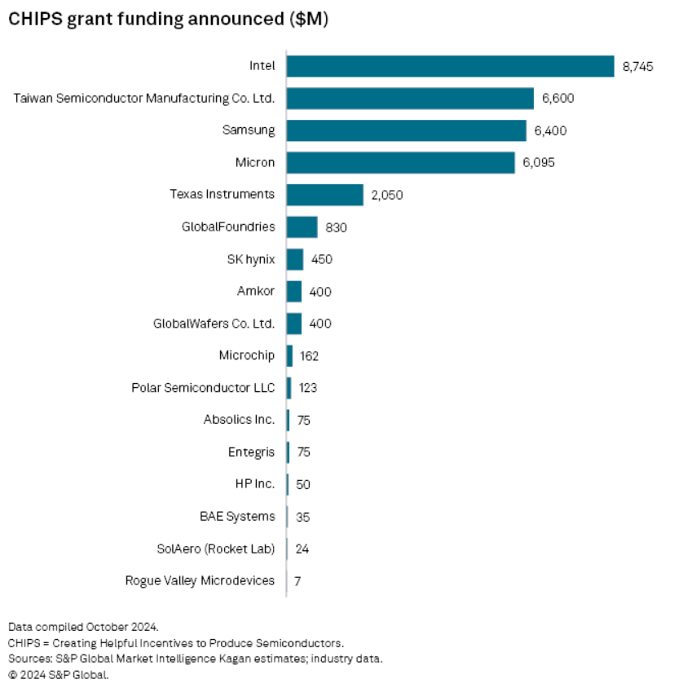

As of October 2024, $32.5 billion of the original $52.7 billion in the CHIPS bill has already been allocated.

While the money has been spread around, three states — Arizona, Texas and New York — have been the biggest beneficiaries… each pulling between $5 billion and $10 billion in funding.

Oregon and Ohio have received $1 billion to $5 billion, while Idaho, Utah, Colorado, New Mexico, Minnesota, Indiana, Missouri, Georgia and Vermont have received $100 million to $999 million.

No other state has received more than $35 million in funding.

When you break it down by company, you can see only five have received more than $2 billion:

Intel Corp. (Nasdaq: INTC) has been the biggest winner of the CHIPS Act funding… by far. The company has received $8.7 billion spread out over four different states.

Taiwan Semiconductor Manufacturing Co. Ltd. (Nasdaq: TSM) is second, with $6.6 billion going solely to its Phoenix, Arizona, production facility.

Samsung Electronics Co. Ltd. (OTC: SSNHZ) and Micron Technology Inc. (Nasdaq: MU) have each received $6.6 billion and $6.4 billion, respectively. Each amount has gone to one location — Austin, Texas, for Samsung and Clay, New York, for Micron.

Nine announced projects have also yet to receive CHIPS Act funding, totaling $12.6 billion.

With that in mind, let’s drill down even further and examine the three largest beneficiaries of the CHIPS Act and see how these government cash infusions have impacted their stock and their ratings.

Washington Cash Doesn’t Always Mean Wall Street Love

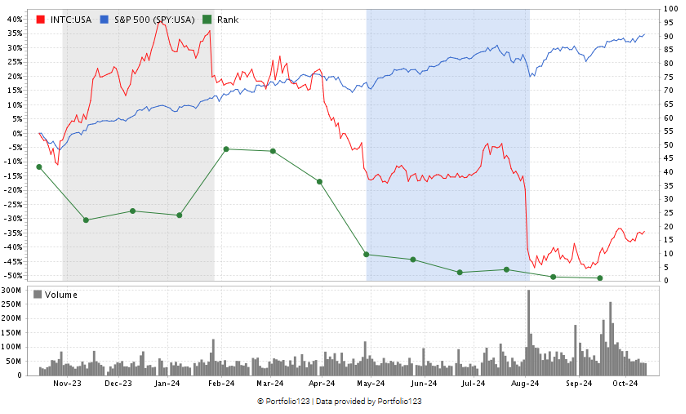

I’ll start with the biggest beneficiary of the CHIPS Act… Intel.

In the year since its last round of CHIPS funding was announced, the stock has fallen 36.4%:

Its rating has also dipped to “High-Risk” on Adam’s Green Zone Power Ratings system.

Pro tip: I wrote about INTC in September and noted a potential catalyst with the stock. Since then, it has risen by 2.6%. Read about it here.

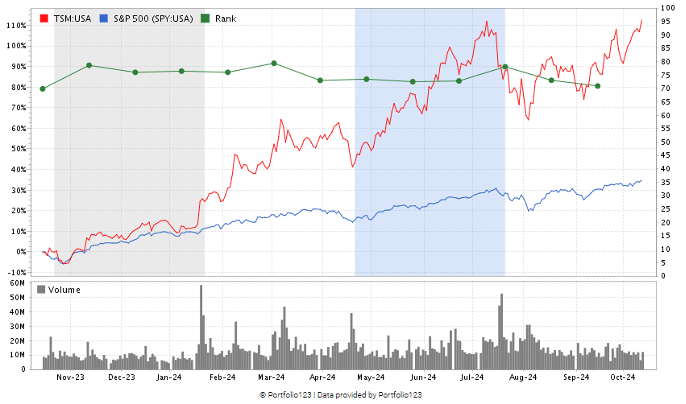

Then, there’s TSM, which has received $6.6 billion in CHIPS funding for its fabrication facility in Arizona:

This stock has been a bright spot in the semiconductor industry, jumping 89% in the last 12 months.

However, its rating is starting to falter, going from a high of 78 out of 100 to its current rating of 69.

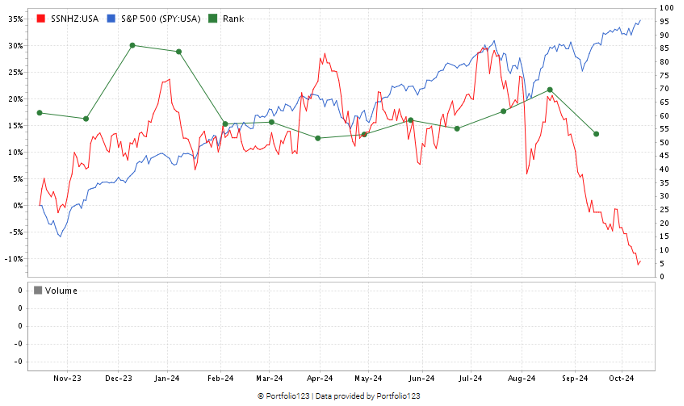

Finally, Samsung Electronics received $6.4 billion for its fabrication facility in Austin, which will produce 4-millimeter and 2-millimeter chips.

In the last 12 months, Samsung stock is down 12%, and its overall rating has dipped from a high of nearly 90 to its current rating of “Neutral” 52 out of 100.

Bottom line: Billions have been poured into the American semiconductor infrastructure… with billions more to come.

And while this injection of capital is helping these chip companies expand their operations in the United States, it’s not necessarily resonating with American investors.

Many of these chip stocks remain in a downtrend or flat despite taxpayer dollars helping grow their footprint.

While it may be tempting to invest in these stocks that benefit from huge amounts of government cash, it still pays to do your research… especially using Adam’s Green Zone Power Ratings system… to inform you as to whether these are worthy of your portfolio.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets