For today’s installment, I’m going to do something a little different…

I’m going to talk about food.

Now, I’m not a foodie by any stretch of the imagination. I love to cook when I have the time, but I keep things simple in the kitchen.

When feeding a household that includes 23-year-old twin boys, simplicity is always the best option (it’s as if they will never stop growing).

Of course, sometimes there just isn’t the time, so we order out.

Pizza is a staple when we go this route. Everyone can get what they want with no fuss.

It takes me back to those Friday nights when it was a treat to order a pizza from a shop down the street and ride along to pick it up.

Today, however, things are a lot different… erm… I mean, expensive!

I remember my family spending about $20 to get four pizzas as a kid. Nowadays, it’s at least triple that … and that’s before you pay for delivery.

After our last delivery, I was looking at our bill from the local spot, and it got me thinking about the state of the pizza business… namely, how it relates to the national economy.

Luckily, with the help of my Bloomberg Terminal, I got answers pretty quickly…

The Peaks and Valleys of Pizza Growth

Going back to before I was a kid, the most economical way to feed a family fast was pizza.

And with so many different styles and toppings (I mean, who puts pineapple on a pizza?), it makes sense that pizza has become a go-to takeout option.

More recently, pizza sales saw a huge boom when the COVID-19 pandemic set in in 2020, because it was an easy and safer way to get a meal (for all involved) without personal contact.

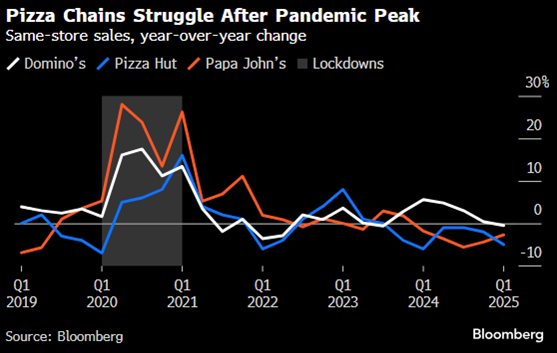

According to Bloomberg, in 2020, Domino’s Pizza Inc. (DPZ) and its smaller rival Papa John’s International Inc. (PZZA) notched double-digit sales growth in their North American stores year over year.

Yum! Brands Inc. (YUM), the parent of Pizza Hut and popular chains such as Taco Bell and KFC, also received a boost later in 2021.

And that would mark the peak of recent pizza growth.

In the years after COVID, inflation started to set in, and now, the price of a pie is making consumers reconsider.

For the first quarter of 2025, all three major pizza chains experienced declines in their same-store sales:

- Yum! Brands Inc. is down 5% year over year.

- Papa John’s dropped 2.7% from 2024.

- Domino’s Pizza fell 0.5% from the year before.

Here’s how that has played out since 2019:

One of the big reasons same-store sales declined at these three chains is the rise of delivery services like Uber Eats and Grubhub, which have made it easier to get other types of food from your neighborhood restaurant.

Essentially, it’s opened up much broader options for those Friday night cravings … pizza is no longer the only easy option.

However, the most significant reason for the decline is simple economics.

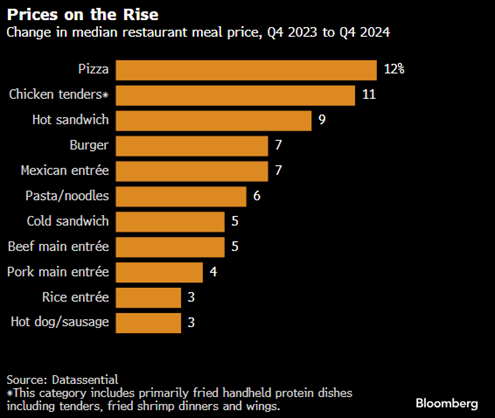

Pizza is getting more expensive, no matter where you live, in part because the ingredients to make pizza are getting more costly.

In just one year, the price of a pizza jumped 12%, compared to a burger, which increased 7%.

The bottom line here is that inflation has hit American households hard, to the point where even buying a pizza is viewed as a tough economic decision.

How Pizza Stock Giants Rate

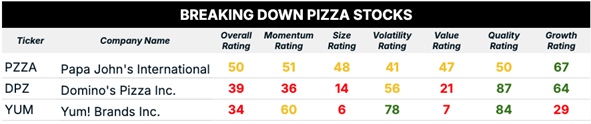

The next logical step in this analysis is to run these major pizza chains through Adam’s Green Zone Power Rating system.

The results were a bit surprising:

Only Papa John’s International (PZZA) is rated above “Bearish” overall. It should also be pointed out that, of the three, PZZA has the smallest market cap ($1.6 billion compared to $16 billion for DPZ and $39.8 billion for YUM).

All three rate “Neutral” or lower on Momentum, Size and Value, while YUM gets a “Strong Bullish” rating on Volatility.

DPZ and YUM rate “Strong Bullish” on Quality, while PZZA and DPZ are “Strong Bullish” on Growth.

From a strict ratings perspective, PZZA does have the highest rating, but it’s “Neutral,” meaning it is set to track the broader market’s performance. All three have different challenges and bright spots.

However, with factors like inflation and more delivery options, along with the simple fact that none of these stocks rates “Bullish” or “Strong Bullish” overall in Green Zone Power Ratings … none of the three would be recommended at this point.

That’s all from me today.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets