There’s been one big story in the technology sector this year.

Artificial intelligence, aka AI.

From the release of OpenAI’s ChatGPT interface in late 2022 to the disruptive leadership changes at that company a year later, AI has dominated our news feeds.

AI has prompted governments around the world … including here in the U.S. … to take a hard look at their own technology and industrial strategies. Businesses are also evaluating how work at every level is done.

And, while 2023 will likely go down as the year AI took the world by storm, the clouds are only just now brewing for a monumental change in how this innovative tech impacts us all.

Today, I’ll look at the challenges facing AI, both as a productivity tool and as an investment, as we head into 2024.

AI Security Is Still a Top Concern

A 2021 survey published by Morning Consult revealed interesting thoughts we have on AI’s implementation.

The biggest concern regarding the use of AI in everyday life was countries or businesses using it irresponsibly.

A close second was losing personal privacy.

Fast-forward to November 1, 2023. 451 Research asked people in business their largest concern over using AI and/or machine learning in their infrastructure.

The results were interesting:

More than one-fifth of those surveyed said that security around AI was their biggest concern for implementing it into their existing infrastructure.

That was even more than the cost, reliability, storage capability or ease of use.

Companies implementing AI into their products — either for internal or external use — will have to develop strict security measures to assuage the fears of data leaks, misleading information and cloud security in the coming year.

This tells me that security around using AI has become the biggest concern of not only businesses but individuals.

AI for the Investor

If you’re asking the best way to invest in AI, it becomes a little more complex.

Most companies developing AI tools — like OpenAI — are private and thus have no stock to buy.

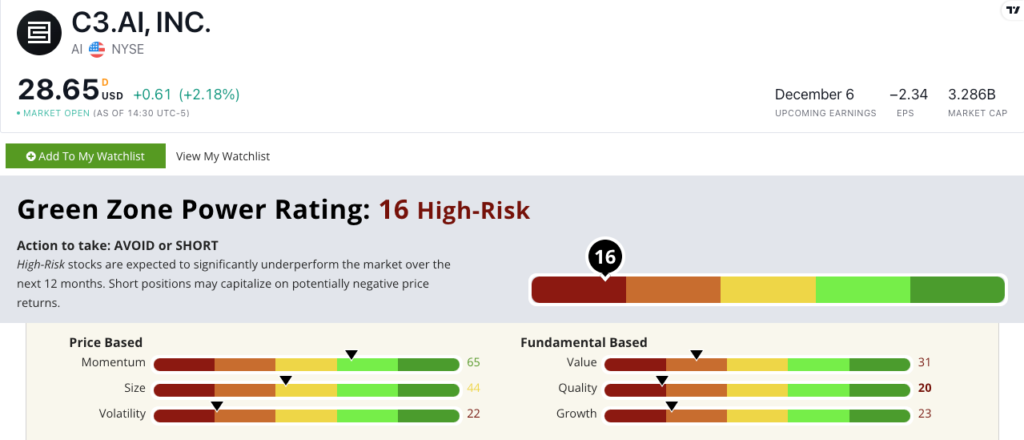

One publicly traded company— C3.ai Inc. (NYSE: AI) — hasn’t made many strides toward becoming investable, according to our Green Zone Power Ratings system:

The company struggles with poor ratings on 5 of the 6 factors we use in the system.

It has not turned a profit since going public in 2020 — leading to its “Bearish” ratings on Value, Quality and Growth.

The stock moves up and down frequently which is why it rates a 22 on Volatility.

These low ratings tell us this is a company to avoid as it is expected to underperform the broader market over the next 12 months.

There are other ways to invest … indirectly.

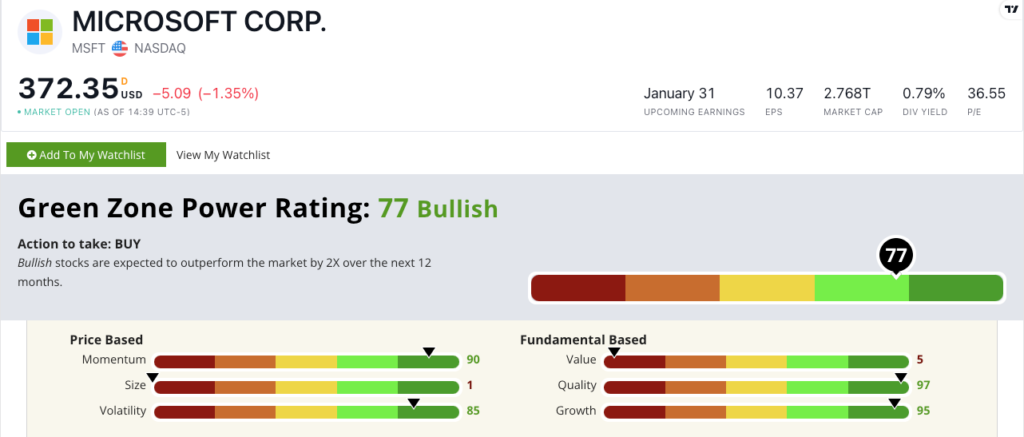

Looking for companies whose sole focus isn’t AI, but is developing AI tools. One such would be Microsoft Corp. (Nasdaq: MSFT).

The company scored a big coup by hiring former OpenAI CEO Sam Altman to lead Microsoft’s AI research team … which reversed when Altman returned to OpenAI just before Thanksgiving.

I don’t think that Altman returning to the company he founded is a blow to Microsoft considering MSFT has invested billions into OpenAI.

Microsoft Corp. rates a “Bullish” 77 out of 100 on our Green Zone Power Ratings system.

Aside from being a large company — with a $2.7 trillion market cap — and being overvalued (as most tech companies are), MSFT is strong fundamentally and comes with solid momentum and low volatility.

Bottom line: AI is the latest craze in the tech world.

But there are still plenty of concerns related to implementing AI into our daily lives.

As investors, it’s important to know what those concerns are and do your homework before deciding what to add to your portfolio.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets