We’ve got a batch of “New Bulls” this week, including one S&P 500 stock with a Green Zone Power Rating that has charged higher over the last month … and just in time for the company’s busy summer vacation season!

Let’s get right to it…

The S&P 500’s “New Bulls”

First, we’ll start with the S&P 500 large-cap stocks we typically do…

These “New Bulls” stocks are now poised to outperform the market by 2X to 3X based on our standard criteria:

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”) in my Green Zone Power Rating system.

- The stock must have been rated less than 60 for each of the last four weeks.

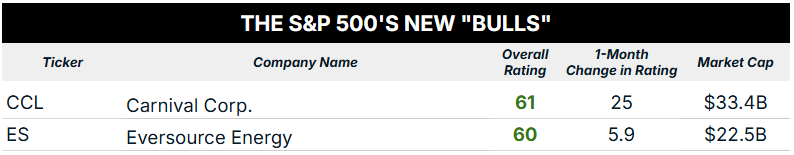

In short, these two stocks were rated “Neutral” or worse … but now are rated “Bullish” or better:

You might’ve seen Carnival Corp. (CCL) cross your news feed earlier this week as it posted strong results for the second quarter.

Shares of CCL popped almost 7% higher on Tuesday after it beat earnings per share estimates by a solid margin (35 cents reported versus 24 cents expected). Carnival also posted record adjusted revenue of $6.3 billion and raised its full-year guidance. The company now expects a 40% increase in adjusted net income compared to 2024.

You can see that CCL’s overall rating within my Green Zone Power Rating system has charged 25 points higher to hit “Bullish” territory. The stock is up almost 8% over the last month compared to the S&P 500’s 2.8% gain.

Volatility is still high for this cruise stock. The pandemic really did a number on stocks in this industry, but it seems like investors are gaining more confidence in CCL’s future.

22 New Bulls Outside the S&P 500

Next, let’s turn our attention to the 22 “New Bulls” that aren’t members of the S&P 500 index…

Once again, we’ve got a healthy list of companies, many of which are based outside of the U.S. It’s natural to have a “home bias” when investing, but you can see what happens when you broaden your scope a bit.

The vast majority of the stocks above also fall into the small- to mid-cap range ($500 million to $10 billion market cap). This is a great place to hunt for new opportunities because you have a chance to get in “early” before these stocks really take off.

We’ve taken advantage of this exact phenomenon in my flagship Green Zone Fortunes investing service. By getting in ahead of the crowd on certain holdings, my subscribers have benefited greatly from “herding” — aka when the masses buy in after seeing some sustained price momentum.

If you’d like to join up and see what we’re holding, this is just about the perfect time. I’m wrapping up this month’s issue, where I am essentially doubling down on some of our best performers, including two stocks that have gained 90% and 120% year to date! This is a perfect starting point if you’ve been wanting to jump in.

You’ll also gain unlimited access to my Green Zone Power Rating system so you can really make the most of these daily screens.

Click here to see how you can join now…

To good profits,

Editor, What My System Says Today