When it rains, it pours … especially for Nvidia (NVDA)…

America’s largest chipmaker kicked off the week with bombshell news from China, revealing that DeepSeek’s new AI model could accomplish the same tasks as ChatGPT with just a fraction of the resources.

NVDA’s shares promptly tanked in response, shedding an unprecedented $600 billion over two trading sessions.

Shares of NVDA bounced back on Tuesday, but the market capitalization still closed down more than $330 billion from where it was when the week started. Shares sank again on Wednesday as President Trump mulled export restrictions on Nvidia’s chips.

On the surface, this sounds like a catastrophe for American tech stocks and a massive win for China. In reality, it’s not quite that simple.

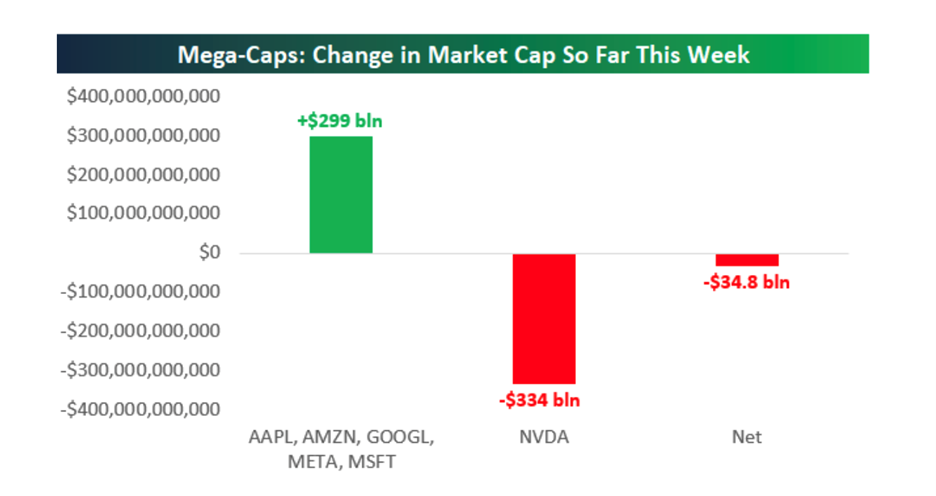

Because almost all of the market cap lost by NVDA found its way into the other Magnificent Seven stocks, as you can see in the chart below:

NVDA’s Bad Week Is A Mag 7 Windfall

This shift is a direct response to the DeepSeek news that dropped this Monday — which indicated that our AI-powered future might not be as hardware-intensive as we believed.

So investors are shifting assets from the hardware/infrastructure side of the AI mega trend (dominated by NVDA) to the software development side of the equation with companies like Apple, Amazon, Google and Meta.

That’s a healthy reaction to the news … especially for stocks with valuations as extreme as NVDA’s.

But it doesn’t mean that you should be hopping on the bandwagon to buy any of the other Mag 7 stocks at today’s valuations. They’re simply not great investments at these levels (more on that in a moment), and 2025 is providing plenty of better opportunities to maximize our returns.

To pinpoint these opportunities, I’ll be relying on my proven Green Zone Power Ratings system — a hybrid system combining fundamental and technical research across 75 categories and six key factors for thousands of stocks.

Because through decades of historical backtesting, these are the factors that make the difference.

If a stock ranks high enough across these six categories, then it’s likely to beat the S&P 500 by at least 3-to-1.

Let me explain…

The 6 Factors You Need to Know After Nvidia’s Crash

Here’s a quick refresher on each of the key “Green Zone Power Factor,” along with an explanation of why it’s so important…

Green Zone Power Factor #1: Momentum

Momentum is arguably the most important factor for determining whether it’s the right time to invest in a stock.

You might find a stock that’s a great value, with impressive metrics and good fundamentals. But if the momentum isn’t there, it’s simply dead in the water. And a stock like that can stay dead in the water for years, as we’ve observed on numerous occasions.

According to the earliest momentum traders, momentum boils down to buying “buying high and selling higher. ”

To go a little deeper, momentum works because it targets the “behavioral” nature of stock investing.

The behavioral side of investing creates certain biases, which I’ve discussed with my Green Zone Fortunes subscribers. These biases, or “mental glitches,” as I like to call them, are baked into the human psyche.

They systematically create the mispricing of stocks, whereby they are either underpriced or overpriced for some period of time.

And it’s the mispricing of stocks that momentum investors take advantage of to earn market-beating returns.

Green Zone Power Factor #2: Size

The academic research is clear: Small companies outperform large companies, in aggregate, over the long run.

I understand that smaller companies can carry more risk. But if you hold a diversified portfolio of small companies, you can make more money buying these somewhat riskier small-cap stocks than you can piling into the big names.

That doesn’t mean that micro caps and penny stocks automatically get a high Green Zone Power Rating on Size. But it also doesn’t help those dominant mega-cap stocks with sky-high valuations.

Green Zone Power Factor #3: Volatility

Volatility measures how “steady” a stock is performing.

Higher volatility typically means share prices are all over the place. Up 30% one day, down 30% the next. That might be appealing to some options traders out there, but it’s a nightmare for Main Street investors.

So it’s something my system accounts for.

Just remember that we reverse the typical association with volatility. So if a stock has a higher volatility score, that actually means it’s less volatile.

It may seem counterintuitive at first, but once you start using the system, you’ll see why I set it up that way.

Green Zone Power Factor #4: Value

When you hear the word “value” in relation to investing, you probably think of the famed investor Warren Buffett.

The value factor in Green Zone Power Ratings represents the same kind of strict assessment of a stock’s financial statements. It uses popular metrics such as price-to-earnings and price-to-book to determine if a stock is “cheap” or not.

Value is still a critical factor when it comes to finding the right investments, as long as it’s weighted against other critical factors, including…

Green Zone Power Factor #5: Quality

As you might imagine, the concept of “Quality” is difficult to express on a numerical scale from 0 to 100.

Ultimately, I built this category as a composite of 27 different individual metrics. It’s perhaps the most classically “fundamental” factor of them all.

Without getting into the weeds too much, my system determines quality by looking at a company’s profitability. It uses metrics including return on assets, equity and invested capital. It also considers a company’s debt load and operational efficiency.

The quality factor does a great job of distinguishing high-quality companies worth considering from the “junk” that we should leave alone at any price.

Green Zone Power Factor #6: Growth

Growth is another critical factor that might seem to speak for itself.

However, I should point out that Green Zone Power Ratings is more focused on identifying high-growth industries than just on rapidly growing stocks.

In other words, this category is meant to quantify the tailwinds that are steadily driving a stock (or even an entire sector) higher.

For example, look no further than meme stock darling Gamestop (GME).

GME’s share prices soared nearly 24% over the last six months. But since it’s selling physical games at brick-and-mortar retail locations, GME is essentially at the intersection of two dying industries. So its Growth score has topped out at a much less impressive 67/100.

Meanwhile, Nvidia (NVDA) has reached stratospheric valuations. But since it’s in the AI business, its Growth score remains pegged at 100/100.

A Practical Recipe for Beating the Market 3-to-1

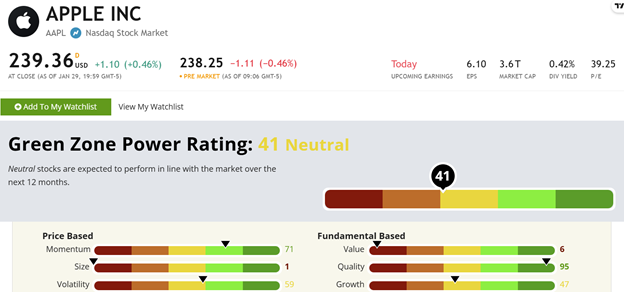

Once we have a score for each of these six categories, we simply add those scores together and average them out to get a stock’s Green Zone Power Ratings, like the one below for Apple (AAPL):

AAPL’s Green Zone Power Ratings in January 2025.

You might be surprised to see AAPL rating so low. But the numbers really speak for themselves here…

AAPL shares have already soared more than 209% over the last five years, but that momentum has decidedly slowed in the last year. Volatility is likewise unfavorable, with multiple extended declines over the last year.

AAPL still scores off the charts on Quality, and rightly so. Apple’s return on equity (ROE) — the measure of the financial performance of a company by dividing its net income by shareholder equity — is particularly strong.

But like the other mega-cap tech stocks, AAPL struggles with extremely low scores on Value (due to its premium valuation) and Size (due to its $3.6 trillion market cap). There’s very little room for AAPL to grow in either regard.

We learn all that from a quick glance at the stock’s rating.

Instead of spending hours researching “in circles” … instead of following a “hunch” or a hot tip from your broker, just use my free Green Zone Power Ratings HERE tool to shortcut hours of research.

If you stick to your discipline and invest only in “Strong Bullish” stocks, then you’ll be on track to beat the market 3-to-1.

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist, Money & Markets