In this Marijuana Market Update, I share an overview of our Money & Markets Cannabis Index.

While markets may be down, there are ways to find profitable opportunities.

Our equal-weighted Cannabis Index tracks the performance of the broader cannabis market. It’s a comprehensive look at the state of the cannabis market.

As we can see, the broader cannabis market saw a nice run into December 2021. But it’s declined to start 2022.

This correlates more with the movements of the broader market than it signifies a shift in investor sentiment in cannabis stocks.

As of this recording, all three U.S. indexes are down between 9% and 19.5% year-to-date.

Cannabis stocks have declined 23.8% in the same time frame, according to our index value.

But does this mean it’s a bad time to invest in cannabis stocks? The short answer is not necessarily.

Politics have been a significant headwind for the cannabis market. Pressures related to infrastructure spending and the budget moved all cannabis discussion to the back burner. It’s likely to remain that way with issues like inflation and the conflict between Russia and Ukraine putting more pressure on the cost of goods and services.

I remain bullish on the cannabis market, but you must know where to look.

The recent downturn in the market has presented valuations for some cannabis stocks that could make them attractive for investors.

CWBHF Analysis + 3 Bargain Cannabis Stocks

Take, for example, a question I recently received from Leo:

Hello, Matt. Can you update me on the prospects for Charlotte’s Web? It was an industry favorite in 2019 when I purchased it, but I cannot find anything substantive in the cannabis press. Your feedback would be greatly appreciated. Best regards. — Leo.

Thank you for your question, Leo. This question works perfectly for our broader conversation.

Charlotte’s Web Holdings Inc. (OTC: CWBHF) is a Colorado-based hemp and CBD producer.

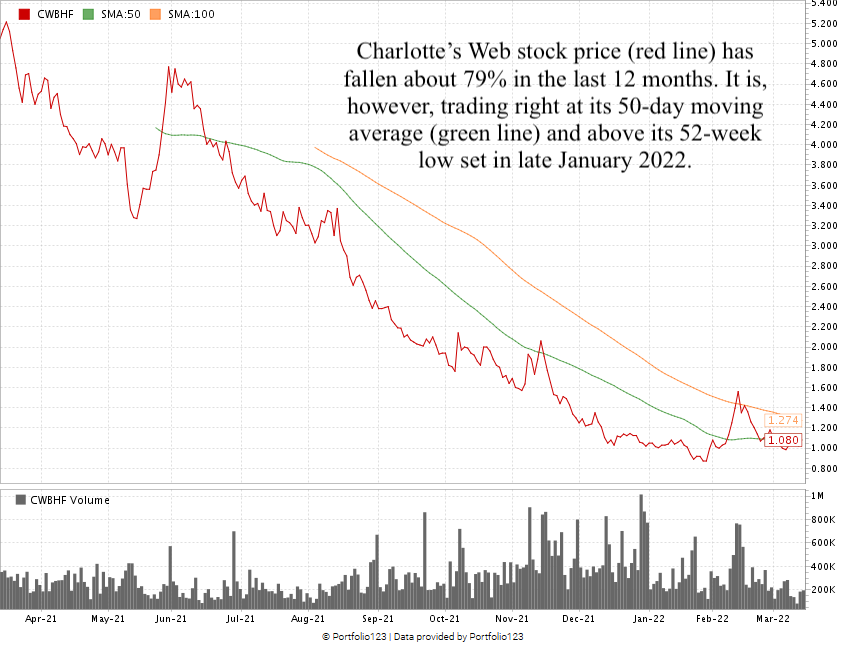

In the last 12 months, the stock price for Charlotte’s Web has dropped about 79%.

The company reported stronger revenue in 2021. Its total annual revenue was around $99 million compared to just $95.2 million in 2020. Analysts forecast total annual revenue of $119.1 million for 2022.

There has been news regarding Charlotte’s Web that has boosted its stock:

- It started selling its gummies at GNC locations across 24 states in January.

- The company’s hemp extract had positive effects on stress, sleep and well-being, according to a clinical trial in February.

- The company started developing CBD-based beverages in February.

One thing about CWBHF stands out when considering our Money & Markets Cannabis Power Rating system: value.

Overall, CWBHF rates a 45, which is “Neutral.” It scores a bearish 14 on momentum as the stock has been in a freefall since last year.

However, Charlotte’s Web scores an 86 on value.

CWBHF’s price drop makes it an attractive value stock. Its current price-to-sales (P/S) ratio is 1.55 compared to the broader industry ratio of 4.52.

It also trades with a price-to-book (P/B) value ratio of 0.63 compared to its industry peers’ average of 1.45 — indicating it is a bargain for its price.

And it’s not alone:

- Fire & Flower Holdings Corp. (OTC: FFLWF) — A Canadian independent cannabis retailer scores a 99 on value on our rating system as it trades with a P/S ratio of 0.09 and a P/B ratio of 0.13.

- Decibel Cannabis Co. Inc. (OTC: DBCCF) — Another Canadian cannabis retailer scores a 93 on value with a P/S ratio of 0.77 and a P/B ratio of 0.79.

- Eve & Co. Inc. (OTC: EEVVF) — A cannabis company that gears its products toward women. It trades with a P/S ratio of 0.45 and a P/B ratio of 0.14.

These are just four examples of stocks whose charts don’t look attractive but present solid trading values.

The Takeaway

The immediate future of the cannabis market remains unclear, but I don’t think we are at the bottom yet.

That’s why I don’t look at single factors when determining potential investments. One factor alone doesn’t tell a story.

While Charlotte’s Web may not be a buy right now — when we do see an uptrend in its stock price, we’ll have momentum and value on our side.

In addition to seeking out high-value cannabis stocks, I also like to see some positive upside in its stock price movement before jumping in. When a stock is already moving higher, it’s more likely the stock will continue moving in that direction.

I hope that answers your question, Leo.

One more thing: You, like Leo, can get Money & Markets swag by submitting a question for me, Adam O’Dell or Charles Sizemore that we’ll use in any of our videos. Just send us your questions and feedback.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

Make sure you subscribe to our YouTube channel and get notified each and every time we post a new video.

We have a lot of great weekly video features on our channel, including:

- Ask Adam Anything — Where I get to sit down with chief investment strategist Adam O’Dell and ask him any question (from you or me) and get his insights into the stock market.

- Investing With Charles — Green Zone Fortunes co-editor Charles Sizemore and I talk about all things related to stocks and the economy, including comparing stocks to give you the best investment advice.

- The Bull & The Bear — Our weekly podcast where I show you the trends and analysis that move the market.

All of these series are on our YouTube channel.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.