AI disruption is the center of the financial world right now.

In one week, the term “AI” was used in the quarterly earnings calls of Meta, Alphabet, Microsoft and Amazon 168 times.

By the next week, there were 1,072 mentions of AI across all earnings calls for first-quarter 2023.

This appears to show the growing mania for artificial intelligence in corporate America. But I think it shows much more than that.

While AI is the latest investment buzzword, the growing mentions of the term show an increased thirst for technology to change how business gets done.

Today, I want to focus on a particular industry in dire need of more efficiency. You’d probably never guess AI would be coming to this centuries-old business, but there’s plenty to suggest it will.

And I’ll use our Green Zone Power Ratings system to find one stock leading the charge…

AI Is Innovating Insurance

Dealing with insurance companies can be challenging. Everything from filing a claim … to getting a resolution, good or bad … and either accepting or appealing the result can involve a lot of time and correspondence.

But right now, insurance companies are working to use technology to improve the efficiency of the entire industry.

This effort is called “insurance distribution.” It focuses on improving the overall insurance model … from communications with claimants to automating processes.

And the insurance distribution market in the U.S. is growing every year:

The value of the insurance distribution market was $195.2 billion last year. By 2026, that value will jump to $261.6 billion — a 34% increase in just four years!

These projections though, strong as they are, likely don’t consider the swift disruption that AI brings to the table.

That’s why today, I want to highlight and recommend Sapiens International Corp. N.V. (Nasdaq: SPNS).

Green Zone Power Rating: SPNS

Sapiens is an Israeli-based company specializing in providing software solutions for the insurance industry.

Its software is used by companies that work in property and casualty, life, pension, annuities and retirement markets.

And, yes, it recently announced a partnership with Microsoft Corp. to integrate AI into its software.

SPNS stock had been on the rise before that announcement, up nearly 19% from a month ago. This piece of AI news only accelerated its climb.

But does the Green Zone Power Ratings system clear it? Let’s see…

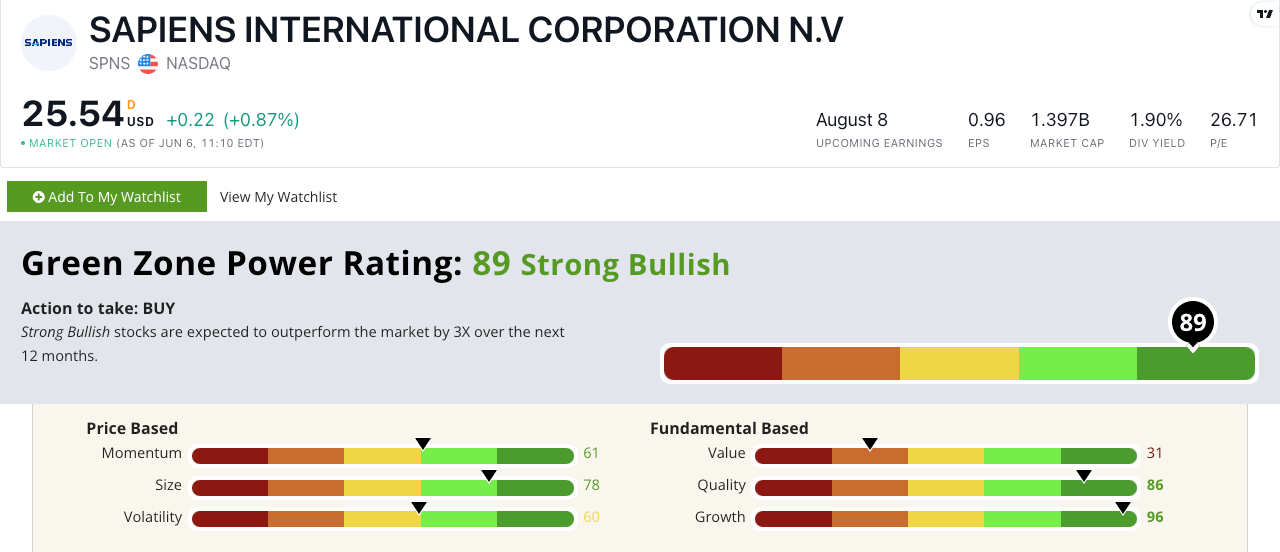

SPNS Green Zone Power Rating in June 2023.

SPNS rates 89 out of 100 on our proprietary Green Zone Power Ratings system. That means we are “Strong Bullish” on the stock and expect it to outperform the broader market by 3X in the next 12 months.

The stock scores high on our growth metric (96) … and its recent quarterly report shows why:

- Quarterly revenue of $124.7 million — a 6% increase from the prior year.

- Gross profit of $53 million — up 7.3% from the same quarter a year ago.

- A 100 basis-point increase in operating margin and 14.2% jump in operating income.

Investors responded favorably to the quarterly numbers:

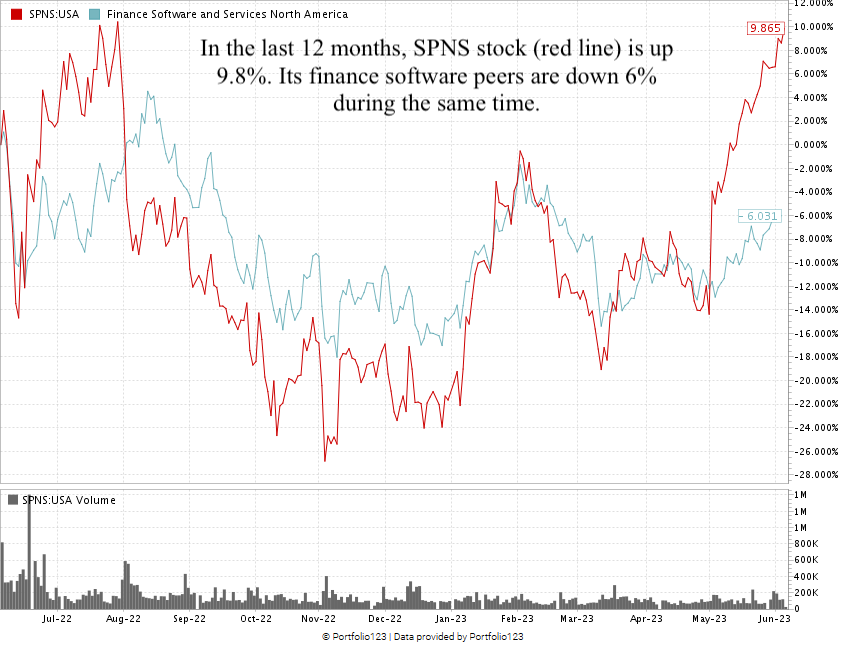

Created in June 2023.

As you can see from the chart above, SPNS is up 9.8% over the last 12 months. Its peers are averaging a 6% loss over the same time.

Focusing on its 52-week low in November 2022, the stock has climbed 50.3% to where it is as I write.

That shows solid strength in momentum, but I believe the stock has more room to run.

Bottom line: The insurance industry continues to adopt new technology to become more efficient.

SPNS is leading the charge by implementing a partnership with Microsoft to integrate AI into its software platform.

That’s a great reason to add SPNS to your portfolio today.

Stay Tuned: How to Find Great $5 Stocks

You might remember that earlier this year, we at Money & Markets were diving deep into the world of $5 stocks and why they make an incredible investment opportunity today.

Tomorrow, Adam will share his process for identifying the best of the best, and show you how you can do the same with our free-to-use Green Zone Power Ratings system.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets