If it’s consistent income you are looking for from an investment, look no further than our Top 3 dividend stocks to buy in 2020.

As a refresher, a dividend stock is a stock that pays shareholders a regular payment — this can be monthly, quarterly, yearly or even sporadically — as determined by the companies. The amount a shareholder gets depends on the dividend yield of the stock and how much stock the shareholder owns.

Most dividend-paying companies make those payments in cash — cash dividends — but some dividend stocks pay out in additional shares — stock dividends.

Dividends are looked at as rewards for shareholders who own stock, or as a way to entice investors to buy into the stock.

For the purpose of our dividend stock focus, we are focusing on those companies paying a cash dividend.

Top 3 Dividend Stocks to Buy in 2020

Entertainment Properties Trust

Market Capitalization: $5 billion

Annual Dividend Yield: 6.4%

Some of the most common dividend-paying stocks are real estate investment trusts. These are companies that own and manage real estate properties and mortgages.

Their investment popularity stems from the requirement that they must distribute 90% of their taxable income to shareholders each year.

One of the strongest — and most unique — of these is Entertainment Properties Trust (NYSE: EPR).

The company holds real estate in three segments: entertainment, recreation and education. Large movie theaters, entertainment retail centers and recreational properties are in its property portfolio.

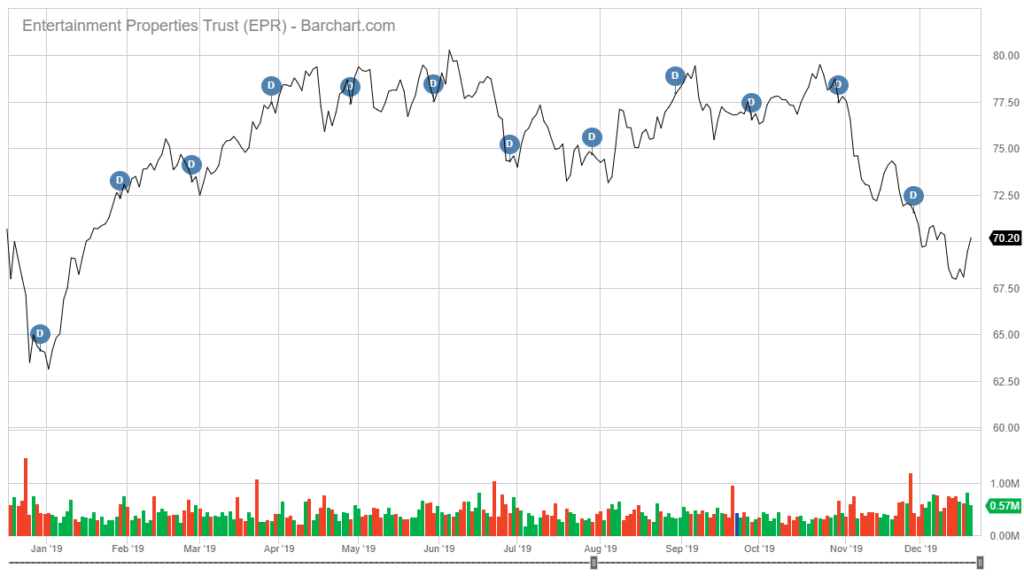

Its forward price-to-earnings ratio is 11.17 compared to its trailing of 12.46. That could be an indicator of a slight change in earnings in 2020.

Its share price has been consistent between $73 and $79 per share in 2019, but its earnings have beaten analysts’ expectations in all first three quarters of 2019.

Entertainment Properties Trust pays a monthly dividend. In 2019, that dividend has been consistent at $0.37 per share, making it a strong dividend-paying stock.

That is the main reason why Entertainment Properties Trust is one of our Top 3 dividend stocks to buy in 2020.

Grupo Aval Acciones y Valores S.A.

Market Capitalization: $9.5 billion

Annual Dividend Yield: 3.98%

Real estate investment trusts are great for dividend stocks, but sometimes you want something a little more out of the ordinary.

Enter Grupo Aval Acciones y Valores S.A. (NYSE: AVAL).

Grupo is a Columbian banking group that provides banking services such as checking and savings accounts, as well as personal and business loans. It also ventures into brokerage and investment banking in Latin America.

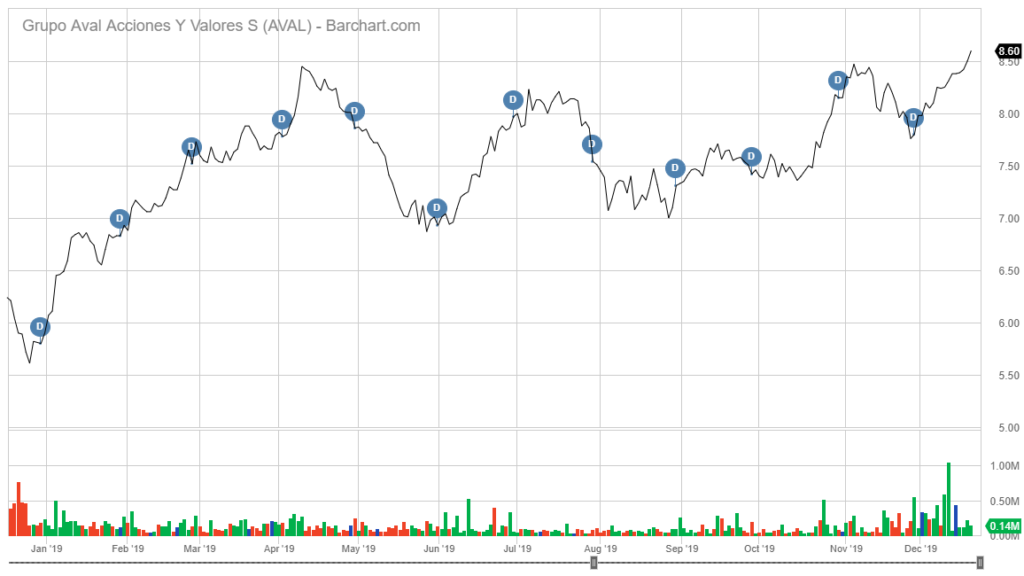

Currently, it’s price-to-earnings ratio is 9.91, compared to the S&P 500 ratio of 19.5 and the finance market of 14.5. This suggests the stock is undervalued and has room to grow in the future.

But the real benefit to Grupo is the fact it has paid a monthly dividend every month in 2019. While that dividend isn’t much, mainly due to the overall price of the stock — $8.60 per share at the time of this writing — consistency is key.

That dividend yield will fluctuate because of currency valuations changing, but being able to invest in a foreign stock that pays a monthly dividend is something outside the norm.

It’s uniqueness and consistent monthly payout makes Grupo Aval Acciones y Valores S.A. one of our Top 3 dividend stocks to buy in 2020.

AGNC Investment Corp.

Market Capitalization: $9.5 billion

Annual Dividend Yield: 10.8%

One of the most consistent monthly paying dividend stocks has been AGNC Investment Corp. (Nasdaq: AGNC).

It’s another real estate investment trust that holds agency mortgage-backed securities on a leveraged basis.

Like Entertainment Properties Trust, AGNC’s forward price-to-earnings ratio is only slightly lower than its trailing ratio. Regardless, because it’s a real estate investment trust, it still has to pay out 90% of its taxable income each year.

Its share price had a unique dip in August and September, but it has held at around $17 a share and higher for most of 2019 — in fact, it rebounded back to $17 a share from a low of around $15 in just under two months.

It did have some earnings-per-share struggles earlier in the year, but it reported an almost 23% earnings beat in the quarter ending September 2019 — that helped lead to the massive rebound the share price experienced in the last four months of 2019.

AGNC is another dividend-paying company that has paid its shareholders monthly. In 2019, that dividend was between $0.16 and $0.18 per share, but consistency has been the key.

Currently, it has one of the highest dividend yields around — 10.8% — and its share price make it extremely affordable to get into for both the first time and seasoned investors.

Because of its consistent dividend yield, low entry price point and high monthly yield, AGNC Investment Corp. is one of our three dividend stocks to buy in 2020.

Remember, there is a great deal of dividend-paying stocks out there. Make sure you do your homework and have realistic expectations.

We have presented you with our Top 3 dividend stocks that have a mix of high yield, consistent payout and uniqueness, which could lead to nice dividend payouts for investors in 2020.

These companies have solid performance and the potential to grow even more in the coming years, making them our Top 3 dividend stocks to buy in 2020.

To learn more about generating monthly dividends as high as 8%, click here.