We’re just over 48 hours from an all-but-guaranteed Federal Reserve interest rate cut…

With major indexes trading at all-time highs and President Trump hinting at “progress” on a trade deal with China, we’ve got plenty of positive news juicing the market right now.

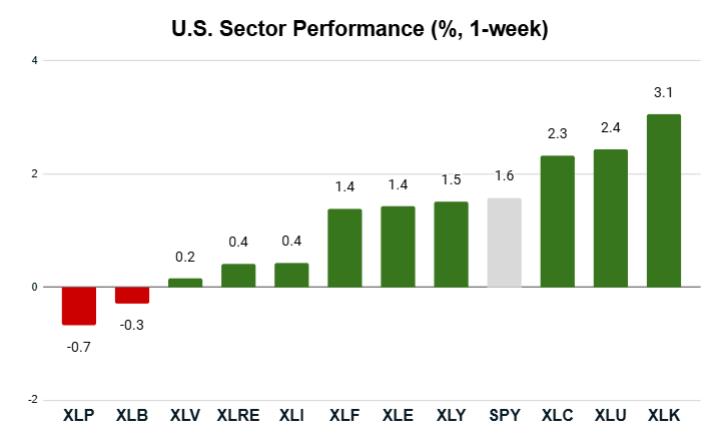

Looking at S&P 500 sector performance from last week, investors are clearly betting on a continued tech bull run heading into Wednesday’s Fed meeting:

Key Insights:

- The S&P 500 (SPY) charged 1.6% higher.

- Three sectors beat the S&P, while eight sectors lagged the broader index.

- Only two sectors closed the week lower, with consumer staples (XLP) clocking in the worst performance.

- The tech sector (XLK) beat the rest with a 3.1% gain.

When investors gain confidence that a bull market has room to run higher, there’s a good chance of two things happening: tech sector outperformance and consumer staples underperformance.

And that’s precisely what happened last week. Oracle Corp.’s massive 36% post-earnings pop showed us that the artificial intelligence (AI) mega trend is here to stay … and expanding to stocks outside of the Magnificent Seven.

Let me show you what I mean by looking at last week’s “big movers”…

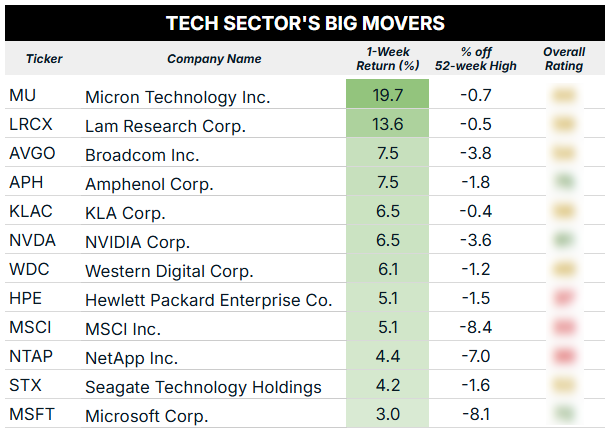

Tech Leads the Pack Again

The tech sector’s 3.1% gain last week almost doubled the S&P 500’s performance.

Below, you can see the tech stocks that gained at least 3% and closed within 10% of their 52-week highs:

Note: Oracle (ORCL) didn’t pass the screen on a technicality: after making a new 52-week high on Wednesday, shares finished the week 11% off that high on profit-taking. All told, the stock was still up 25% on the week – an absolutely massive gain for a $650 billion company!

That said, Oracle wasn’t the only tech company that had an incredible week!

Looking more broadly at the 12 stocks that passed my screen this week, six rate “Neutral,” three are currently “Bullish,” and three are “Bearish.” That’s about as balanced as it can get as far as distribution between my three categories.

Investors drove Micron Technology Inc. (MU) stock 19.7% higher following positive news for its AI data center business. Revenue on that front has increased significantly year-over-year, and Micron even raised its fourth-quarter 2025 guidance based on this growth. We’ll find out more in its next earnings call on September 23.

This is a significant turnaround for a stock that was stuck in a consistent downtrend. MU stock lost roughly 55% of its value from June 2024 to April 2025.

Since April’s low, MU has charged 144% higher!

While my Green Zone Power Rating system still has MU stock rated “Neutral,” the stock was identified as poised to outperform by my Infinite Momentum Alert system in late August — with a 35% gain since August 22, it’s the top-performing position in the service’s “Tech Titans” portfolio.

As always, if you want to dig in and look up where these stocks land within my system, click here to see how you can join up in Green Zone Fortunes now. With interest rates likely coming down this week, it’s a great time to look for new “Bullish” buys.

Let’s move on to the worst-performing sector last week…

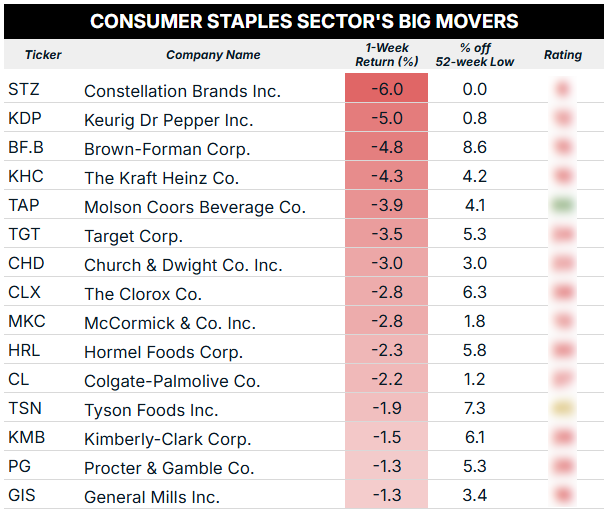

Consumer Staples Lag

When you see the tech sector leading the charge, there’s a good chance a defensive sector like consumer staples (XLP) will do the opposite.

It’s natural, considering investors want to follow the bullish action, and there’s only so much money to go around.

With that said, here are the 15 consumer staples stocks that lost -1% or more and closed within 10% of their all-time lows:

The big trend I will note with the stocks above is that 13 rate “Bearish” or “High Risk” in my Green Zone Power Rating system.

That’s rough!

This isn’t a “sell all staple stocks” moment, but it does point to broader underperformance in the months ahead.

To good profits,

Editor, What My System Says Today