Adobe Inc. (Nasdaq: ADBE) is one of the largest and most well-known software companies in the world. But does that mean Adobe stock is a buy?

It provides a wide range of software products for everything from graphic design and video editing to web development and digital marketing.

In addition to its popular Creative Suite products, Adobe also offers a variety of cloud-based services that have transformed the way businesses operate.

Today, we’ll look at the company’s history and business model, then run it through our Stock Power Ratings system to see how ADBE looks.

Adobe Started Small and Then Expanded Rapidly

Founded in 1982 by John Warnock and Charles Geschke, Adobe has changed the way we work and play, revolutionizing graphics editing and photo manipulation around the world.

Adobe made a big splash in the printing world when they released Adobe PostScript, its first product back in 1982.

PostScript revolutionized the way documents could be printed by introducing a computer language specifically designed for that purpose.

Since then Adobe has become an industry leader in developing products and services related to printing and digital media.

Adobe PostScript paved the way for Adobe to continue innovating its products. It’s made it easier for users around the world to create, manage and share their work.

Adobe Photoshop, released in 1987, came at a crucial point in the history of image editing. It allowed people to create and manipulate digital images with unprecedented ease.

Photoshop is now the industry standard for image professionals and home hobbyists alike.

Creative Cloud Drives Adobe’s Business

Adobe has come a long way since it first introduced Creative Cloud in 2011.

Today’s Adobe suite of products is impressive. Users can easily create and edit digital content on any platform with Adobe apps.

From videos and photos to Adobe XD for constructing websites, Adobe Creative Cloud has become the go-to source for creatives worldwide.

Adobe Stock Power Ratings

From unassuming beginnings in 1982 to becoming one of the biggest names in the tech scene, Adobe has consistently grown. Since 2002, it has been profitable every year with revenues hitting an impressive $17.6 billion in 2022.

Much of Adobe’s success can be attributed to its stock soaring from $58 to over $650 at one point in 2021.

But how does Adobe stock rate now? Let’s see using our proprietary Stock Power Ratings system.

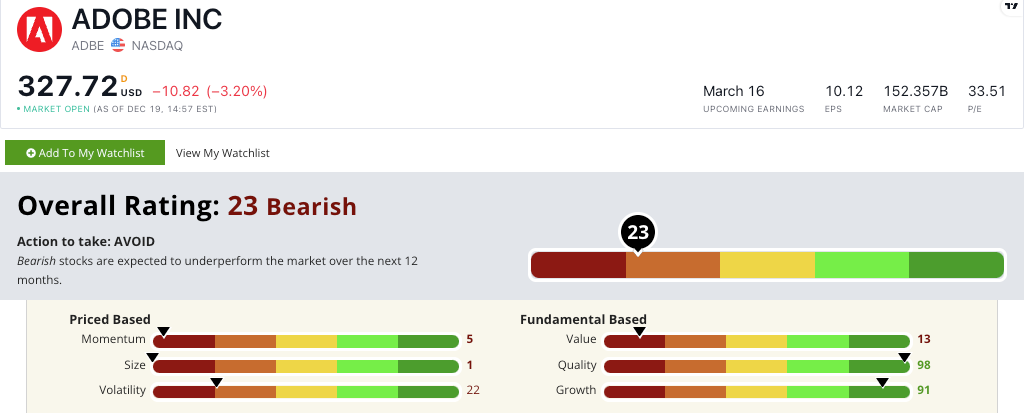

ADBE stock scores a “Bearish” 23 out of 100 on our Stock Power Ratings system.

This means we expect it to underperform the broader market over the next 12 months.

A big reason for ADBE’s score is its momentum — where it scores a 5.

The stock reached a 52-week high in December 2021.

It has fallen 40.3% since then.

The bottom line: Investors have traded Adobe stock since 1986. And the company has been profitable every year since 2002.

Adobe offers a suite of products that allow users to create and edit digital content. It also offers enterprise software solutions for businesses of all sizes.

In 2022, Adobe’s revenues exceeded $17 billion.

Despite that, our proprietary Stock Power Ratings system says Adobe is bearish now.