Welcome back for another earnings Friday here at What My System Says Today!

The S&P 500 has been on quite a tear of late.

In fact, since Trump’s “Liberation Day” reciprocal tariff announcement in April, the benchmark index has risen more than 35%.

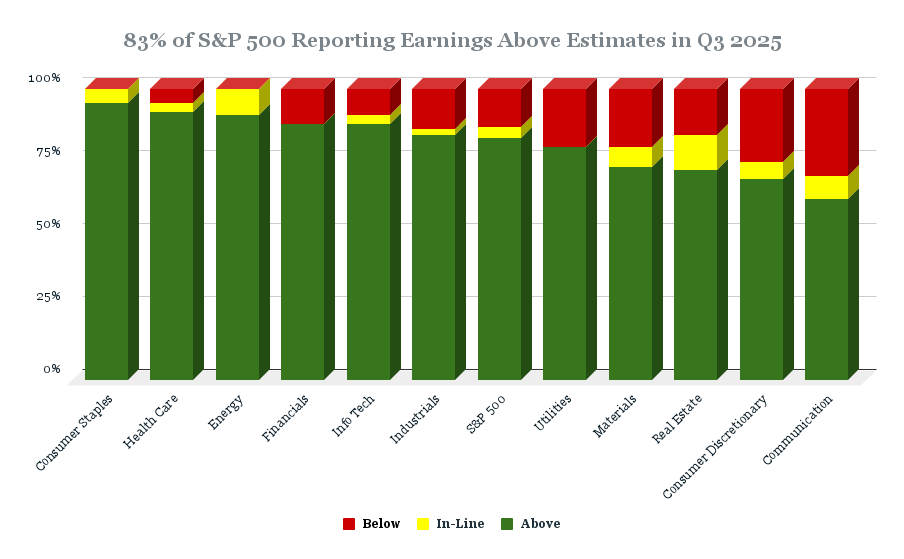

Most companies within the index have continued this trend of strong performance, as illustrated in recent earnings calls.

As of the end of October, 64% of companies in the S&P 500 have reported quarterly earnings.

Of those reporting, 83% have reported actual earnings per share above estimates, which is above the 5-year average of 78% and the 10-year average of 75%.

If 83% holds, it will mark the highest percentage of S&P 500 companies reporting positive EPS surprises for a quarter since 2021.

The average growth rate in earnings for companies in the index is 10.7%. If that stands, it will be the fourth straight quarter of double-digit earnings growth for the index.

On the revenue side, the blended revenue growth rate for the index is 7.9%. Holding there will mark the 20th consecutive quarter of revenue growth for the index.

Now, let’s get into “bullish” earnings potentials for next week.

“Bullish” Earnings to Watch

These stocks are expected to beat their previous quarter’s earnings per share (EPS), and thus, if those expectations are met or exceeded, they could potentially trade higher.

For this screen, stocks must meet four criteria:

- 10 or more analysts cover the stock.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

Here are three companies that made this week’s list:

Regardless of questions over valuations, the AI trade is still very much a part of Wall Street’s lexicon.

One of the many companies benefiting from this AI surge is Cisco Systems Inc. (CSCO).

Cisco specializes in designing and manufacturing networking products and services related to the IT and communications sectors.

On the earnings side, Cisco has had six consecutive quarters of revenue growth and three straight quarters of EPS growth.

Analysts’ expectations are for the company to report earnings of $0.98 per share in Q3 2025 —a 38% quarter-over-quarter increase and a 44% year-over-year increase.

I believe the company will meet, and likely exceed, Wall Street’s expectations for earnings this quarter.

That can only help CSCO’s “Neutral” rating on Adam’s Green Zone Power Ratings system.

Now, let’s move on to potential “bearish” earnings next week…

“Bearish” Earnings to Watch

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

Here are two companies that passed this screen:

The surprise here is The Walt Disney Co. (DIS).

Over the last 12 months, the stock has only increased by 9.4%, compared to the S&P 500’s 12.3% advance.

In short, DIS has been a stock that’s just been “meh.”

Two things to watch for in Disney’s earnings next week:

- How much did its entertainment and experiences segments increase/decrease?

- Have its subscribers to Disney+, Hulu, and ESPN ticked up at all?

Both the entertainment (think movies and television) and experiences (think parks) segments rose moderately over the previous two quarters.

Its subscriber base to its streaming platforms has slowly started to recover after a significant drop to start the year.

Wall Street is anticipating slippage in both categories, and I tend to agree.

That could spell trouble for the company’s “Bullish” rating on Adam’s system.

That’s all from me today.

I hope you all have a great weekend.

Until next week…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets