In this Marijuana Market Update, I answer a viewer’s question about IM Cannabis Corp. (Nasdaq: IMCC), an international cannabis stock. I also look at the five U.S. states most likely to legalize cannabis this year.

IM Cannabis Corp. Analysis

Before we talk cannabis legalization, let’s look at a question from Scott.

Matt, what do you think of IM Cannabis? Thanks — Scott.

Scott, first, thanks for your question. We will send you some Money & Markets gear to show our appreciation.

IM Cannabis Corp. (Nasdaq: IMCC) breeds, grows and supplies medical and adult-use cannabis products in Israel, Germany and Canada.

It offers strains under several different brand names like:

- Roma.

- Dairy Queen.

- London.

- Tel Aviv.

- Paris.

- Pandora.

It also has CBD oil products marketed under the IMC brand. And it offers its intellectual property services to the medical cannabis industry.

IMCC Is Trending Higher

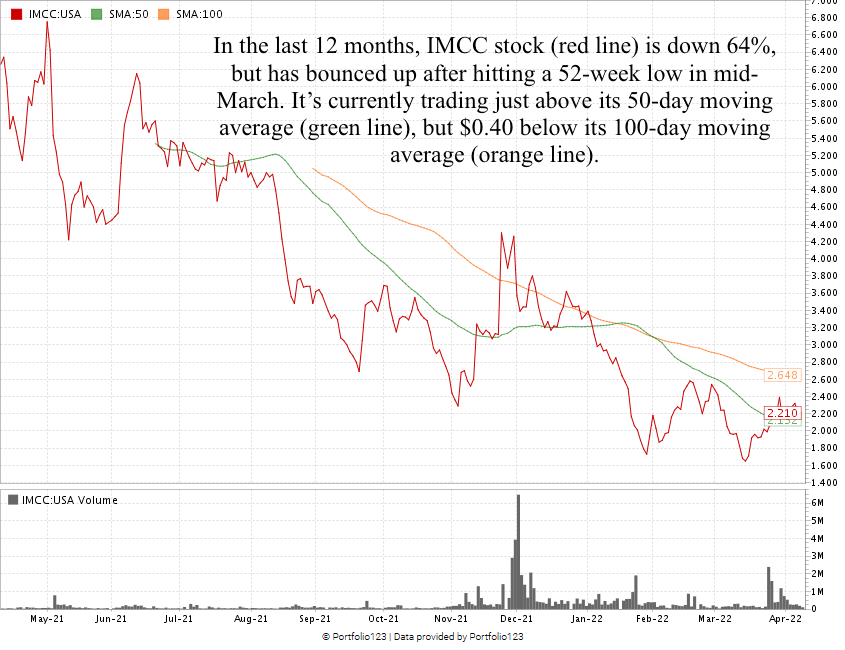

In the last 12 months, IMCC has dropped 64% and is trading at about $0.40 off its 100-day simple moving average.

It is, however, still above its 50-day moving average and has experienced a 26.7% bounce off the 52-week low it hit in mid-March.

IMCC has sustained that bounce thanks to the great quarterly and yearly report it issued recently.

Some of the highlights of that report include:

- A 309% growth in revenues from the fourth quarter of 2020 to the fourth quarter of 2021.

- A $7.5 million positive change in its net loss from $20 million in the fourth quarter of 2020 to $12.5 million in the fourth quarter of 2021.

- Annual revenues for 2021 were up 242% from the previous year.

- The company sold 8,410 kilograms of dried flower in 2021 compared to 2,586 kilograms sold in 2020.

The company also gave a positive outlook for its sales and gross margin in the first quarter of 2022 — which it will officially report next month.

IMCC’s future revenue looks promising:

After IMCC reported a massive increase in total revenue from 2020 to 2021, expectations from analysts strengthened.

Analysts expect 2022 revenue to grow to $103.6 million — 140.9% up from 2021. And by 2024, the total annual revenue for the company is projected to hit $159.5 million.

That’s a 270% increase from its 2020 numbers!

Part of the reason is that IMCC recently announced it was streamlining its products and delivery. It closed on a cultivation farm in Israel and began importing more cannabis from its Canadian facilities.

Overall, IMCC scores a “Bullish” 71. It’s in the top 50 of all cannabis stocks we rank.

IMCC’s 71 on our value metric drives its overall score.

It currently trades with a price-to-sales ratio of 3.29, compared to its peer average of 6.1. Its price-to-book ratio is at 0.89, compared to its peers’ 1.51 average. So it’s undervalued compared to others in the industry.

Outside of our rating system, IMCC also shows growth potential with a one-year annual sales growth rate of 256.6% and a one-year earnings-per-share growth rate of 56%.

As for quality, IMCC has negative returns on assets, equity and investment, but those returns are still higher than its peers.

The Takeaway: I like IMCC because of its value and growth potential. I want to see a little more momentum before buying. But this is a cannabis stock that could be going places.

5 States Most Likely to Legalize Cannabis

Now, let’s talk cannabis legalization … and I don’t mean federal legalization, which isn’t likely to happen anytime soon.

Marijuana Business Daily recently did an overview of states with a high probability of passing some form of cannabis legalization this year.

Some states to watch include:

- Rhode Island — The state Senate, House and governor’s office have each proposed a form of adult-use legalization. The House and Senate’s versions are closely aligned but have not been voted on in their respective chamber committees. The legislature bills include a 10% excise tax in addition to the current state sales tax rate of 7%.

- South Carolina — The state Senate passed a medical cannabis bill, and the House advanced an amended version of the bill. It would allow medical cannabis in the forms of oils, salves, patches or vapors, and the number of pharmacies allowed to sell would be limited.

- Delaware — After his first attempt failed by just two votes, Rep. Ed Osienski filed a new adult-use bill. The bill would permit 30 retail stores and 30 processing licenses, and current medical cannabis operators would be allowed to apply for licenses. It also allows cities in the state to opt out of recreational marijuana sales by ordinance.

- Kansas — The state Senate has a medical marijuana bill introduced and in committee. The Senate has held no hearings and taken no votes. Rough plans are for Kansas to establish a director of Alcohol and Cannabis Control to issue licenses and designate a pharmacist consultant to audit medical cannabis recommendations to patients.

- North Carolina — The state’s General Assembly has a medical marijuana bill that has already moved through several committees. It would issue 10 medical marijuana supplier licenses, and each licensee could operate four dispensaries, with at least one in a county designated as economically disadvantaged.

Other states like Minnesota, New Hampshire and Pennsylvania have some recreational marijuana bills floating through their respective legislatures. Still, only New Hampshire has a cannabis legalization bill with any form of interchamber momentum.

One more thing: You can get Money & Markets swag by submitting a question for me, Adam O’Dell or Charles Sizemore that we’ll use in any of our videos. Just send us your questions and feedback.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

Make sure you subscribe to our YouTube channel and get notified each and every time we post a new video.

We have a lot of great weekly video features on our channel, including:

- Ask Adam Anything — Where I get to sit down with Chief Investment Strategist Adam O’Dell and ask him any question (from you or me) and get his insights into the stock market.

- Investing With Charles — Green Zone Fortunes Co-Editor Charles Sizemore and I talk about all things related to stocks and the economy, including comparing stocks to give you the best investment advice.

- The Bull & The Bear — Our weekly podcast where I show you the trends and analysis that move the market.

All of these series are on our YouTube channel.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.