It’s been the market’s hottest story since 2022…

The AI trade has propelled the benchmark S&P 500 to new highs, led by seven specific stocks — Alphabet Inc. (GOOGL), Apple Inc. (AAPL), Amazon.com Inc. (AMZN), Nvidia Corp. (NVDA), Microsoft Corp. (MSFT), Meta Platforms Inc. (META) and Tesla Inc. (TSLA).

These Magnificent 7 stocks have driven the market higher since the launch of ChatGPT to the general public in late November 2022.

S&P 500 Up 75% Since December 2022 Low

Since hitting a low in December 2022, the benchmark index has risen 75%, primarily driven by the “Magnificent 7” stocks.

However, the recent sell-off of high-valued tech stocks may point to a winter hibernation of these seven market drivers.

In some investment circles, that may spell trouble for the S&P 500; however, it could be an opportunity for the other 493 stocks in the index to shine.

Let me explain…

Houston, We Have A Valuation Problem

Despite a trade war, and using the AI boom, the Magnificent 7 stocks have risen virtually unchecked.

That has pushed key valuation spreads to the top of their ranges.

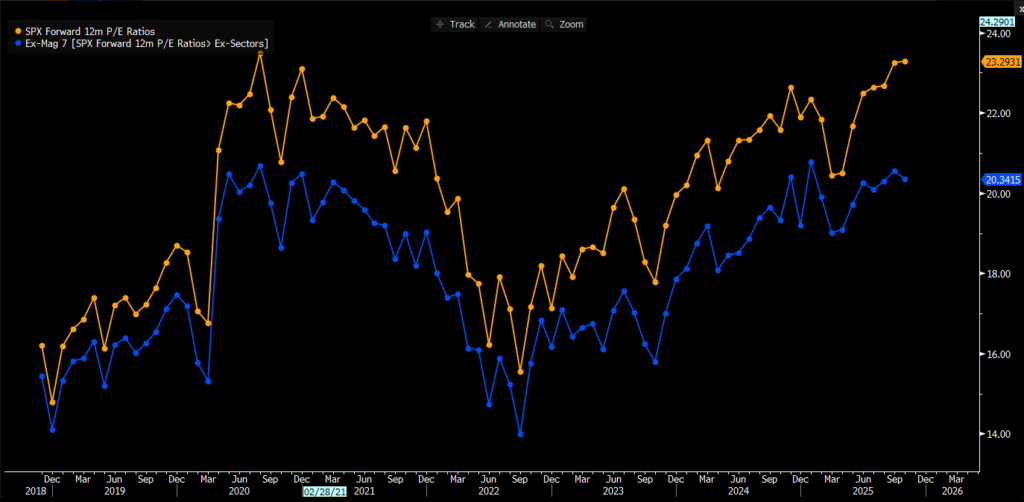

S&P 500 Valuation Spreads Hit High

The divide in the forward P/E of the benchmark with the Mag 7 and without is hovering near all-time highs.

Currently, the forward P/E spread between the S&P 500 and the index minus the Mag 7, is approximately 2.9.

This signifies a potential for the Mag 7 stocks to “cool off,” while the remaining 493 stocks in the index have time to catch up.

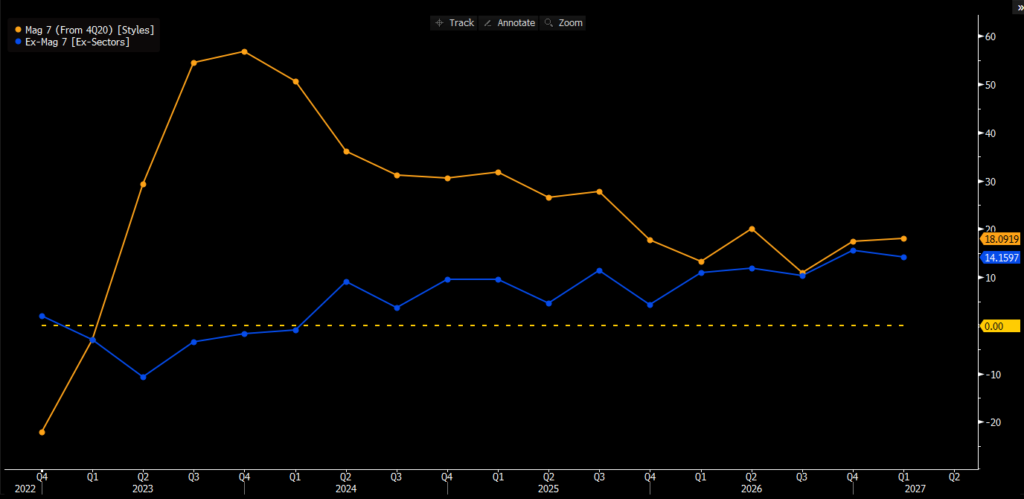

The variance in forward P/E is also illustrated in the earnings gap between the Mag 7 and the remaining stocks in the index.

Earnings Gap Between Mag 7 and The Rest of the Index Closes

As we can see, the earnings gap between the Mag 7 and the rest of the S&P 500 has been wide since the second quarter of 2023.

However, that gap is starting to narrow to the point where the rest of the index is projected to close it by the first quarter of 2026.

The closure of this gap could lead to a rotation out of the Mag 7 and into the remaining 493 stocks in 2026.

Ratings Journey Provides Peek At Mag 7 Rotation

While the rest of the S&P 500 is starting to catch up to the Mag 7 stocks in terms of earnings, another piece of analysis suggests a decline in those seven stocks.

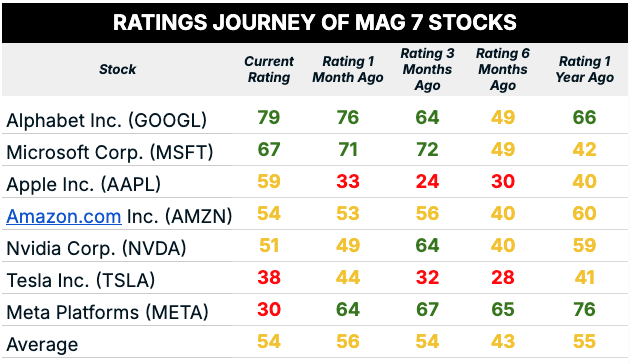

I screened a ratings journey for the Mag 7 stocks on Adam’s Green Zone Power Ratings system and discovered something interesting.

I analyzed the ratings of each of the seven stocks at various points in time (current, one month, three months, six months and one year).

What I found is that four of the seven stocks earn a “Neutral” rating, while two are “Bearish” and two are “Bullish.”

Meta Platforms (META) has been the biggest drag on the group’s ratings, falling from a “Bullish” 67 three months ago, to a “Bearish” 30 today.

Only Alphabet Inc. (GOOGL) has remained somewhat consistent in its “Bullish” ratings as others have bounced.

The average is the interesting part to me.

On average, the Mag 7 stocks rate a “Neutral” 54… the second-lowest rating in a year. That is down from 56 a month ago.

This suggests that some wind is being taken out of the sails of the Mag 7 stocks, which could play nicely for the remaining 493 stocks in the S&P 500.

Time will tell.

That’s all from me today.

Until next time…