AI fatigue.

It’s a phrase I’ve been hearing a lot…

At its core, AI fatigue is the mental and operational exhaustion resulting from the overwhelming pace of artificial intelligence advancements, leading to burnout, stress, and difficulty keeping up with new tools, updates, and constant change.

In a sense, it is a response to information overload, unrealistic expectations, and the fear of job displacement.

While AI fatigue is a genuine concern in general, it is equally relevant for investors.

AI fatigue in the stock market occurs when there is a shift in investor sentiment, where initial euphoria and indiscriminate buying of any company associated with artificial intelligence give way to skepticism, caution, and a more discerning approach.

The question becomes: When will AI fatigue set in for investors… or has it already?

Let’s dive in…

Is The AI Run Coming To An End?

Artificial intelligence stocks have driven a 78% gain in U.S. equity markets over the last three years, led by the “Magnificent 7.”

Just as with any investment, when you put your money into something, you expect a positive return on your investment.

However, many investors are concerned about AI’s ability to deliver the massive changes to the American economy once expected — and the huge profits that come with that.

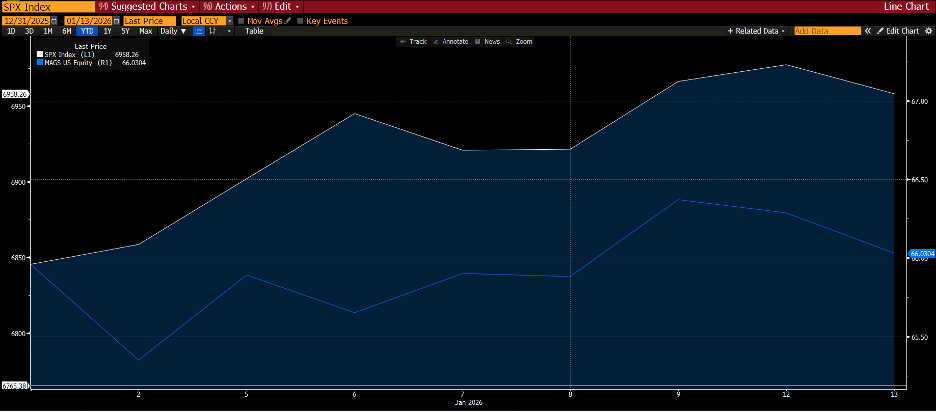

We need only look at the performance of the S&P 500 compared with that of the Roundhill Magnificent 7 ETF (MAGS) since the start of the year:

Benchmark Outperforms Mag 7 To Start 2026

In the chart above, the white line is the performance of the S&P 500 since the start of the year. The blue line is the performance of MAGS.

As you can see, the benchmark got off to a strong start, while Mag 7 stocks stumbled out of the gate.

While one week does not make a trend, we can zoom out to see how real AI fatigue in the stock market truly is…

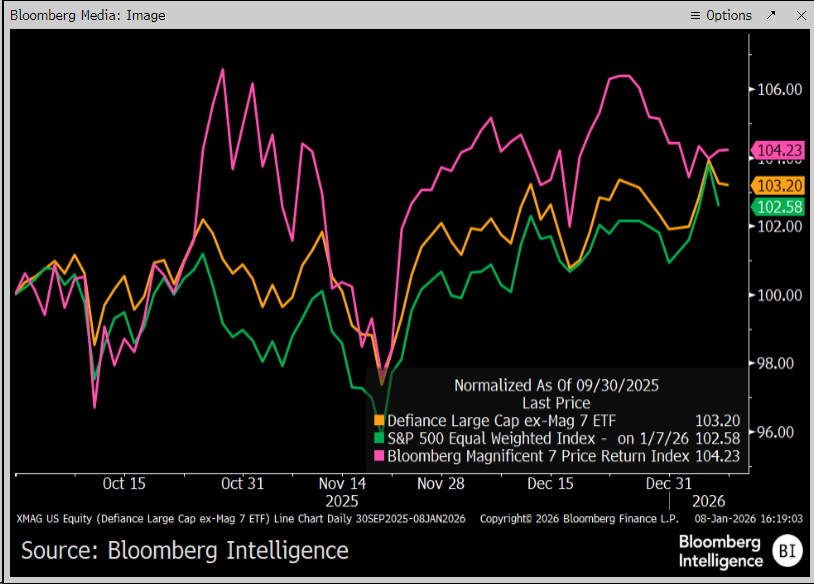

Mag 7 Stocks Continue To Top Benchmark

The Bloomberg Magnificent 7 Index is up about 4.2% since October 2025, on an equal-weighted basis. The equal-weighted S&P 500 is only up 2.6% and the Defiance Large Cap ex-Mag 7 ETF (XMAG) — a large-cap index without Mag 7 stocks — has gained 3.2%.

On the surface, it can be argued that Mag 7 stocks (thus, the AI trend) still have plenty of fuel left to run.

However…

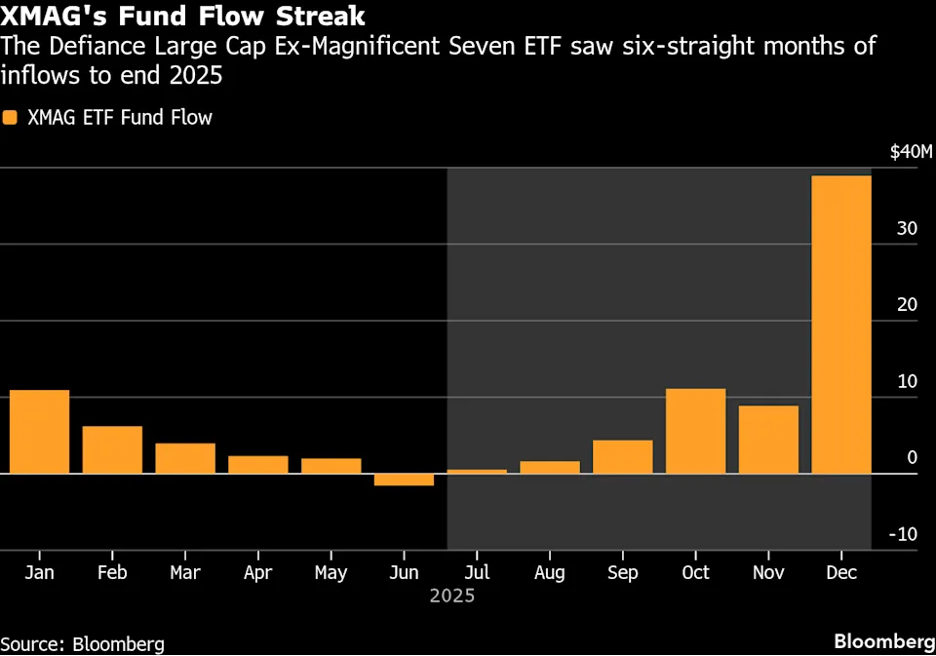

At the end of December, XMAG notched its most significant inflow of 2025 — nearly $40 million.

That capped off six straight months of inflow increases for the fund, which does not include the Magnificent 7 stocks.

This suggests more investors are rotating away from Mag 7 stocks and into the remaining 493 stocks in the benchmark.

The top 10 companies on the benchmark by market cap contribute to 40% of the S&P 500 gains, while the top 10 companies based on earnings contribute 27%.

While it is still too early to tell if AI fatigue is setting in among investors, signs indicate that traders are starting to shift out of Mag 7 and AI stocks and into the rest of the market.

And, that’s not necessarily a bad thing when you consider how concentrated the S&P 500 gains are relative to AI stocks.

That’s all from me today.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets