Adam, here. I’m back after some mostly restful time away with the family. I hope you had a fantastic Fourth of July weekend!

A big thank you to my lead analyst, Matt Clark, for holding down the fort while I was away.

We’ll get right back to our Monday analysis by reviewing sector performance before markets closed for the holiday.

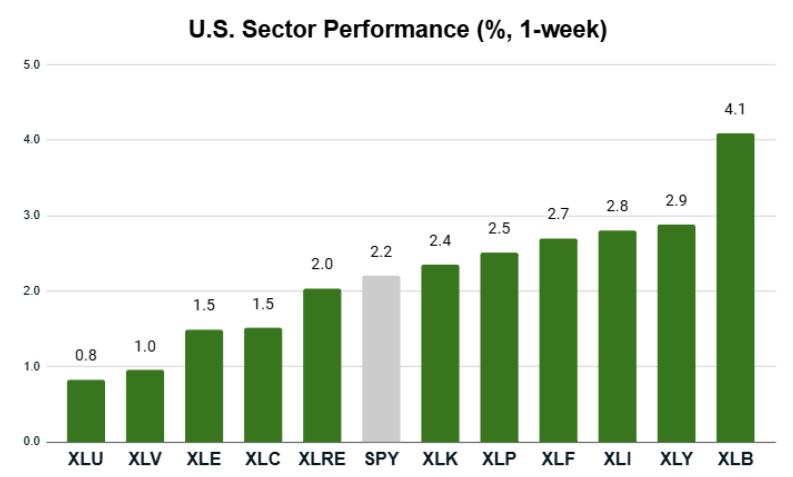

And as you’ll see below, investors were feeling bullish as they pushed all 11 S&P 500 sectors higher:

Key Insights:

- The S&P 500 (SPY) closed the week 2.2% higher.

- All 11 major sectors gained during the four-day trading week.

- The materials sector (XLB) was the top-performing sector with a 4.1% gain.

- Six sectors beat the S&P’s gain, while five sectors underperformed.

Seeing broad bullishness is always an encouraging sign. It tells me that investors are feeling confident about the current state of things and are looking for new opportunities outside of flashy high-growth sectors such as tech.

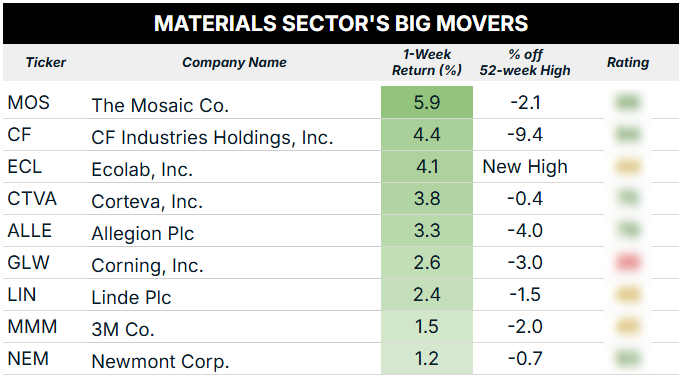

Let’s see what my Green Zone Power Rating system says about the stocks that helped the materials sector almost double the S&P 500’s gain last week.

Materials Sector Leads the Charge

After screening for all S&P 500 materials sector stocks that closed last week within 10% of their 52-week highs, you can see the top performers from last week in the table below:

At first glance, what stands out to me is how many stocks on this list are rated “Bullish” or “Strong Bullish” in my Green Zone Power Rating system. Five of the nine stocks fall into those lauded categories, which tells me to expect more outperformance in the weeks and months ahead.

When we see more “Neutral” or “Bearish” stocks on our top-performing screen on Mondays, that tells me to “press pause” and look closer at the stocks leading the charge. Investors may be chasing short-term price growth and are itching to sell when they think the gains are slowing.

But the data above tells me that the materials sector is worth a closer look, which we’ll get into in tomorrow’s edition of What My System Says Today.

If you want to get right to it and look these stocks up yourself using my system, click here to see how you can become a member of my flagship investing service, Green Zone Fortunes. After joining (or if you’re already a member), you can look up thousands of tickers here.

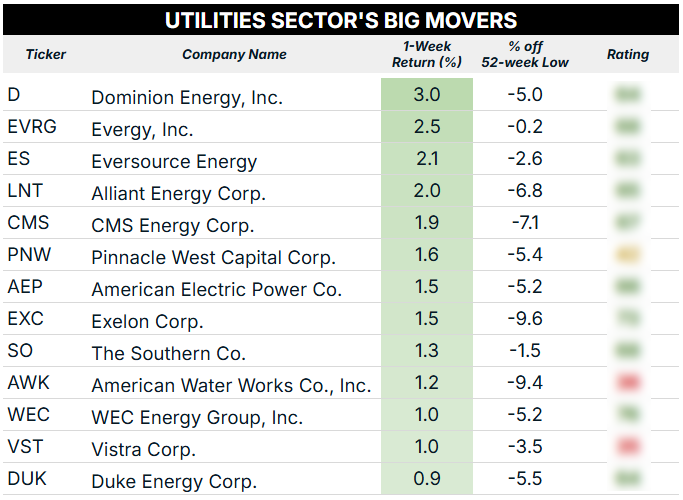

Now, let’s move on to the worst-performing sector, even though it was still in the green during last week’s bullish run.

Utilities Sector Keeps Up Positive Momentum

I’m going to break the rules slightly with today’s analysis because it’s not often that you see all 11 S&P 500 sectors net a positive gain for the week.

Below, you’ll find the same analysis we run for the top-performing sector, but I cut the list off at the stocks that managed to beat the Utilities Select Sector SPDR Fund’s (XLU) 0.8% gain:

Again, we’re seeing broad bullishness here with 10 of 13 stocks rated “Bullish” or better. I will say, though, that all of these stocks rate between 63 and 76 overall in my Green Zone Power Rating system. There isn’t a single stock that falls into my top-tier “Strong Bullish” category, the small group of stocks that are set to beat the broader market by 3X.

But if you’re looking for solid stocks that should continue to outperform in this bull market, both the materials and utilities sectors are fantastic places to start!

I’ll be back tomorrow with a closer look at the materials sector in particular.

Have a great week!

To good profits,

Editor, What My System Says Today