In this Marijuana Market Update, I discuss a potential problem in the cannabis sector, how it can be fixed and how you can profit from it using cannabis real estate investment trusts (REITs).

How Mergers and Acquisitions Emphasize a Cannabis “Problem”

The cannabis sales market flourished last year.

Cannabis sales flourished in 2020, but according to market research firm BDSA, 2021 was even better as legal cannabis sales topped $25 billion — a 40% increase from the year prior.

Projections suggest cannabis sales could reach $30 billion this year (something I predicted last year) to upward of $45 billion.

That boost in sales has created a huge market for mergers and acquisitions (M&A) in the cannabis space.

The cannabis sector had 278 related mergers and acquisitions in 2021 compared to just 201 in 2020.

All told, deals in 2021 were valued at $9.4 billion compared to 2020’s $4.5 billion.

This suggests that cannabis companies looking to merge or acquire need additional capital. However, banking regulations in the U.S. strangle the amount of money these cannabis operators have access to.

Current law leaves traditional banks open to a slew of penalties for working with cannabis-related companies.

The legalization status of cannabis across the U.S. creates additional pressure as it broadens the market for potential M&A deals — allowing larger operators to expand into previously untouched markets by acquiring smaller ones.

In 2021, state lawmakers in Connecticut, New York, Virginia and New Mexico adopted legislation approving cannabis for recreational use, while Alabama approved a medical program.

So the list of states approving cannabis on some level continues to grow, and additional states are looking at measures for 2022 and 2023. Missouri, which passed a medical cannabis program in February, and both Carolinas — which are expected to vote on legalizing cannabis this year — are all states to watch.

Delaware, Rhode Island and Maryland will begin debating the issue this year, and sales in New Mexico could start as early as April.

The recent surge in M&A coupled with the expansion of legalized cannabis have put overwhelming pressure on cannabis operators for capital and space.

REITs Present a Profitable Opportunity

This is where REITs come into the picture — with the ability to provide both capital and space.

REITs own property and lease it to companies in a related space. Cannabis REITs own property used by cannabis operators for growing or retail.

Operators can sell their property to the REIT in exchange for cash and stay in the property by signing a long-term lease.

So these operators get an immediate infusion of cash without losing the space they need to either grow or sell.

Using traditional lenders can be an expensive process for cannabis companies. It can even mean selling off part of the company. However, REITs can give cannabis companies non-diluted capital — essentially money without selling shares.

IIPR Company Analysis

One strong player in the cannabis REIT space is Innovative Industrial Properties Inc. (NYSE: IIPR).

The Maryland-based company owns property leased back to experienced, state-licensed operators for medical-use cannabis facilities.

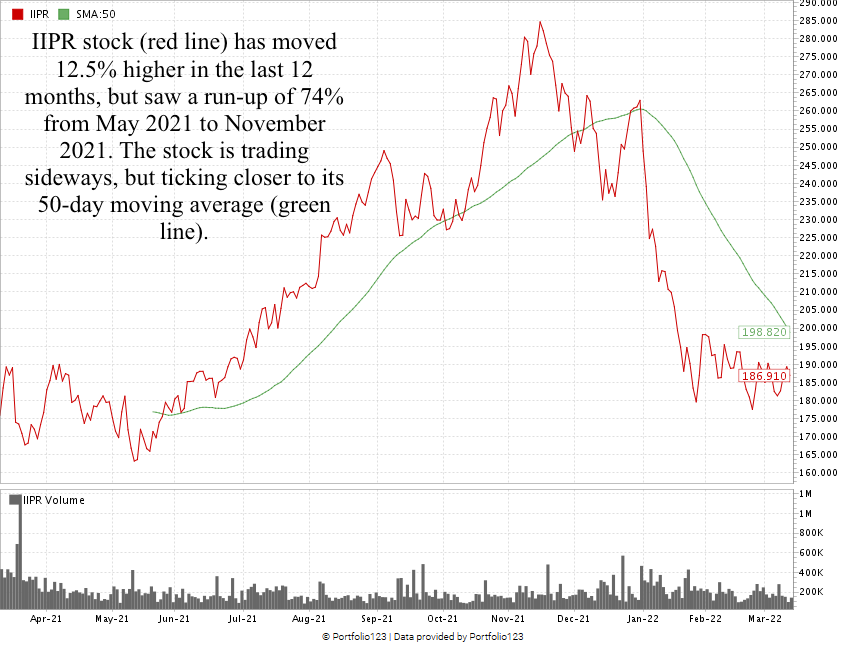

Over the last 12 months, IIPR is up 12.5%. It had a strong run from May 2021 to November 2021, where the stock gained 74%.

IIPR is trading sideways now, but it’s testing some resistance at $190 to $195. A break past that level could see another strong run of the stock.

The company generated $204.6 million in total revenue in 2021 — a 75% increase from 2020. The REIT also invested $714 million in new acquisitions, the highest amount of any year since the company started.

As we can see from the chart below, Innovative Industrial Properties is only going to get stronger:

IIPR is expected to more than double its total annual revenue to $441.8 million by 2025.

According to my Cannabis Power Rating — which rates cannabis stocks on various metrics against each other — we are “Bullish” on IIPR, but only by a hair.

The stock rates a 61 overall — which puts it just above the middle of the pack of all the cannabis stocks we rate.

Its strongest showing is momentum — where it scores an 82 in part because of its 222% jump in stock price over the last two years. It’s trading a bit sideways now but has weathered the massive headwinds experienced by other cannabis stocks a bit better.

IIPR scores a 31 on value, as its trading ratios are higher than its peers. However, the company is operating with a 97.8% gross margin and a 66.2% operating margin — both of which are very strong.

The Takeaway

There are other cannabis-related REITs you can look at to jump on this trend of REITs being a strong source of capital for cannabis operators:

- Power REIT (NYSE: PW).

- NewLake Capital Partners Inc. (OTC: NLCP).

- AFC Gamma Inc. (Nasdaq: AFCG) — a mortgage REIT in the cannabis space.

However, in looking at strong players within the cannabis market, IIPR is well-known, with healthy ties to big cannabis operators.

As sales continue to increase, and the M&A market in the cannabis space grows, look to these REITs as saviors for cannabis operators to obtain non-diluted capital to fuel expansion.

One more thing: You can get Money & Markets swag by submitting a question for me, Adam O’Dell or Charles Sizemore that we’ll use in any of our videos. Just send us your questions and feedback.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

Make sure you subscribe to our YouTube channel and get notified each and every time we post a new video.

We have a lot of great weekly video features on our channel, including:

- Ask Adam Anything — Where I get to sit down with chief investment strategist Adam O’Dell and ask him any question (from you or me) and get his insights into the stock market.

- Investing With Charles — Green Zone Fortunes co-editor Charles Sizemore and I talk about all things related to stocks and the economy, including comparing stocks to give you the best investment advice.

- The Bull & The Bear — Our weekly podcast where I show you the trends and analysis that move the market.

All of these series are on our YouTube channel.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.