When looking for new stocks to buy, it’s natural to form a bias toward a particular sector or industry … depending on your unique experience.

You might lean toward industrial stocks after years working in manufacturing or engineering … or maybe you’ve had great success investing in technology stocks, so you’re always hunting for the next big innovator.

Heck, maybe you’re a huge film and TV buff, so communications stocks are your playground.

For me, that sector used to be health care…

As most of you know, I attended medical school for a year before finding my passion for finance. So in those early years, I felt more comfortable analyzing health care stocks.

However, in time, I realized that I shouldn’t allow this bias to creep into my decision-making process. Instead, I learned that…

- There are times when there are good opportunities in the health care sector, and times when there are not.

- There are just as good opportunities in all sectors, and a data-driven approach to finding them can help overcome any bias I have for or against a particular industry.

With all that said, let’s have a look at the current setup in health care stocks right now…

Health Care Stocks X-Ray: Still Mostly Bearish

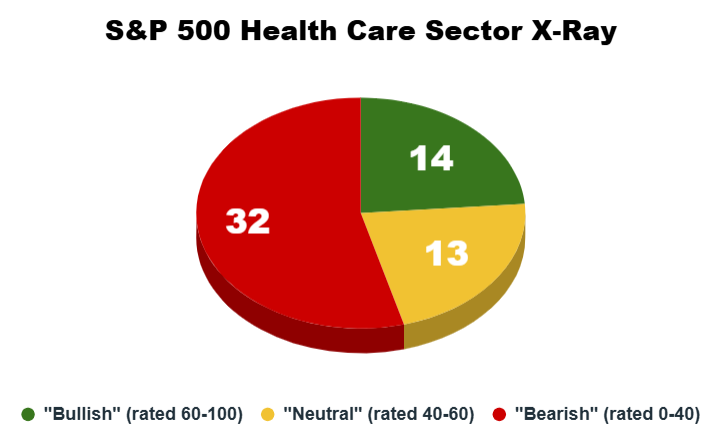

Roughly two months ago, I ran the health care sector through my Green Zone Power Rating “x-ray.” Things look a bit worse today than they did at that time…

As a reminder, there are three broad categories that stocks fall into:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

Back in May, my x-ray revealed 28 “Bearish” stocks, 12 “Neutral” stocks and 19 “Bullish” stocks in the health care sector.

Since then, the sector’s standing has worsened, now showing a greater number of “bearish” stocks and fewer “bullish” ones:

With a little over half (54%) of the sector’s stocks set to underperform the S&P 500 over the next 12 months due to a “Bearish” rating, and another 22% “Neutral”-rated stocks set to merely track the broader market, my off-hand advice is to avoid buying a health care exchange-traded fund (ETF) altogether right now.

Doing so would put too much of a burden on those 14 “Bullish” stocks, which would need to outperform by a wide margin to offset likely underperformance from the other lower-rated holdings.

That’s why this initial “x-ray” is a great starting point. It tells us that there is opportunity in the health care sector, but not broadly … and we’re going to have to pull up our sleeves to find it.

Let’s do just that by reviewing the Green Zone Power Rating factor breakdown…

You Can Bank on One Factor for Health Care Stocks

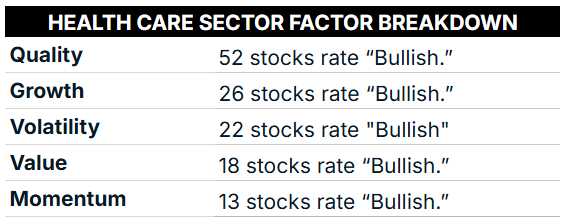

A closer look at these 59 stocks reveals one obvious standout … high Quality ratings!

A full 88% of the health care stocks we’re looking at here boast “Bullish” ratings on Quality. That means these are rock-solid businesses with solid balance sheets and margins.

At the same time, only 13 stocks rate well on my Momentum factor, which reflects the fact that investors collectively have little interest in bidding the price of this group of stocks higher.

But back to Quality…

5 High-Quality Health Care Stocks

To understand a bit more about how my rating system assesses the “quality” of a company, you should know it’s built on five unique subfactors: debt, efficiency, returns, cash flow and margins.

The debt subfactor is meant to determine whether the company’s outstanding debt is reasonable and easily serviced. Efficiency measures how well the company handles its inventory and sales.

The other three subfactors — returns, cash flow and margins — all seek to size up the company’s profit-generating capabilities.

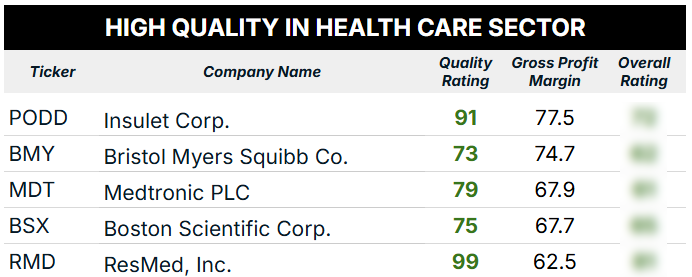

Each is equally important, but today, I want to focus on the gross profit margins of some of the sector’s top companies.

Gross profit margin is simply the difference between the price at which the company sells its product or service and the “raw” cost required to create the product or service. It doesn’t account for other overhead costs, but gives analysts a good idea of the company’s pricing power (which drives the sales price) and its ability to create the product or service as efficiently as possible (which drives the “cost of goods sold” metric).

Back to the health care stocks we’re examining today …

When running the numbers on gross profit margin for these companies, I noticed an incredible trend…

Below, you can see the top five stocks based on this metric:

As you can see, these top-5 health care companies are managing a gross profit margin of between 63% and 78% — quite impressive!

And while I won’t reveal the exact overall ratings, I will say that all five of these stocks rate “Bullish” overall in my Green Zone Power Rating system.

If you want to look these tickers up to see how they stack up, click here to find out how you can join Green Zone Fortunes and gain full access to my system (if you are already a member, click here to go to our ratings search page now).

All told, these are five high-quality and overall bullish stocks based on my Green Zone Power Rating system!

To good profits,

Editor, What My System Says Today