There’s been a lot of “AI bubble” talk recently…

Valuations of certain Big Tech stocks are most certainly questionable after the incredible run we’ve seen in this bull market.

But there’s a silver lining to that story …

As investors ponder the risk-reward of trying to squeeze out the last drops of juice from the already-massive Big Tech AI players, a window of tremendous opportunity is now opening for the less obvious tech-adjacent companies – the ones that are both essential to the physical infrastructure necessary to power AI’s wildest ambitions, and that have incredible long runaways of growth still ahead of them, largely because of the capital expenditures Big Tech is practically forced to make as they compete in the AI arms race.

And a perfect example of that just showed up in my latest Green Zone Power Rating “New Bulls” screen…

An Unexpected AI Boom

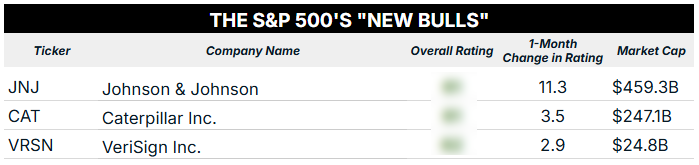

For a quick review, the criteria for this S&P 500 screen are:

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”),

- The stock must have been rated less than 60 for each of the last four weeks.

After running my screen, only one stock passed the 60-point threshold:

I want to talk about Caterpillar Inc. (CAT) for a moment here.

The first thing you likely think of when someone mentions “Caterpillar” is massive industrial equipment littered around construction sites in your community. Dump trucks, excavators, cranes … all painted that iconic Caterpillar yellow.

But Caterpillar’s business has expanded well beyond the limits of the construction yard … and it’s been making moves to assure an innovative edge in an otherwise “dull” market segment.

One of its biggest successes in recent years is related to, you guessed it, artificial intelligence! As the most popular Big Tech companies spend hundreds of billions of dollars to build out expansive data center facilities, they need more and more power to keep things running smoothly.

And one of Caterpillar’s lesser-known products — power-generation turbines — is helping to fulfill that critical need.

That’s leading creative-thinking investors to buy CAT stock hand over fist. Consider that since April, the stock has gained almost 85%, more than tripling the S&P 500’s 26% gain!

CAT Stock’s AI-Driven Boom

CAT’s market-beating momentum triggered a bullish cross on my Kinetic Profits Indicator as far back as early June. You can see where the green line crossed above the red line in the chart above.

With CAT shares now rated “Bullish” on my Green Zone Power Rating system, I expect this solid outperformance to continue.

Now, let’s move on to stocks that aren’t within the world’s most popular index…

Huge Ratings Moves Outside the S&P 500

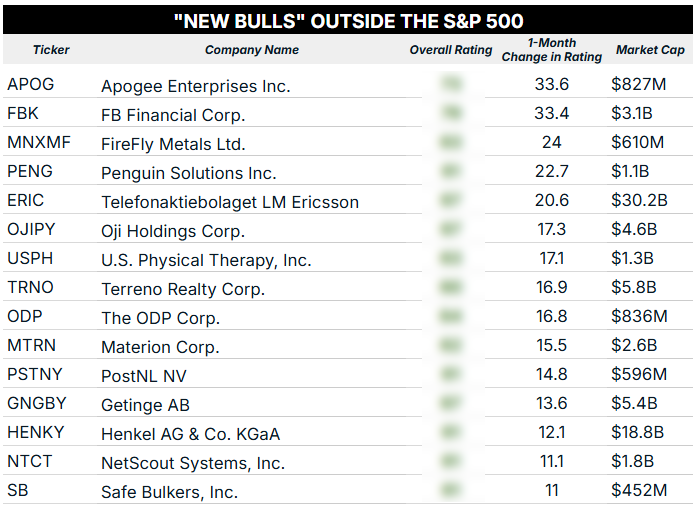

While running this week’s “New Bulls” screen on stocks outside of the S&P 500 index, I found 15 stocks that have improved ratings by at least 10 points or more in the last month!

Here’s that list:

These are some impressive ratings moves!

What’s more, only three stocks on the list above boast market caps greater than $5 billion.

With 12 of these stocks, we have a combination of rapidly improving ratings and smaller market capitalizations, meaning we could see strong outperformance as more investors buy in.

We’ve taken advantage of this exact phenomenon in my flagship Green Zone Fortunes investing service. By getting in ahead of the crowd on certain holdings, my subscribers have benefited greatly from “herding” — aka when the masses buy in after seeing some sustained price momentum.

If you want to look up any of these stocks in my Green Zone Power Rating system, you can gain full access with a Green Zone Fortunes subscription.

Once you’re in, look for this button on our homepage:

Then, search up any of these tickers — or any other stocks you can think of (my system tracks thousands).

To good profits,

Editor, What My System Says Today