Money & Markets Daily: The 5

Keeping up with everything going on in financial markets and the economy is tough these days. That’s where “The 5” from Money & Markets Daily comes in…

Let’s start your week off right!

A Jackson Hole-In-One

It may not have been a big banner draped over the command tower of an aircraft carrier, but Federal Reserve Chair Jerome Powell’s message was as clear as Fed-speak can be.

The fight against inflation has been won.

In his keynote speech at The Jackson Hole Economic Symposium last week in Wyoming, Powell confirmed their key metrics were on track.

According to the Fed’s preferred gauge, inflation is down to 2.5% from a peak of 7.1% two years ago.

The speech moved the S&P 500 to within 1% of its all-time high on Friday as Wall Street anxiously awaits the first fed funds rate cut since 2020 in September. According to the CME FedWatch website, 66% of economists are now expecting a 50 basis-point cut, while the other 34% expect a 25-point move lower.

While that fueled a rise in equities on Friday, Wall Street’s mood cooled on Monday after 100 Israeli warplanes bombed several missile launchers in Lebanon, escalating tensions in the Middle East over the weekend.

But it looks like markets have largely recovered from last month’s sell-off. With a rate cut on the horizon, investors are gearing up for a bullish end to the year.

2024’s Most Important AI Event (Happens This Wednesday!)

Nvidia Corp. (Nasdaq: NVDA) has emerged as the biggest winner of the early AI boom, with a staggering 17,400% return since early 2016.

That means an investment of just $3,600 in NVDA back then … would be worth $642,000 today.

But could NVDA become a victim of its success?

As Adam O’Dell recently pointed out, Nvidia relies on other “Magnificent Seven” mega-cap tech stocks for roughly 40% of its annual revenue. As a result, Nvidia has become a critical indicator for the health of the sector and the AI trend at large.

And Adam expects this Wednesday’s announcement to contain a big surprise for investors…

Another Gold Rush?

Investors usually only talk about gold when the market is hitting the skids.

But now, the yellow metal is back in focus as it trades at near-record highs.

The spot price of gold has been up 22% since the beginning of 2024, compared to the 19% rise in the S&P 500.

We asked Chief Research Analyst Matt Clark for an explanation:

The biggest reason for gold’s recent hike is not a weaker stock market but a weaker dollar. Lower inflation readings and weaker housing and industrial production numbers are causing headwinds for the dollar.

With the strong prospect of a rate cut in September, the dollar may see additional weakness in the coming months… good news for gold investors.

If the Fed moves to make even more rate cuts, gold investors may end the year with a pleasant surprise.

Another No Good, Very Bad Day for Elon

As you might have suspected, Elon Musk’s Twitter takeover is going … poorly.

Musk finalized his purchase of the massive social media platform in October of 2022. Since then, revenue has declined by a catastrophic 84%, according to the New York Times.

In the final quarter before Elon’s takeover, Twitter booked $661 million in revenue. Fast forward to this last quarter, and that number has collapsed to $114 million.

Musk’s ownership has been defined by massive layoffs and sweeping policy changes that alienated both users and advertisers (whom Musk is now suing).

Adding fuel to the flames is the fact that Elon borrowed $13 billion from big banks to fund the deal … and the banks have since been stuck with those loans, since no one’s buying. It’s become the biggest “hung deal” in the history of leveraged buyouts.

Without the ability to fund those loans through operations, Musk will inevitably be forced to liquidate stock to pay his debts. That’s bad news not just for Musk but for Tesla Inc. (Nasdaq: TSLA) shareholders across the board.

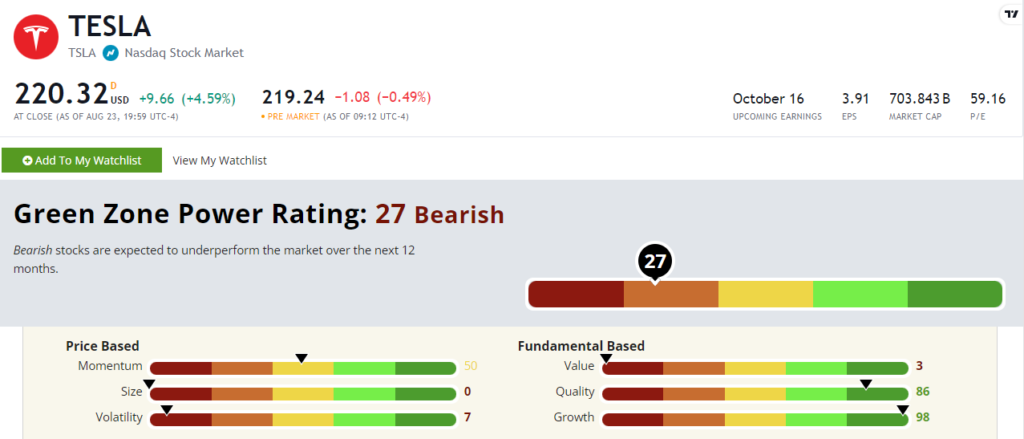

And TSLA stock already rates a “Bearish” 27 out of 100 in Green Zone Power Ratings…

Community Highlight: Good Luck, Subway

Last week, we asked if you’ve noticed any crowds dwindling at popular restaurants like Subway. Rick M. chimed in with a great observation:

I don’t see lines at Subway these days like in the past. I like their subs. I think there are so many options out there now. Tough competition, except for McDonald’s, which never sees short lines. Lots of chicken sandwich places opening up (not Popeyes or KFC). These seem to be the place to go now. I don’t.

Good luck, Subway.

Thanks for reaching out, Rick!

We agree that Subway subs are pretty good (especially when they were $5 for a footlong!). Editor Matt Collins has mentioned eating at Subway almost daily for high school lunch since it was a healthy and affordable alternative to fast food from Burger King or McDonald’s.

But as Rick points out, times change … and so do tastes. Fried chicken joints are currently taking Palm Beach County by storm. Locals can’t seem to get enough Raising Cane’s lately!

— Money & Markets Team