Artificial intelligence used to be the stuff Hollywood dreams were made of.

Now it has transformed into one of the most important trends to watch for in the tech space.

But investors shouldn’t get into a stock just because it claims to have some connection to artificial intelligence. It’s best if you find companies with established reputations because the artificial intelligence space shifts almost daily.

When looking for AI companies to invest in, it’s important to look for companies that have that established track record. But they also should have room to grow in the future.

Remember, there are a ton of companies that claim to be part of the artificial intelligence space. Only a few can truly say they are blazing a trail, thus worth a look for potential investment.

Here are five companies with a proven track record in artificial intelligence to watch for in 2020 — but remember, these are only companies to watch, not purchase recommendations:

1. Baidu Inc.

To put it simply, Baidu Inc. is the Chinese equivalent of Google.

The company operates Baidu, the Chinese internet search engine where people can find news, information, images and, well, just about everything else we in the United States use Google for.

Baidu is the most popular website in China and the fourth-most popular website globally.

This year, Baidu has traded well above its 50-day moving average of $108.93 and its 100-day moving average of $107.81. It’s also still below its 200-day moving average of $127.63.

Baidu’s current market capitalization is $41.4 billion with annual sales of $14 billion as of December 2019. It’s forward price-to-earnings ratio is 17.35x with a profit margin of 26.96%.

It uses artificial intelligence to help personalize its search engine user experience as well as online advertising impact.

The artificial intelligence company recently partnered with King Long Motors to launch a fully autonomous bus.

Baidu experienced a dip in share price in November but has since rebounded and is trading well above its 50-day moving average.

Coming into 2020, Baidu should continue to develop its AI usage — expanding into its iQiyi video platform along with its maps, wallet and encyclopedia platforms. That should translate into stronger gains as the company is still well below its high for 2019.

That room to grow makes it one of the Top 5 AI stocks to watch in 2020.

2. Nvidia Corporation

Nvidia Corporation remains on many analysts’ lists for top AI stocks to buy now and in 2020.

And for good reason.

The company made its bones with its graphics processing units (GPUs) — microchips that process huge amounts of data cost-effectively. But recently, Nvidia found that those GPUs have a place in artificial intelligence.

Nvidia has grown this year as the company’s stock price is trading 57.54% higher than its year-to-date moving average. Over the past six months, Nvidia’s price has grown from $133.78 on June 3 to $216.74 on Nov. 30.

But the company is still well below its high point of $284.16 set back in October 2018. In 2019, Nvidia stock has beaten analyst’s earnings estimates and its earnings are projected to be between $1.36 and $1.34 (131.03% higher than the prior year). Those estimates are expected to jump 77.61% year-over-year.

So the company has started to sell those GPUs, which were initially built for gaming, to companies to use in data centers and self-driving vehicles.

The only real drawback is Nvidia has a forward price-to-earnings ratio of 40.1x, which is high. However, this is a massive industry and Nvidia remains one of the market leaders.

Its continued leadership in the chip-creating space and its use of those chips in the AI realm make it one of the Top 5 AI stocks to watch next year.

3. Yext Inc.

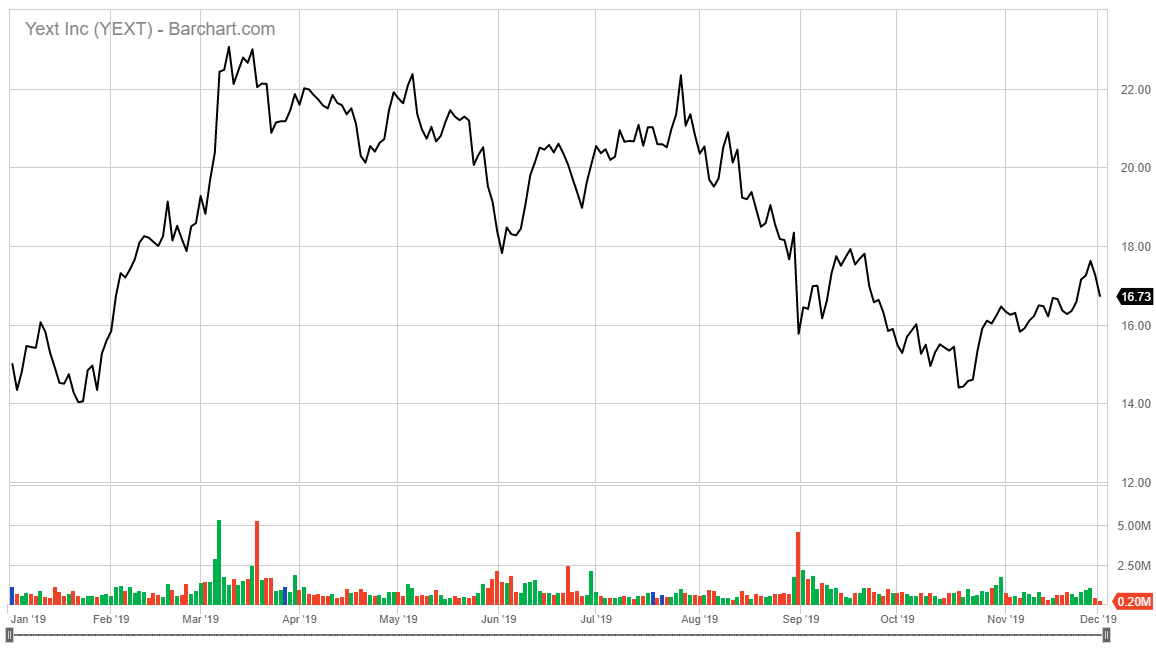

Thanks to lower guidance in the third quarter, Yext Inc. — a digital knowledge management (it actually invented that) company — experienced a 20% sell-off.

While its year-over-year losses per share hover around 50%, its revenues are up nearly 30% from a year ago. The stock traded at a high of $21.91 back in March, so it still has a lot of room to grow from where it’s currently priced.

In its last quarter, the company reported sales of $72 million with a market capitalization of $1.9 billion. Annually, Yext sales are around $228 million — a marked increase from the $170 million in sales the company reported in 2018.

Yext serves as a middleman between companies and search engines, providing its clients with the ability to engage with all search engines simultaneously. It’s not owned by any of the big FAANG stocks, but it also doesn’t compete with them either.

It basically helps businesses put their information in the cloud and syncs it to more than 150 different services and applications — including Amazon Alexa, Google Maps, Siri, etc. This includes information like the address and phone number of a restaurant, ATM locations and more.

This is what makes it an artificial intelligence company.

While Yext has rebounded from its third-quarter beating, it is still trading well below its one-year target of $22. That gives it a ton of potential upside. Its forward price-to-earnings ratio is -17.79x, making it extremely affordable.

Oppenheimer analyst Brian Schwartz said his price target is $26 for Yext over the next 12-24 months, which constitutes a 57% upside to the stock.

Yext has seen a rough 2019, but what it offers in the artificial intelligence space makes it another of the Top 5 AI stocks to watch in next year.

4. Salesforce.com Inc.

Anyone who has used or heard of Salesforce.com Inc. may be tilting their head a bit as to why this is considered an artificial intelligence stock.

The company specializes in customer relations management software used by a wide variety of businesses.

The company purchased Bonobo AI — which uses automated analysis of customer phone calls, texts and chats to deliver insights. It also has its AI-powered Einstein platform identifying patterns to deliver sales leads.

That’s where it transforms into an artificial intelligence company.

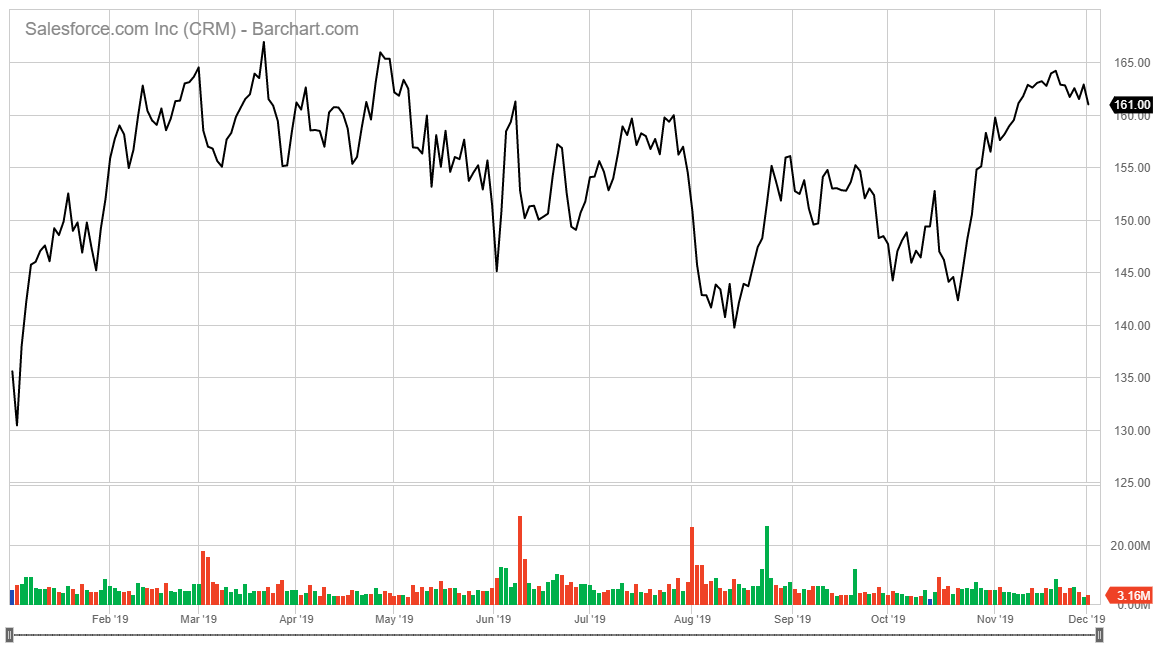

Salesforce had a strong 2019 with sales of more than $13 billion, an increase of 26.02% over 2018. The company reported quarterly sales of $3.9 billion for the quarter ending July 31, 2019 — a year-over-year increase of 21.82%.

Over the past year, its earnings have beaten estimates by 73% to 177.7%. In the quarter ending July 31, 2019, Salesforce reported earnings of $0.25, beating analysts’ estimates of $0.09.

The company is trading 3.89% above its 100-day moving average, making it a buy to many analysts.

Despite that, its share price has fluctuated very little all year. The company has seen its share price drop from a previous high of $166.97 in March to a low of $138.94 in August.

Salesforce is performing well below its average highs, meaning it is a company with room to grow in 2020. If the stock drops to its low near $140, it would still make a good opportunity for someone to invest in a continually growing artificial intelligence company.

Because of that potential for growth, Salesforce is one of the Top 5 AI stocks to watch in 2020.

5. Intel Corp.

Santa Clara, Calif.-based Intel Corp. is a giant in the semiconductor chip manufacturing space.

If you have a computer, it’s a good chance it has chips manufactured by Intel.

Where it enters the artificial intelligence sphere is its field-programmable gate arrays used by Microsoft to do deep learning on the cloud. Its vision processing components are used in surveillance cameras to analyze the behavior of crowds and perform facial recognition.

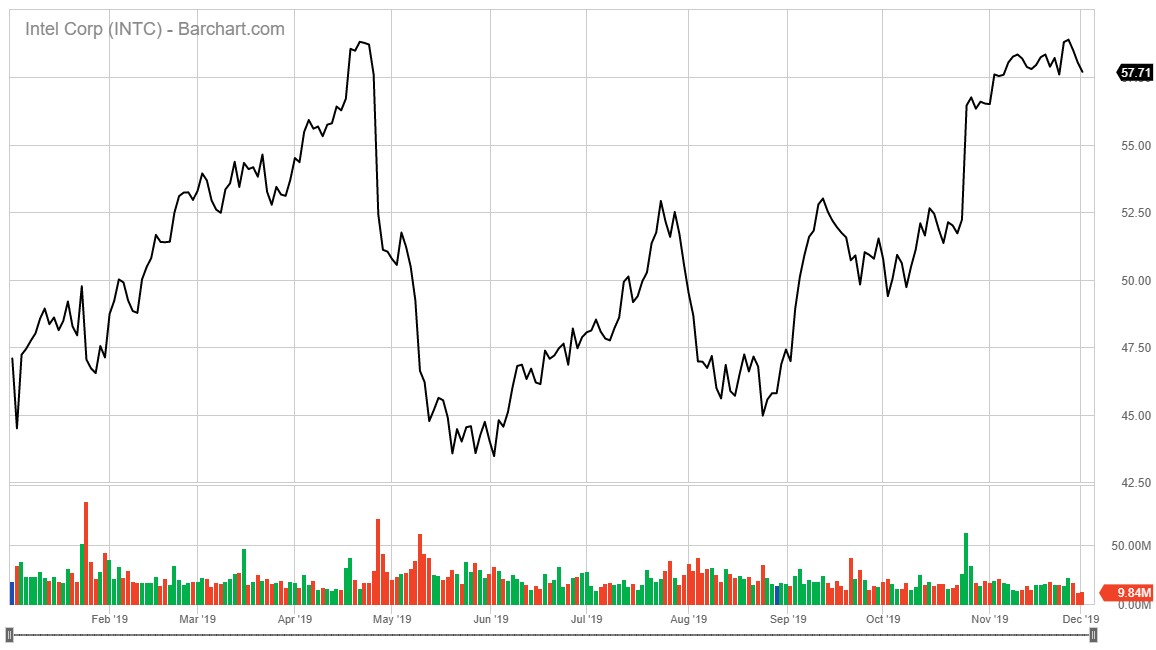

Financially, the blue-chip company continues its growth. For the 12 months ending Sept. 30, 2019, Intel reported a net income of $19.33 billion, a 27.47% year-over-year increase. Its revenue for the 12 months ending Sept. 30, 2019, was $70.41 billion, a 1.69% year-over-year increase.

Its share price suffered a drop in May 2019 to less than $44 but it has since rebounded to more than $57 a share in December. It’s still trading 23% higher than its year-to-date moving average and 19% better than its 100-day moving average.

The other factor making Intel attractive as an artificial intelligence company is it pays a dividend. Its annual dividend yield is around 2.17% and its most recent dividend was $0.315 on Nov. 6, 2019 — which is up from the $0.30 paid a year ago.

It has beaten each of its last four quarterly estimates and is on track to do the same in 2020. There is a projection of a 17.98% year-over-year growth rate for the first quarter of 2020.

Additionally, it’s average price-to-earnings ratio is 12.42, which is well below the industry average of 17.39, making it a good value and a strong buy to most analysts.

Because it is a steady earner, pays a dividend and continues an upward trajectory, Intel Corp is one of the Top 5 AI stocks to watch next year.

From established artificial intelligence companies to those just starting to make a dent in the space, each of these five companies has something to watch for next year. That can be growth potential, expanded dividends or established leadership in artificial intelligence.

They all bring something to the table and, thus, are our Top 5 AI stocks to watch next year.

For our friends: This tech stock could triple your money in 2020.