I got scammed!

I couldn’t believe it. I’ve grown up on the internet, and I’ve seen all the tricks.

Or so I thought…

It happened late Saturday night. After a couple of drinks, I was hunting for a box of trading cards (got to diversify those assets, right?!).

Some quick Google searching revealed a good deal. It was right at the top of the page, and the online Shopify store had a 5-star rating from what looked like real people!

So I placed the order, got my confirmation email and waited…

And waited…

By Wednesday, I knew something was up. I had not received a shipping notification, and any email I sent to the seller was kicked back as “undeliverable.” A little more digging revealed the store no longer existed on the internet!

To make matters worse, I’d accidentally used my debit card instead of credit (thanks, Maker’s Mark).

Now, I wasn’t worried about my $85. I was terrified because this bad actor had access to my hard-earned money. I was bracing for the string of additional charges to drain my account.

Luckily, it never got to that. I canceled the card, and I’m working through the fraudulent claims process with my bank now.

Why tell this tale in a financial newsletter?

Because our world is becoming more digital every day, and scammers will always find new tactics to take whatever they can. Protecting our information and assets is critical.

And that sets up well for cybersecurity stocks…

Why Cybersecurity Is Critical

Companies need to protect our information. Executives don’t want their company in the headlines after hackers access sensitive customer data.

Comparitech ran the numbers on 28 companies that went through a data breach, and it found the associated stocks dropped 7.2% on average 14 days after the leak.

Falling stock prices are another thing executives don’t want!

And with everything being online, cybersecurity isn’t optional anymore. Companies need to shore up their defenses as bad actors develop new attacks.

An Infosecurity Magazine report from earlier this year revealed that 69% of companies expect to increase cybersecurity spending by at least 10%. And 20% expect to hike their budget by 30% to 49%!

Let’s use Adam O’Dell’s proprietary Green Zone Power Ratings to look for cybersecurity stocks that could benefit from this spending trend.

Cybersecurity Stocks for 2024

My initial scans revealed some “Neutral” stocks. These tickers are expected to perform in lockstep with the broader S&P 500.

Stocks like CrowdStrike Holdings Inc. (Nasdaq: CRWD) and Palo Alto Networks (Nasdaq: PANW) have ratings in the 50s and are worth watching. If those ratings improve into our “Bullish” zone, the stocks should outperform.

So let’s instead stick to the biggest guns.

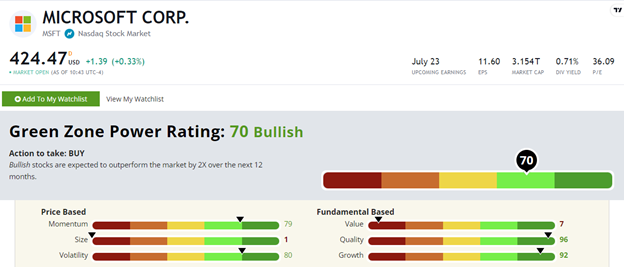

Microsoft Corp. (Nasdaq: MSFT) rates a 70 out of 100, which means it’s set to beat the market by 2X over the next year.

Strong ratings on Growth (92) and Quality (96) show that MSFT’s business is sound and growing. In its latest earnings report, the company posted $61.8 billion in revenue, a 17% increase year over year. It also increased operating income by 23% year-over-year to $27. 5 billion. Microsoft isn’t going anywhere!

The stock is also up 35% over the last year, which is why it boasts a 79 on Momentum.

And Microsoft is committed to cybersecurity. Its security arm brought in $10 billion of revenue in 2021, and that number quickly doubled to $20 billion last year!

It now has more than 1 million cybersecurity customers (think businesses that need to protect mountains of data), and a vast majority own four or more products offered in Microsoft’s security suite.

Add that to Microsoft’s efforts in other areas, like artificial intelligence and cloud services, and you’ll have a well-diversified stock.

That’s why Green Zone Power Ratings expects it to outperform from here.

Until next time,

Chad Stone

Managing Editor, Money & Markets

P.S. While we’re focused on securing our bank accounts and Social Security numbers, Adam is thinking bigger. He’s found a tech company that’s using innovative “Closed AI” algorithms to assist the U.S. government on defense. And now is the time to buy in before AI’s next wave starts. Click here to see how.