In this zero point nothing yield environment, investors will scratch any post possible, attempting to unearth yield in sometimes all the wrong places.

Within my world of coverage (REITs), it’s a struggle to find attractive yields in that 5% plus range, something that used to be a lot simpler in more normal interest rate environments.

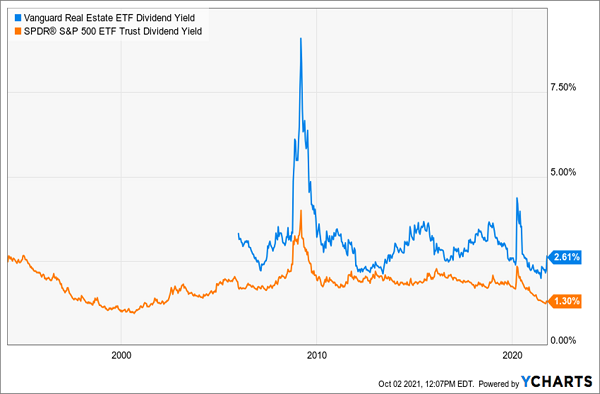

Today, the Vanguard Real Estate ETF (NYSE: VNQ) yields 2.6%, double that of the S&P 500 index. It’s not BAD, but it’s not what many of us need when planning out our retirement income.

I’ve seen an adventurous retiree or two dip their toes into those real estate investment trusts (REITs) yielding above 6%, grasping for yield, however ignoring all the risks associated with a dividend more than double the sector average.

The REITs with solid secular tailwinds such as American Tower Corp. (NYSE: AMT) in 5G or Duke Realty Corp. (NYSE: DRE) in industrial and e-commerce or Equinix Inc. (Nasdaq: EQIX) in data centers all have yields below 2%.

Growth oriented investors have piled into these stocks, although dividends haven’t been able to keep pace with the torrid rise in stock prices.

AMT, which is a recommendation in chief strategist Brett Owens’ Hidden Yields portfolio, is benefiting tremendously from the explosion of demand for leasing from 5G operators, allowing its monopoly-like business to provide strong dividend growth, and helping support a near 2% yield for retirees into the foreseeable future.

I love AMT, but I also like nice, big dividend yields today: ones that can deliver those 5-plus percent yields to help fund my income goals.

So, what’s a yield seeker to do in this divided and challenged environment?

First, we need to look out for (and avoid) what I would call high-yielding REITs that are “growth challenged.”

If a REIT has a high yield but no opportunity for growth, there’s a high likelihood that yield won’t stay very high for long.

Thus, the key is identifying those that have attractive growth opportunities.

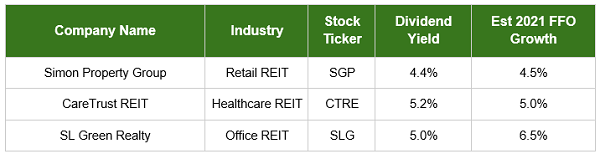

I scoured the universe for REITs with yields above 5% and what I believe are attractive growth opportunities. The good thing — if the growth expectations are on point, we should have an above-average dividend payout and potential for capital appreciation as investors bid up the shares — a win-win for your retirement portfolio.

The majority of 5% plus yielders tend to fall within a few specific REIT industries — mortgage, office, long-term healthcare facilities and retail (specifically mall-based retail property owners). So, ultimately, these are areas of the market that have some headwinds.

However, I’ve identified one name from three REIT industries that should post above-industry growth to sustain an attractive yield for our retirement portfolios.

This 4.4% Yielding Mall Landlord Should Get A Holiday Bounce

Simon Property Group Inc. (NYSE: SPG) was under direct fire during the pandemic. COVID fears left consumers wholly reliant on online purchases, leading to a swarm of mall-based retailer bankruptcies. Shares were more than cut in half at the height of pandemic fears, but SPG shares have crawled back, now trading only slightly short of pre-pandemic levels.

But, the question remains, can we still invest in mall-based REITS?

My answer is a resounding YES. With SPG, I’m betting on the best horse in an ugly race. Proof of this is that Simon Property’s management was able to navigate the pandemic and grow when many were struggling.

Thanks partly due to its dominant position within the industry, along with a solid balance sheet that allowed for success during difficult times — Simon proactively kept occupancy rates high throughout it all; while also working to reduce any significant exposure to any one retailer.

Simon cut its dividend during the pandemic; however, I see this as a temporary one-time move made to help conserve cash during a once-in-a-lifetime black swan event. Management is now committed to maintaining and growing its yield (currently at 4.4%) for the foreseeable future.

Everything is now looking up — occupancy rates keep climbing (now up to near 92%), and management has its eyes on numerous development and redevelopment opportunities. I expect that shoppers will be back shopping in full force this holiday season.

A 5% Yielding Senior Housing Landlord With A History Of Rewarding Shareholders

Within the Healthcare space, I like the pure-play senior housing landlord CareTrust REIT Inc. (Nasdaq: CTRE). The firm pays a generous 5.2% divided, four times as much as the S&P 500 Index!

Of course, senior facilities were hit hard during the peak of the pandemic, as COVID-19 wasted no mercy on some of the most vulnerable patients.

However, things have improved significantly in recent months. Management has made shrewd moves to diversify exposure to particular tenants (Ensign) while occupancy rates have continued to climb higher.

The management team for CTRE is known as one of the best in the game and has easily outpaced competitors in unearthing acquisitions at better than market cap rates. So from a growth perspective, I like backing a team with past expertise in acquisitions.

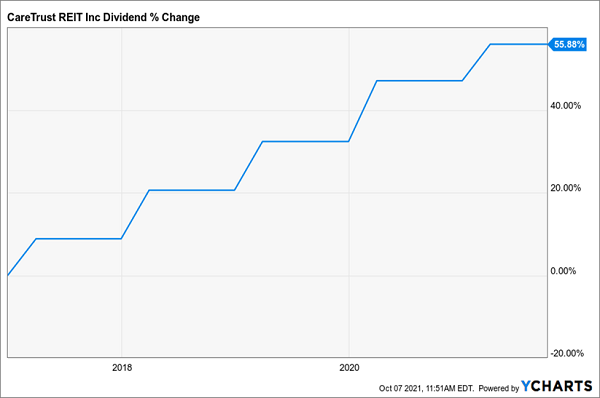

In addition, CTRE has raised its dividend every year — even through the height of the pandemic. If it’s high yield with growth you’re after, CTRE should be at the top of your REIT shopping list.

Back To Work, Might Mean A Good Bet For Higher Yields With This Monthly-Paying Office REIT

SL Green Realty Corp. (NYSE: SLG) owns some of the biggest and baddest office properties in New York City. It’s shares were decimated when NYC went full ghost town and office workers in the Big Apple hunkered down at home.

A key to a bet on SLG is that NYC returns to its glory days as a bustling and thriving epicenter housing some of the biggest and brightest minds in technology and finance.

The street has been worried about office workers migrating south to the Sunbelt region, however, recent data shows that young workers are coming back to NYC in full force.

And a recent move by Google in which it gobbled up a Manhattan-based office property for $2.1 billion shows that this thesis definitely has legs. This marked the most expensive transaction for office property since the start of the pandemic.

Oh and let’s not forget that Google was one of the companies spearheading more of a hybrid work environment.

My guess is New York City will remain a cornerstone for most big businesses, both within technology and finance. This means a desire to be situated in the best parts of Manhattan, most of which are owned by SLG.

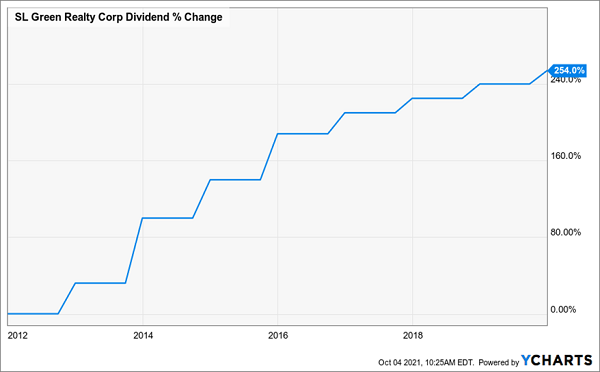

Meanwhile, SLG pays a well-covered 5% dividend yield that was converted from quarterly to monthly payouts in the early days of the pandemic. By rewarding shareholders consistently with over 250% dividend growth over 7 years, SLG is my return-to-the-office, NYC recovery play.

To learn more about generating monthly dividends as high as 8%, click here.