My wife and I recently made our annual pilgrimage back to Kansas for our grandson’s third birthday.

In our younger years, my wife would insist we drive 17 hours from the Carolinas or, even worse, 23 hours from our current digs in South Florida — something I’m glad we are too old to do now.

Instead, thanks to lower airfares, we’re taking advantage of the convenient flight … plus there’s no wear and tear on our vehicle and no arguing over stretch breaks.

This trip was seamless. We had an early morning flight to avoid potential delays or cancellations (a fun flight hack for you).

Judging by how crowded the airports were, air travel is back after the COVID pandemic lockdowns threatened to stifle the entire industry.

Our trip got me thinking about the status of the airline industry in the U.S.

What I found out was very interesting…

Travel Is Up, But Airlines Stocks Aren’t Seeing a Payoff

It stands to reason that if demand for something is up, stocks related to it would be up, too.

That’s not the case for the airline industry.

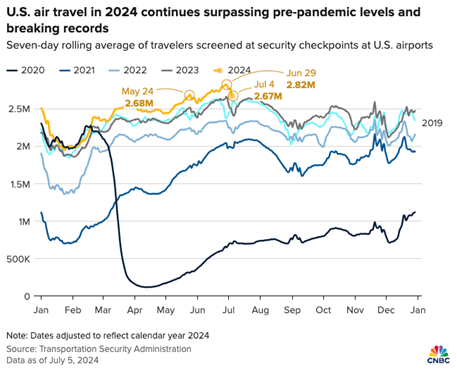

According to the Transportation Security Administration, the number of travelers passing through U.S. airports in 2024 is at its highest point since 2020:

For the week ending June 29, 2024, nearly 3 million people passed through U.S. airport checkpoints — more than 5X those 2020 pandemic lows.

Another 2.7 million were screened during the Fourth of July holiday week.

One reason for increased travel is ticket prices. According to the latest consumer price index data, the average airfare decreased 6% from the same time a year ago.

But airfare declines and more passengers have not translated to stronger performances for U.S. airline stocks:

While the S&P 500 has jumped roughly 26% over the last 12 months, the NYSE Arca Airline Index (green line) — an index tracking 16 mainly U.S. airlines — is down almost 28%.

The three more prominent U.S. airlines are also lagging behind the broader index:

- Delta Air Lines Inc. (NYSE: DAL) — down 3%.

- United Airlines Holdings Inc. (Nasdaq: UAL) — down 13.6%.

- American Airlines Group Inc. (Nasdaq: AAL) — down 38.3%.

Increased costs (think, fuel and staffing) have provided a headwind to airline bottom lines.

Let’s look at one of those underperforming airline stocks through the lens of Green Zone Power Ratings…

Green Zone Power Ratings Journey: Delta Air Lines Inc.

In 2023, Delta Air Lines Inc. (NYSE: DAL) was one of the largest U.S. airlines by market share. It held 17.3% of the U.S. market — second to American Airlines (17.5%).

Despite a 3% drop, DAL stock is also the best-performing major U.S. airline stock over the last 12 months. The company is set to report its second-quarter earnings on Thursday.

DAL Moves Into “Neutral” Territory

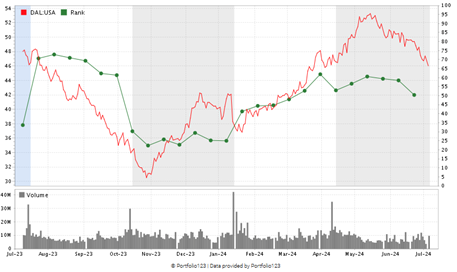

DAL stock rates 43 out of 100 on Adam O’Dell’s Green Zone Power Ratings system. That means we are “Neutral” on the stock and expect it to perform in line with the market over the next 12 months.

A year ago, the stock was in “Bullish” territory, but a late-year dive in the stock price dropped it to “Bearish.”

DAL climbed 68% from its 52-week low in October 2023 to its 52-week high in May 2024, but it’s pared back 12% since reaching that high.

Regarding individual factors, DAL rates “Bullish” on Value, Growth and Momentum. Its roller-coaster ride over the last 12 months earns it a 29 on Volatility. (Click here to view its full ratings page.)

Bottom line: More Americans are traveling this summer, but inflation has cut into airline profit margins in a big way.

Higher fuel and employee costs are making it difficult for U.S. airlines to expand their bottom lines.

While being one of the best-performing airline stocks, Delta Air Lines has struggled to capitalize on its strong performance at the beginning of 2024.

That, coupled with a “Neutral” rating on our Green Zone Power Ratings system, tells me that now is not the time to put DAL in your portfolio.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets