With the third-quarter earnings season basically in our rear-view mirror, it’s time to look ahead to the final quarter of 2025

Rather than analyze earnings per share (EPS) or revenue expectations, now is a good time to see where analysts believe the smart money should be flowing into the next quarter.

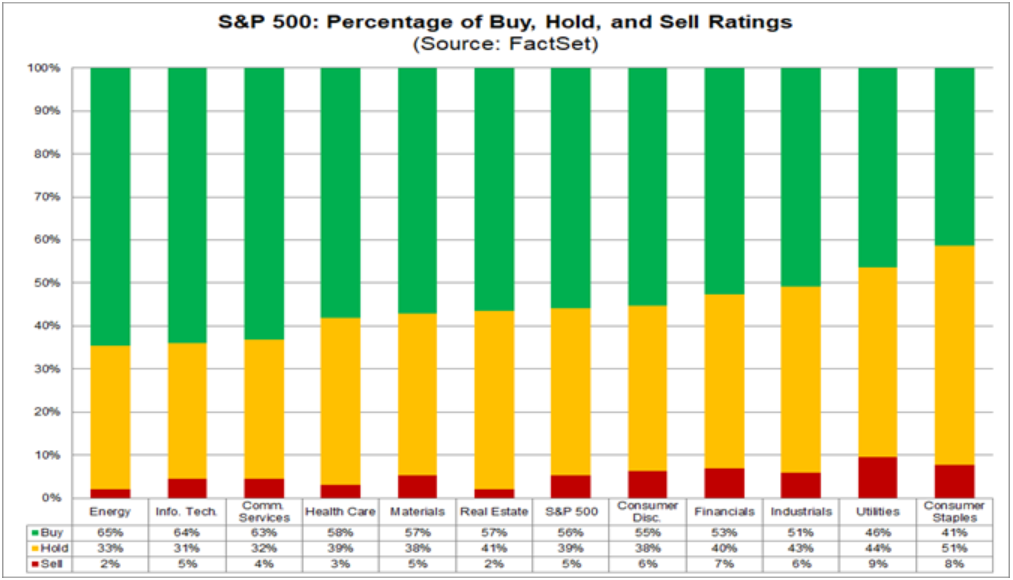

Data firm FactSet examined 12,351 ratings of stocks in the S&P 500, ranging from “buy” to “sell” or “hold.”

This gives us a picture of where analysts are the most optimistic heading into the final quarter of the year.

The chart above breaks down all 11 of the S&P 500 sectors, and shows the number of “buy,” “hold,” and “sell ratings in each sector.

At the sector level, analysts are most optimistic about the energy sector (65% “buy” signals), followed closely by information technology (64%) and communication services (63%).

Only four sectors increased their percentage of “buy” ratings since June 30, led by consumer staples (40% to 41%) and materials (56% to 57%).

Sectors with the highest “sell” recommendations are utilities (9%), consumer staples (8%), and financials (7%).

Overall, Wall Street’s expectations are weighted heavily in the “buy” and “hold” categories, which is a good sign for the market heading into the fourth quarter.

Back to energy … this is a sector that has seen very little positive momentum in the last year.

XLE Trading Virtually Flat

If the analysts’ optimism holds into the fourth quarter, there could be a breakout for energy stocks.

It will come at a time when oil and natural gas demand should increase as the northern hemisphere enters the winter months.

We’ll keep an eye on this trend as we get deeper into the next quarter.

For now, let’s analyze potentially “bullish” earnings for next week…

“Bullish” Earnings to Watch

These stocks are expected to beat their previous quarter’s EPS, and thus, if those expectations are met or exceeded, they could potentially trade higher.

For this screen, stocks must meet four criteria:

- 10 or more analysts cover the stock.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

As earnings season winds down, the number of S&P 500 companies reporting decreases. For this week, I included all the stocks in our universe on the screen.

Here are the three companies that made the list:

The company of interest here is clothing manufacturer Levi Strauss & Co. (LEVI).

In its last quarter, the company beat on both earnings and revenue expectations, increasing revenue by 6.4% year over year.

Its gross margin topped 62.6% thanks to lowering product costs and growth in its direct-to-consumer channel.

What’s more critical is that Levi Strauss upped its full-year guidance for both earnings (up $0.05 per share from prior guidance) and revenue growth (up a whole percentage point).

I believe Levi Strauss has the right recipe in place to beat expectations again this quarter,

Doing so could lift its Green Zone Power Ratings out of “Neutral” territory and push this stock higher.

Levi’s future guidance should also give us more insights into consumer spending heading into the holiday season.

Now, we’ll look at potentially “bearish” earnings for next week…

“Bearish” Earnings to Watch

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

As with our “bullish” screen, I opened the door to all companies this week.

Here are the two companies that passed this screen:

The interesting thing is that both Conagra Brands Inc. (CAG) and United Natural Foods Inc. (UNFI) specialize in food distribution to grocery stores.

Like the energy sector, consumer staples have moved very little over the last 12 months. In fact, the SPDR Consumer Staples ETF (XLP) has trended lower since August.

This might be most evident with The Kroger Co. (KR), which I mentioned earlier this month as a “bearish” earnings stock.

Kroger barely beat expectations for earnings, but fell short on revenue for the quarter. The stock has fallen 14% from its 52-week high set last month.

An earnings miss for CAG and UNFI could not only hamper stock performance but also negatively impact their Green Zone Power Ratings.

That’s all I have for you today.

Make sure to enjoy your weekend!

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

P.S. If you want to see where these stocks stand in our system ahead of next week’s earnings calls, click here to see how you can join Green Zone Fortunes now. It’s a perfect time to join, as Adam is gearing up to release his latest recommendation in the coming days.