We’re at the midway point of the quarterly earnings season and the takeaways continue to provide valuable insight into the state of the economy and markets…

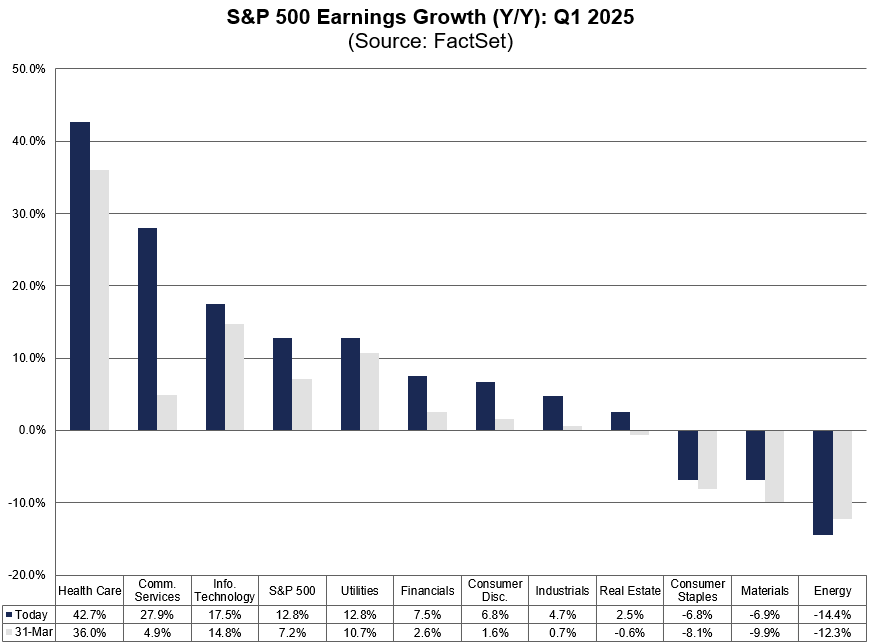

Despite the heightened uncertainty surrounding tariffs and a potentially slumping economy, 8 of the 11 sectors of the S&P 500 have reported year-over-year earnings growth:

On average, S&P 500 companies have grown their earnings by 12.8% year over year.

That metric has improved since the beginning of earnings season, when reporting companies were averaging just 7.2% growth.

However, we are only halfway through the season and, while the earnings picture is looking more promising now, we’ll feel better it that sticks once all companies have reported.

Of course, for any one company a strong or weak earnings reports can drastically change its stock’s price performance. My Green Zone Power Ratings system gives us the power to factor in earnings and examine a wide range of metrics (75 of them) across various factors and timeframes.

Today, let’s look at S&P 500 companies on the calendar to report next week — including one big, household name.

First, I want to briefly look at one company I mentioned last week, and how their earnings shook out.

Our Data Hit the Mark With Occidental

Last week, I mentioned one earnings report I was keeping an eye on was Occidental Petroleum (OXY).

As the chart above shows, energy has been the worst-performing sector not only in terms of earnings but also stock performance.

In the last 12 months, the SPDR Energy Sector ETF (XLE) is down 11%, while the S&P 500 has been up 10%.

In terms of earnings, OXY beat the number we posted as Wall Street’s forecast, reporting $0.87 EPS versus expectations of $0.78. That number was also a significant improvement over the negative $0.31 print the quarter prior.

With West Texas Intermediate oil prices below $60 per barrel, oil producers like Occidental are focusing on cutting costs — the company reduced its capital spending forecast by $200 million.

Now, let’s get into the week ahead on the earnings calendar…

A Chinese Flex… Or Not

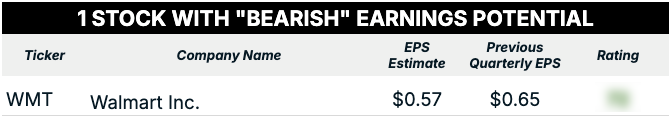

Let’s start with the “bearish” side of expectations this week.

For this screen, we’re only looking for two things:

- The stock must be covered by 10 or more analysts.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

Just one stock made the list… Walmart Inc. (WMT).

The interesting thing about Walmart is its Chinese connection.

While the company does operate 336 stores in China — both Walmart and Sam’s Club — the most significant connection the company has to the country is how much discretionary merchandise (clothing, electronics and toys) Walmart imports from China.

Walmart isn’t specific about its import data, but some estimates show that the company brings 60% of its goods from China.

That puts Walmart in the crosshairs of the latest tariff drama.

My Green Zone Power Ratings system has Walmart rated a “Bullish” 72 out of 100, but its Value factor rating is 28 (WMT is trading at 41-times earnings).

Our “Bearish Earnings” screen indicates the potential for a negative earnings report, but that doesn’t mean it’s time to offload your Walmart stock.

Despite its pricey valuation, the sum total of the 75 metrics used by my Green Zone Power Ratings system still paints a picture of Walmart being a well-rounded company and stock.

That said, I’ll be eager to see their report and any hints of the early impacts of U.S. tariffs on Chinese goods.

“Bullish” Stocks to Watch

Now, let’s switch gears and look at companies that are expected to beat their previous quarter’s earnings and, thus, potentially trade higher if those expectations are met… or even exceeded.

For this screen, stocks must meet four criteria:

- The stock is covered by 10 or more analysts.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

Here are four important companies set to report next week:

Four companies report next week and have the potential to surpass their previous quarter’s earnings per share.

One thing that likely stands out is the fact that all four of these stocks are rated “Neutral” or lower, which may pose a question: Why?

Keep in mind that the Green Zone Power Ratings system considers much more than earnings (75 different metrics cover price-based and fundamental analysis over different timeframes).

The system doesn’t forecast earnings, but instead quickly incorporates them into a company’s stock rating following each report.

You may notice how three of the four companies expected to post gains in EPS this quarter are from the tech sector.

Quarterly tech earnings started the season sluggishly, but encouraging reports from META and MSFT may have reversed that trend.

It will be interesting to see how management teams from these three companies respond to questions about the impact of tariffs and continued economic uncertainty.

Don’t think for one second they won’t get those questions from Wall Street analysts.

That’s all from me today. I hope you all have a great weekend!

To good profits,

Editor, What My System Says Today