Dividend stocks are going to be living in a different world in 2022.

The Federal Reserve will likely raise interest rates in the first half of 2022. Fed Chair Jerome Powell and his peers have telegraphed it for months. So, barring any major disruptions, rates will increase for the first time since 2018.

The Fed is also well on its way to phasing out its bond-buying program. It reduced its $120 billion in monthly purchases to “only” $90 billion in December with plans to drop it to $60 billion in January. By March, it should be phased out altogether.

What does this mean for dividend investors in the new year?

Bonds and the 2022 Market

All else equal, bond prices should fall without the constant buying pressure from the Fed. (Falling bond prices translates to rising bond yields.) Falling bond prices mean falling prices for assets that are seen as bond substitutes, such as high-yield stocks and REITs.

I can’t tell you for sure whether bond prices will go higher or lower next year. This market quit making sense a long time ago. But I can tell you to be prepared for lower bond prices by concentrating on dividend growth over raw yield.

Even in more normal times, bonds and bond-like dividend payers will lose purchasing power to inflation. That’s why your income portfolio should always have a growth component. In a perfect world, every dividend stock in your portfolio consistently raises its dividend at or above the rate of inflation.

Last week, I highlighted some of my favorite dividend stocks. Today, I build on that list, focusing on high-growth dividend stocks.

3 High-Growth Dividend Stocks for 2022

Realty Income Corp.

If you’re looking for a serial dividend raiser, you can’t lose with Realty Income Corp. (NYSE: O). This triple-net retail real estate investment trust (REIT) has raised its dividend for 97 consecutive quarters and at an annualized rate of almost 5%. Most of its tenants have rent escalators built into their leases, so if inflation continues to rage out of control, Realty Income should be able to keep pace with it.

At today’s prices, Realty Income yields a respectable 4.3%. That’s not the highest yield you’re going to find, but it’s decent and safe.

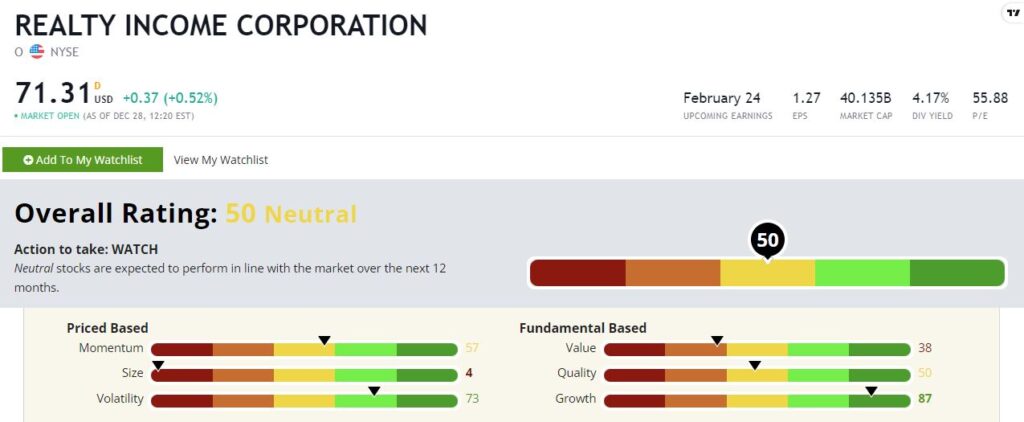

Realty Income rates a 50 on our Green Zone Ratings system, but it rates an 87 and 73 on our growth and volatility factors, respectively. That means we’re getting consistent, well-above-average growth with low volatility.

Enterprise Products Partners

When it comes to income stocks, boring is beautiful. If I want drama, I’ll buy a small-cap growth darling or a cryptocurrency. But I don’t want to depend on that for my monthly expenses. I want boring stability.

And that brings me to Enterprise Products Partners LP (NYSE: EPD). Enterprise Products’ primary business is moving natural gas and natural gas liquids from point A to point B across its vast network of pipelines crisscrossing the U.S. It’s a toll road for natural gas.

EPD yields a massive 8.4%. Over the past few years, distribution growth has been modest, but the company has managed to average a 7% annual increase over the past 23 years and counting.

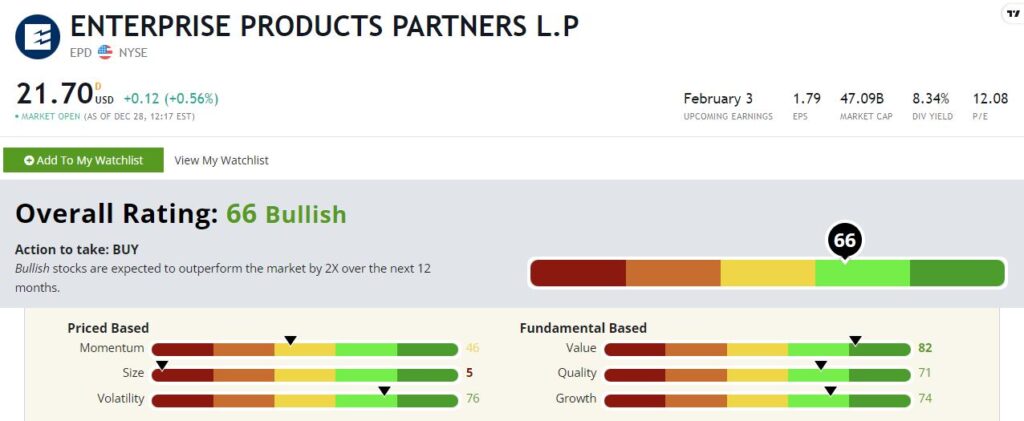

Enterprise Products rates a “Bullish” 66 on Green Zone Ratings. It rates well on our value, volatility and growth factors at 82, 76 and 74, respectively.

That makes EPD a top high-growth dividend stock to buy for 2022.

Crown Castle International

For one final high-growth, low-volatility income option, take a look at Crown Castle International Corp. (NYSE: CCI). Crown Castle is an unconventional REIT. Rather than own apartments or office buildings, it owns a network of more than 40,000 cell towers and 80,000 route miles of fiber cable.

The growth story here tells itself. Five years from now, do you think you’ll be using more or less mobile data on your phone or other devices than you do today?

Yeah, that’s what I thought. Me too.

At its current price, Crown Castle yields just shy of 3%, and it’s been raising its dividend aggressively. In December, the REIT hiked its payout by 11%.

Crown Castle rates a “Neutral 51” on our Green Zone Ratings system. But it rates in the top 5% of more than 8,000 stocks on growth. It’s also one of the least volatile stocks out there, with a 90 volatility rating. That’s no-drama growth, which is exactly what we want here.

All the best in 2022!

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.