Matt here, and I’m filling in for Adam once again while he takes advantage of the holiday week to spend some time away. Although knowing him, I bet he’s still peeking at his phone from time to time to keep up with what’s going on in the world of finance.

He’ll be back on Monday with our regularly scheduled analysis.

In the meantime, I’ve got a new list of “Bullish” stocks based on our Green Zone Power Rating system to look over before U.S. markets close at 1 p.m. ET today for the long Fourth of July weekend.

Let’s get right to it!

The S&P 500’s “New Bulls”

We’ll stick to our plan in today’s edition and start by screening the S&P 500 for “New Bulls.”

These are stocks with Green Zone Power Ratings that have improved enough recently to become “Bullish” or “Strong Bullish,” which means they are set to outperform the broader market over the next 12 months by a factor of 2X or 3X, respectively. And we’re looking for two things when running this screen:

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”) in my Green Zone Power Rating system.

- The stock must have been rated less than 60 for each of the last four weeks.

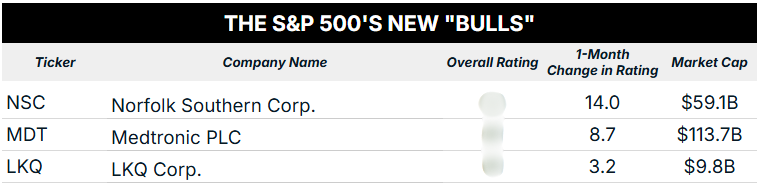

Here are the three S&P 500 stocks that passed the screen this week:

I want to focus on Norfolk Southern Corp. (NSC), a rail transportation company that moves raw materials and finished goods throughout the country by rail.

The company also transports goods overseas using a network of ports located on the Atlantic coast and the Gulf of America.

One significant driver of NSC’s move in Adam’s Green Zone Power Ratings system is its momentum.

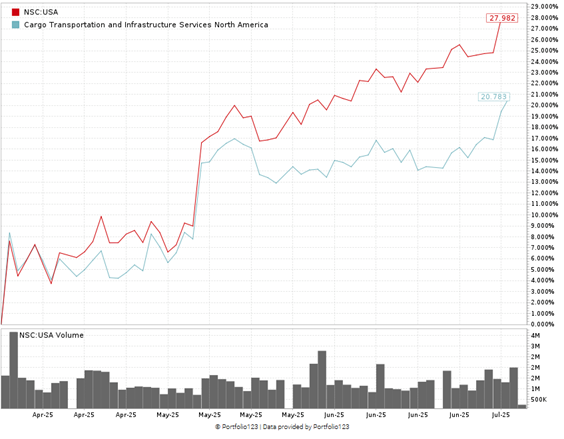

Two months ago, the stock was rated below 40 on Momentum. Today, that rating is above 70.

NSC Up 28% From April 2025 Low

After hitting a low amid Trump’s reciprocal tariff announcement, NSC rallied 28%, while the cargo transportation and infrastructure services industry is only averaging a 21% rise.

This dramatic shift in momentum was boosted when the company unveiled its quarterly earnings in late April.

Norfolk Southern reported a $933 million increase in its income from railway operations and an increase in earnings per share from $0.23 in the first quarter of 2024 to $3.31 in 2025.

Its total railway operating revenue was up $2.8 billion year over year, with the exception of lower fuel surcharge revenue.

I will be interested to see if Norfolk Southern can continue this momentum uptrend into the next quarter.

26 Newly Bullish Stocks Outside the S&P 500

Casting a wider net when looking for new investing opportunities can lead to finding stocks that likely were never on your radar.

And that’s what this broader screen of stocks outside the S&P 500 is intended to do.

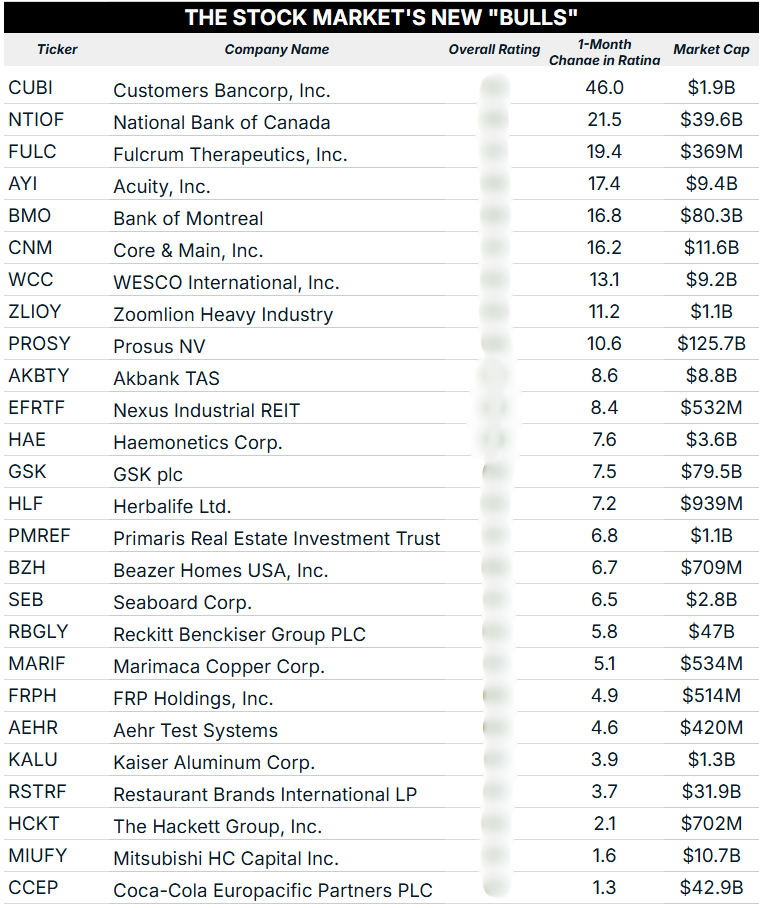

This week, while running our typical analysis, I found 26 stocks that aren’t currently included in the market’s most popular index:

If you want to look up any of these stocks to see how they stack up in the Green Zone Power Rating system, including their ratings on each of our six individual factors that contribute to their composite score, click here to see how you can join Green Zone Fortunes now.

There are some big ratings moves on this list, especially with Customers Bancorp Inc. (CUBI), whose overall score in our system has climbed an impressive 46 points over the last month! That’s not something you see very often, and it tells me this is one stock to look closer at.

We also have a broad range of stocks based on market cap, so if you’re looking for stocks of a certain size, this list offers a good variety. Here’s how it breaks down by the typical categories referenced in financial markets:

- 10 large-cap stocks (market cap between $10 billion and $200 billion).

- 4 mid-cap stocks (market cap between $2 billion and $10 billion).

- 12 small-cap stocks (market cap between $250 million and $2 billion).

We’ve harped on this before, but seeing such a wide range of stocks based on size is a very encouraging sign for the broader bull market. With 12 stocks in the small-cap category, that tells me that investors are gaining confidence and looking for stocks that can deliver outsized gains compared to their larger peers.

What’s more, there isn’t a single mega-cap stock (greater than $200 billion market cap) on this list!

That’s a wrap for today.

Have a safe holiday weekend!

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets