We’ve seen investors dumping new money into tech stocks amid this AI-driven bull market.

And while the Magnificent Seven and many other AI-related stocks like Oracle (ORCL) and Palantir Technologies (PLTR) trade at some hefty premiums, they’re also rewarding investors with strong price momentum that is, frankly, crushing the broader S&P 500.

Then, there are stocks in other corners of the market that also trade at hefty premiums … but are not rewarding investors with outsized gains.

Obviously, these are the stocks that should be avoided at all costs.

Luckily, I designed my six-factor Green Zone Power Rating system to help you identify stocks that aren’t, in layman’s terms, “worth the price of admission.”

And after running today’s analysis on the materials sector, I’ve identified a few I want to share with you.

Let’s start by running my “X-ray” on the sector as a whole…

Materials Sector Stocks Still Lean “Bearish”

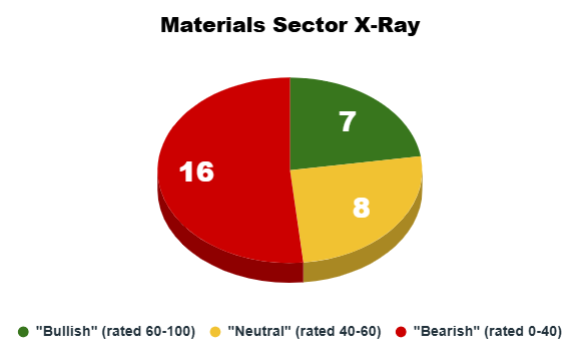

Back in early July, my analysis of the materials sector revealed a mostly “Bearish” batch of stocks based on my system’s breakdown:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

Two-thirds of the 31 stocks held by the materials sector ETF (XLB) rated “Bearish,” and only five stocks rated “Bullish.”

Things have improved over the last three months, but roughly half of the stocks still rate “Bearish” overall:

The breakdown above suggests you should “tread lightly” when looking for a new materials stock to buy.

Luckily, my Green Zone Power Rating system is a fantastic starting point. In just a few clicks, you’ll know if a stock is set for “Bullish” outperformance in the coming months … or if it’s set to lag the market (and be a drag on your portfolio’s overall performance).

Click here to find out how you can gain unlimited access to my system with a Green Zone Fortunes membership today.

Now, let’s see what we can learn from my individual Green Zone factors…

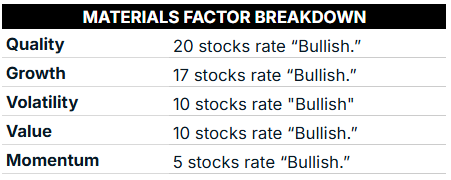

Roughly two-thirds of the materials sector rates “Bullish” on Quality, indicating that a majority of these companies are managing their balance sheets and generating profits efficiently. And the fact that 17 of 31 stocks rate “Bullish” on Growth is fairly positive as well.

But then things fall off a cliff…

Notice that only 10 stocks are boasting “Bullish” Volatility and Value ratings, and only five stocks currently have “Bullish” Momentum.

That’s a bad combo … who wants to buy a stock that’s expensive, volatile and not generating market-beating momentum?!

Let me show you five of the worst of those…

Lacking Momentum; Expensive to Boot

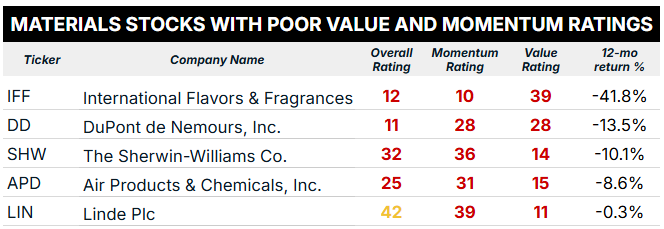

For my last screen, I wanted to find materials stocks that rate “Bearish” on both my Momentum and Value factors of my Green Zone Power Rating system.

These are the stocks that investors are paying a higher price for based on a variety of Value metrics (price to earnings, sales and book value, for example), but are not getting rewarded for it:

As you can see, these stocks have either traded flat or lost between 8% and 41% over the past year!

With four stocks rated “Bearish” and the last rated “Neutral,” overall, my system is indicating more poor performance ahead.

As I mentioned at the beginning, these stocks are simply not worth the price of admission at this time.

To good profits,

Editor, What My System Says Today