You’re probably familiar with Netflix Inc. (Nasdaq: NFLX) is a company that many people are familiar with. But is Netflix stock worth owning?

However, not everyone knows the story behind how this streaming giant got its start.

Here’s a quick look at Netflix’s company background, business model and Stock Power Ratings.

It All Started With DVDs

Netflix started out as a DVD-by-mail service back in 1998.

Since then, the company has revolutionized the way we watch films and TV shows.

It started in 2007 when Netflix introduced its streaming service, allowing people to instantly watch content from anywhere.

Netflix disrupted the entire entertainment industry and changed our perception of how we access entertainment.

It now boasts over 223 million subscribers across 190 countries.

Through its streaming services, it provides access to a wide variety of films and TV shows, making Netflix an entertainment hub.

Netflix’s business model is based on a monthly subscription, with different pricing based on geographical locations.

Netflix Plans Further Expansion

Netflix has been a disruptor in the media industry since its inception.

It plans to continue this disruption by increasing its own content production and actively investing in new technologies to make its services better.

Netflix’s growth so far has been propelled by the desire of its users to watch what they want when they want, and Netflix intends to keep up with that demand through further investment.

Netflix Stock Power Ratings

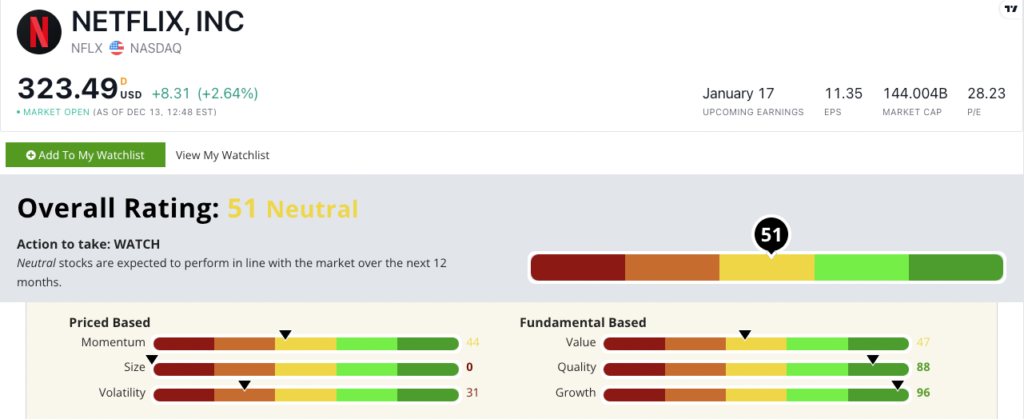

Netflix stock scores a 51 out of 100 on our proprietary Stock Power Ratings system.

That means we are “Neutral” on the stock and expect it to perform in line with the broader market over the next 12 months.

NFLX earns its highest factor score on growth — where it scores a 96.

This is largely due to a one-year annual earnings-per-share growth rate of 84.8% and a sales growth rate of 18.8%.

The stock earns an 88 on our quality factor with returns on assets, equity and investment all positive — compared to negative averages for the internet and data services industry.

NFLX earns neutral ratings on value and momentum but does score a “Bearish” 31 on volatility.

This means the stock is prone to more wild ups and downs compared to similar stocks.

The bottom line: Netflix has pivoted away from its humble beginnings as a DVD-by-mail service. The company has reinvented itself multiple times and has become one of the leading streaming services in the world. With over 223 million subscribers in 190 countries, Netflix is still growing and plans to continue expanding its reach by producing its own content and investing in new technologies.

But Netflix stock looks like it’s going to perform in line with the market for now.