According to Warren Buffett, the smartest, safest way to make money in the stock market is to buy and hold assets for long periods of time (as long as they’re winners), so here we’ll show you the Top 4 stocks to buy and hold for 2020.

For the investor looking to earn money for things like retirement, it’s always good to look at the long-term.

Looking for something to make a quick buck doesn’t provide the stability you need to feel confident about investing.

So if you’re looking at cashing in down the road on investments you make now, we have a list for you.

This article presents companies that have demonstrated long-term growth potential in the past, but more importantly, for the future.

Remember, as the title suggests, these aren’t stocks you simply buy and sell once they go up or down slightly. These are companies you buy for the long-term.

4 Stocks to Buy and Hold for 2020

1. Docusign Inc.

Market Capitalization: $13.3 billion.

Analyst Rating: 10 Strong Buy, 1 Moderate Buy, 2 Hold, 0 Moderate Sell, 0 Strong Sell.

Current Dividend Yield: 0%

Let’s just say, we really like Docusign Inc. (Nasdaq: DOCU). So much so, we included it in our 5 tech stocks to buy in 2020 list.

From September to December 2019, Docusign stock jumped through the roof — gaining more than 22%. In 2019, the stock jumped from $38.80 on Jan. 3 to a 52-week high of $76.28 on Dec. 9 — that’s an 81% increase.

The company has outperformed the S&P 500 Index by more than 30% in 2019. It’s outperformed the Dow Jones Industrial Average by more than 23%.

But the big thing about Docusign is its growth potential.

Let’s just say it has the potential to be a really good year for Docusign.

Analysts have the 12-month price forecast for the company at a low of $67 per share and a high of $93. The median is around $86 — a sizable increase from there the stock is priced now (around $74 per share).

Additionally, analysts are forecasting annual sales growth of more than 37% and annual earnings per share growth of 172%. Docusign’s earnings per share has grown 33% from last year, but it still has room to grow further.

That sizable growth potential makes Docusign one of our Top 4 stocks to buy and hold in 2020.

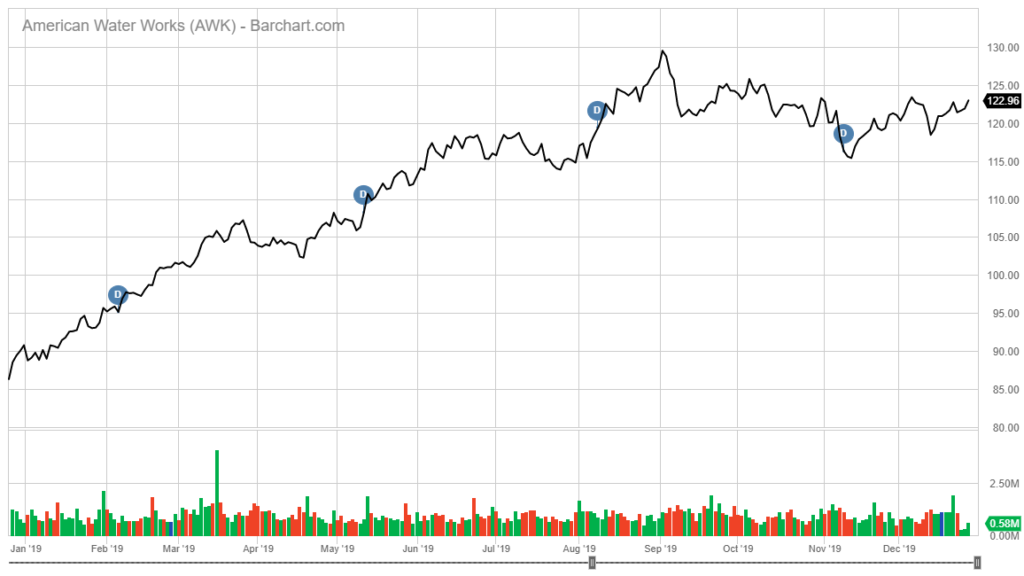

2. American Water Works

Market Capitalization: $22.2 billion.

Analyst Rating: 2 Strong Buy, 0 Moderate Buy, 4 Hold, 1 Moderate Sell, 0 Sell.

Current Dividend Yield: 1.63%

Utilities can be hit and miss but one consistent winner is American Water Works (NYSE: AWK).

The largest and most geographically diverse, publicly traded U.S. water and wastewater utility company has been shooting upward all year long.

The stock will close out 2019 at around $122 per share, but analysts believe there is much more room to grow with American Water Works.

Price targets are between a low of $125 per share (still lower than where the stock is) and a high of $153. The median is around $132 per share. That means the growth pattern shown by American Water Works should continue into 2020.

It is still trading below its 52-week high of $129.89.

Analysts are also expecting the earnings per share for American Water Works to have year-over-year growth in 2020 — an average of about 5% each quarter.

Its earnings per share growth in 2019 was 10.8% over the previous year.

Another aspect that makes American Water Works attractive as a stock to buy and hold in 2020 is its dividend. In 2019, the company actually increased its dividend from $0.45 per share to $0.50 per share.

Because its share price is still below even the lowest estimates by analysts and its strong dividend payout, American Water Works is one of our Top 4 stocks to buy and hold in 2020.

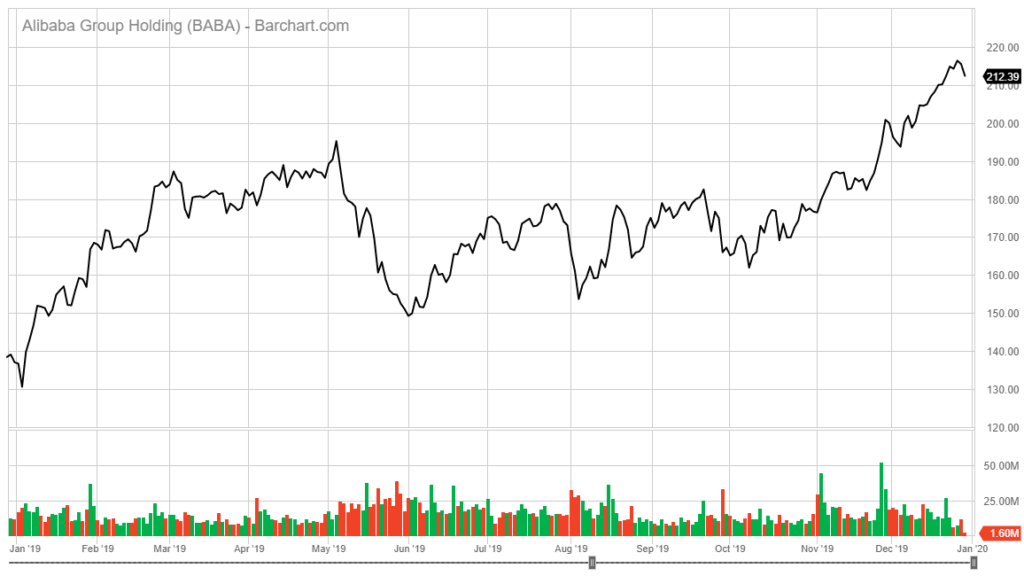

3. Alibaba Group Holding

Market Capitalization: $548 billion

Analyst rating: 15 Strong Buy, 0 Moderate Buy, 1 Hold, 0 Moderate Sell, 0 Strong Sell

Current Dividend Yield: 0%

It’s easy to think that buying Apple Inc. (Nasdaq: APPL) or Amazon.com Inc. (Nasdaq: AMZN) will lead to immense riches.

However, there is one online and mobile player that seems to keep flying under the radar despite being one of the biggest in the world: Alibaba Group Holdings (NYSE: BABA).

This Chinese-based online retailer (the Chinese Amazon, basically) was a strong performer in 2019 and looks to keep that trend going in 2020 and beyond.

While having a strong presence in China, Alibaba is expanding its footprint across Asia and the globe, putting it squarely in a growth market.

Additionally, the company’s cloud segment continues to grow at a rapid pace — nearly 65% in its most recent quarter.

At the end of 2019, Alibaba was trading at around $212 per share, up over its 52-week low of $129 from back in January. It has been on an upward trajectory all year long.

Alibaba’s earnings per share have been a surprise to Wall Street analysts all year long — most recently beating estimates by more than 25%. Analysts believe the company will grow its earnings per share by as much as 64% in 2020.

But the big thing about Alibaba is where it’s going.

Analysts expect the online giant’s quarterly sales to grow by 33% and its annual sales to jump nearly 38% next year.

And, if those same analysts are right, now is the time to buy Alibaba shares. In the next 12 months, the expectation is those shares will jump to as high as $1,998 per share (that’s an 841.7% jump). The low end of projections is $1,216 per share (a 472.8% increase from its current share price).

So the average is a share price jump of 662.6% from its current price of around $212 (December 2019).

You have a company aiming at more market share, projected sales expansion and a share price that is only going up. For those reasons, Alibaba Holdings Group is one of our Top 4 stocks to buy and hold in 2020.

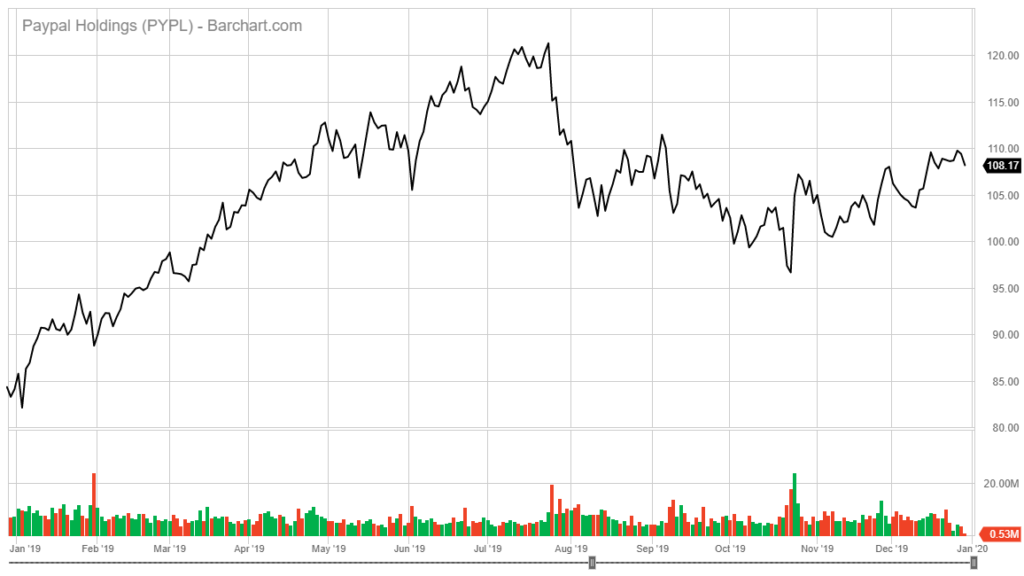

4. Paypal Holdings

Market Capitalization: $128 billion.

Analyst Rating: 19 Strong Buy, 1 Moderate Buy, 4 Hold, 0 Moderate Sell, 0 Strong Sell.

Current Dividend Yield: 0%.

If you do a lot of online shopping, you are probably familiar with our fourth stock to buy and hold in 2020: Paypal Holdings (Nasdaq: PYPL).

PayPal is an online payment company allowing users to pay others, get paid and withdraw funds to their bank, among other things.

Its share price has been a consistent grower all year long. It started with a low of around $81 in January 2019 and rose to its 52-week high of $121 in July. It has since settled to around $108 per share.

Analysts remain very bullish on PayPal heading into the future. Forecasts have PayPal jumping to a high of $150 per share and a median of $127 — that’s a 17% jump even at the average.

Keep in mind that PayPal is actually a financial stock, but it trades like a tech stock with its price at nearly 30 times its estimated earnings for fiscal 2020. The 17% average jump mentioned above goes a long way to justify PayPal’s valuation.

PayPal has provided earnings per share surprises in each of the last four quarters — including a 20% surprise in the quarter ending September 2019. Projections are that the company bests its earnings year-over-year in 2020 as well.

The bottom line is PayPal is still trading well below its 52-week high and even farther below Wall Street forecasts. It’s a company that has set itself apart in the realm of digital payments and it seems no one else is going to come close anytime soon.

Those are exactly why Paypal Holdings is one of our Top 4 stocks to buy and hold in 2020.

Well, there you go. Retail, tech and utilities all make up our list. They all have strong growth and value potential going into 2020 and beyond.

Because of that, these are Money and Markets’ Top 4 stocks to buy and hold for 2020.

If you are new to investing, make sure to check out our five steps to investing for beginners. If you are looking to invest in exchange-traded funds, visit our page on how to invest in an ETF.