A recent AB Bernstein report shows total U.S. debt, including all government, state, local, financial and entitlement liabilities, comes close to 2,000% of U.S. gross national product, a staggering figure that only keeps going up.

The biggest piece of the pie, which is about 1,832% of GDP to be exact, comes from so-called “entitlement programs” like Social Security and Medicare, but rising levels of federal government debt due to out-of-control spending also is a major concern. The warning comes as the total federal debt in the U.S. is now up to $22.5 trillion.

AB Bernstein’s formula includes both traditional levels of public debt like bonds as well as financial debt and future obligations like Social Security, Medicare and public pensions.

Of course, not all of the debt obligations are set in stone and new legislation could address government programs, so it takes a bit of nuance to fully understand the math at play here.

“This conceptual difference is important to acknowledge because this lens is often used by those who wish to paint a dire picture about debt,” Philipp Carlsson-Szlezak, chief U.S. economist at AB Bernstein, said in the report. “While the picture is dire, such numbers don’t prove we are doomed or that a debt crisis is inevitable.”

The key to solving the problem is not always the big picture dollar amount, but rather an ability to pay the debt.

“U.S. debt is large. And it’s growing. But if we want to think about debt problems (in any sector — sovereign, households, firms or financials) the conditions rather than the levels are more significant,” Carlsson-Szlezak said. “Debt problems could, arguably would have, already happened at lower levels of debt if the macro conditions forced it.”

With federal debt ticking up to $22.5 trillion, or 106% of GDP, total debt held by the public is about $16.7 trillion, or 78% of GDP, and that number is expected to rise to 105% of GDP by 2028, according to projections by the Congressional Budget Office.

“Globally, we have become over-reliant on borrowing as a solution for everything. Political excuses abound for why it doesn’t matter, which just clearly isn’t the case,” Committee for a Responsible Federal Budget President Maya MacGuineas said. The group is a bipartisan committee of legislators, business leaders and economists, including former Fed Chairs Paul Volcker and Janet Yellen.

“We are quickly approaching a situation where we have dug ourselves a debt hole which is going to have profoundly negative effects on the economy for probably decades going forward.”

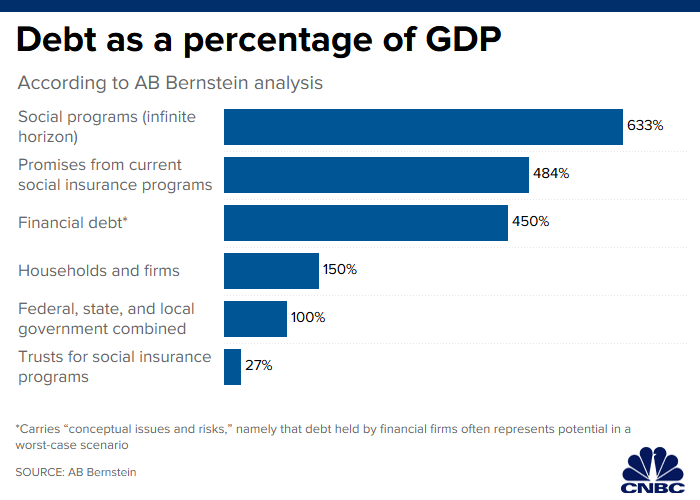

According to CNBC, AB Bernstein pulls in debt from a number of sources, comparing to GDP as such:

- 100% of GDP using federal, state and local government debt combined

- 150% for households and firms

- 450% for financial debt, which carries “conceptual issues and risks,” namely that debt held by financial firms often represents potential in a worst-case scenario involving various derivative instruments that can carry high notional levels that are unlikely ever to be realized

- 27% in trusts for social insurance programs

- 484%, which values all the promises from current social insurance programs

- 633%, which tallies up an “infinite horizon” of obligations for social programs, rather than just the traditional 75 years used in computations

As the report notes, different debt holds different risks, and impacts on different sectors of the economy as a whole would vary.

“A default on U.S. treasury bonds would be catastrophic to the global economy — whereas changes in policy (while painful for those whose future benefits were diminished) would barely register on the economic horizon,” Szlezak wrote.

Moody’s Investor Service recently warned an already growing number of junk-rated companies could “swell dramatically” whenever the next recession inevitably hits, “substantially increasing default risks.”

“In the next credit cycle downturn, then, the generally lower credit quality of today’s speculative-grade population means that the default count could exceed the Great Recession peak of 14% of all rated issuers,” Moody’s Senior Vice President Christina Padgett said in a statement, according to CNBC.

The economy is still in a good place so default rates remain low. And since the economy is still in good shape, now is the time to act regarding the debt, MacGuineas said.

“First, you start having politicians level with voters instead of promising freebies. Second, you recognize that the time to do that is when your economy is strong,” she said. “When people were arguing for more borrowing they should have been doing the reverse. We’re still not in recession. It’s time to put in long-term strategies.”