This month, we’ve used our Wednesday edition to talk about pizza and nuclear stocks.

Today, we’re going to venture into the world of emerging markets.

You might yawn at this topic … until I show you why they piqued my attention this week.

Let’s get into it…

Emerging Market Indexes On the Rise

Global trade impacts markets all around the world.

Flash back to the first week in April when President Donald Trump announced reciprocal tariffs on just about every country the United States does business with.

Not only did markets fall here in the U.S., but across the globe.

Now, however, data suggests certain emerging markets are experiencing significant bullishness due to changes in global trade dynamics.

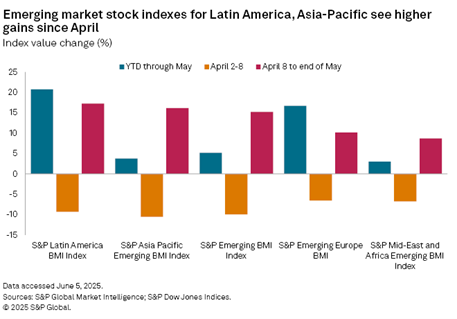

From April 8 to the end of May, the value of certain stock indexes in Latin America, Asia/Pacific and Europe all experienced double-digit increases.

This bullish action has pushed the performance of all four emerging market indexes into positive territory for the year.

Latin America is the clear winner here so far, despite a 25% tariff imposed on Mexico. That’s because many of the region’s counties were not assigned a pending reciprocal tariff rate in April, thus giving them a more favorable trade status with the U.S. should higher tariffs take effect in July.

In the Asia/Pacific region, despite India and Vietnam facing 26% and 46% tariffs, respectively, both countries have been proactive in negotiating with the Trump administration to solve the trade issue.

It all leads back to supply chains.

Companies with substantial supply chain exposure to China started to decouple from the nation during Trump’s first term in office. Those companies look to Vietnam, India and countries in Latin America to fill the manufacturing void created by high tariffs on Chinese goods and services.

Drilling down further, I’ve found one emerging market that has come out on top of all others, and it didn’t surprise Adam or me…

It’s Not Just About Messi

When I see the perfect opportunity to name-drop my favorite football player, Lionel Messi, I take it!

That’s because his home country of Argentina has been the biggest surprise in emerging markets.

Argentina was once a country known only for great football, amazing beef … and rampant inflation.

The value of the Argentine peso against the U.S. dollar has been steadily declining since 2007.

In January, I mentioned Argentina as one of those under-the-radar investment opportunities after its stock market climbed 172% in 2024.

Well, if you kept your eye out, you’ll know that Argentinian stocks continue to run higher:

ARGT Climbs 52% In the Last 12 Months

The Global X MSCI Argentina ETF (ARGT) — an ETF with the most exposure to the Argentine market (the white line in the chart above) — has pushed 52% higher in the last 12 months.

Compare that with the 10.3% jump in the S&P 500 (blue line in the chart above).

I went one step further and ran ARGT’s holding through our Green Zone Power Ratings x-ray to see how it stacks up:

ARGT Stays In the Green

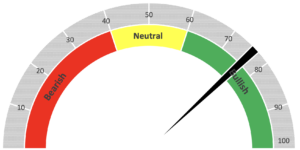

In Adam’s system, ARGT earns 75 out of 100 overall. For context, when I did the same analysis in January, it was rated 73.

Here’s another mind-blowing piece of analysis: 15 of the 19 stocks held by ARGT and rated on Adam’s system were rated 70 or higher.

That means nearly 80% of the holdings in the ETF are rated “Bullish” or higher.

In January, I mentioned that 2024 was a good year for the Argentinian market and that 2025 had more in store.

It is certainly showing that now.

That’s all I have for you today.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets