Will they or won’t they?

On Wednesday, the Fed will decide whether to keep rates steady or to cut them.

And from the looks of things, Mr. Market considers a cut a foregone conclusion. The futures market is pricing in an 88% probability that the Fed cuts its benchmark rate by 0.25%.

Of course, a single 0.25% cut isn’t going to move the needle much. Investors are going to be far more interested in Chairman Jerome Powell’s outlook for 2026. And judging by the market’s action last week… they’re not exactly sure what to expect.

Technology stocks tend to be sensitive to interest rates because, as growth stocks, they are priced based on what investors expect their earnings to be years or even decades in the future … and higher interest rates make the value of future earnings worth less in today’s dollars.

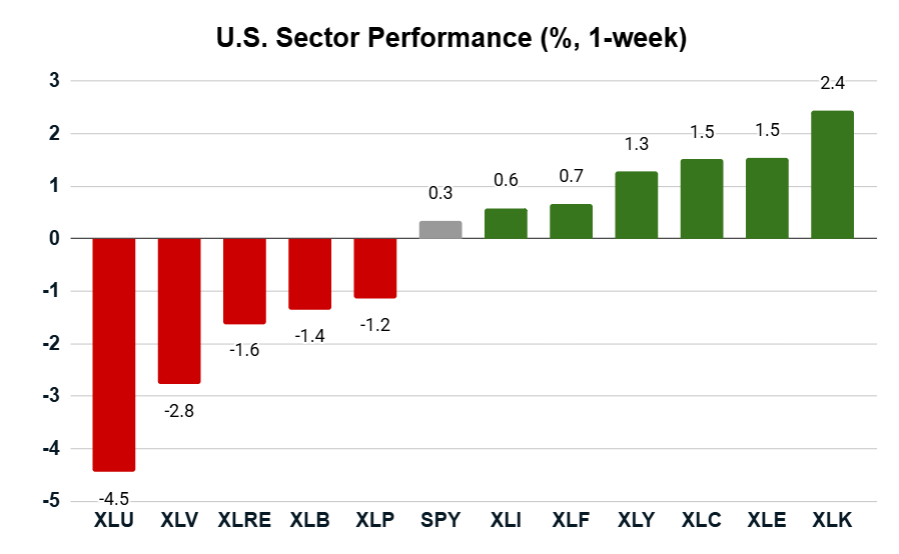

The Technology Select SPDR ETF (XLK) was the strongest performer last week, up 2.4%, following a previous week in which it was up a solid 5.2%.

So, that’s a sign that investors are expecting an accommodative Fed, right?

Maybe.

But then, utilities stocks, as high-dividend payers (typically), are also highly sensitive to interest rates, and the utilities stock got slaughtered last week, down 4.5%. And real estate stocks – which are equally interest-rate-sensitive – were also down 1.6%.

Of course, the Fed isn’t the only factor. Investors are also weighing in on the sustainability of the AI boom. But even here, we’re getting mixed signals. Utilities have been riding high this year due largely to the fact that data centers are massive energy hogs. So, weakness in utilities doesn’t make a lot of sense if investors are bullish on tech.

All this said, it’s always a mistake to read too deeply into a single week’s worth of data, as there is always a degree of random noise (more so than “signal,” actually). But as I have been emphasizing for the past several weeks, this suggests a market in transition and searching for direction.

What does that direction look like?

We may know more on Wednesday after picking through Powell’s post-meeting comments.

But in the meantime, why don’t we do a deeper dive into best-performing and worst-performing sectors to see what insights we can glean?

Key Insights:

- Tech stocks were the best-performing sector last week.

- Some of this is due to enthusiasm over an expected Fed rate cut.

- The market is sending mixed signals over the direction of interest rates.

Buy the Dip in Tech?

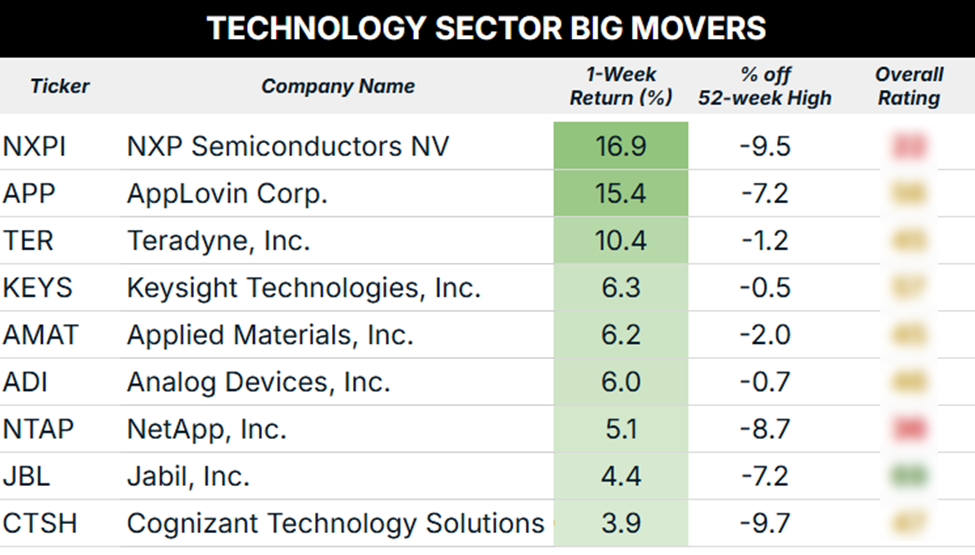

I screened for the biggest winners of the week that are now trading within 10% of their 52-week highs. We’re looking for strong stocks that are trending higher.

I’ll be straight with you.

The results don’t look all that great. Of the nine stocks that were up the most last week, only one – Jabil, Inc (JBL) – rates as “Bullish” on my Green Zone Power Rating system. All the rest are either “Neutral” or “Bearish.”

Jabil Inc. (JBL) provides engineering, supply chain, and manufacturing solutions to some of the world’s leading brands, and the company is a key beneficiary of the reshoring trend. Companies bringing their manufacturing closer to home need Jabil’s expertise in setting it up.

Jabil rates particularly strongly on its momentum, growth and quality factors.

Utilities Can’t Catch a Bid

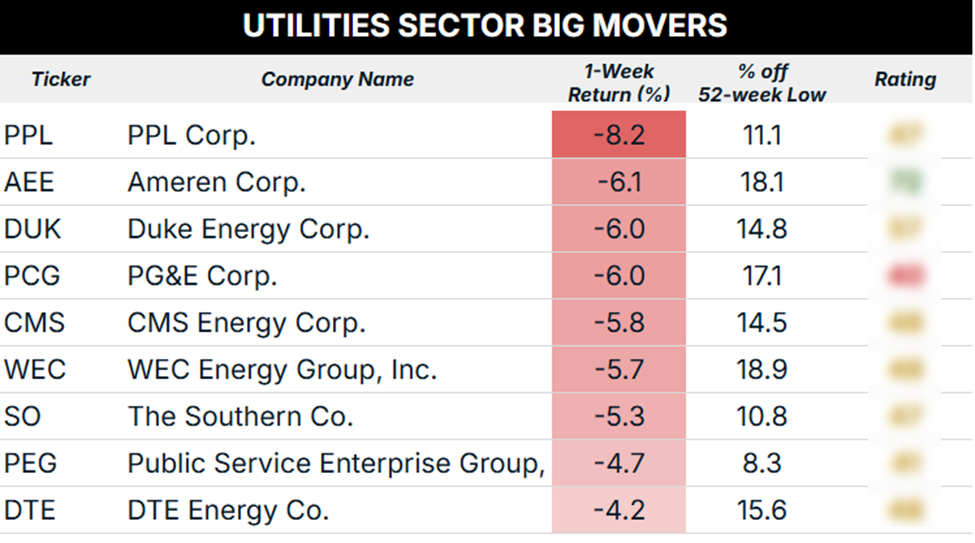

Utilities have had a great year, up about 14% as a sector this year. But they’ve been trending lower for about seven weeks now, and they’ve clearly lost their momentum.

Normally, I would run a screen of the worst-performing utility stocks last week that are within 10% of their 52-week lows. Well, if I stuck to that rule, I wouldn’t have much of a list this week. Most of the worst-performing utilities this past week are still significantly above their 52-week lows due to the sector’s strong performance this year.

All the same, might there be any hidden gems in the utilities sector?

Perhaps one.

There’s not much to see on this list, as seven of the nine rate as “Neutral” on my Green Zone Power Ratings system. Only one – Ameren Corp (AEE) – rates as bullish.

Ameren, an electricity and gas provider in Missouri and Illinois, is one of the lowest-drama stocks you can own, with a volatility factor rating of 92.

But despite its conservatism, Ameren is no slouch on growth. It rates a very impressive 88 on its growth factor rating. It also sports a dividend yield of just under 3%. While not exceptionally high, it’s going to be more and more competitive with bond yields as the Fed continues to cut rates … as we expect it to on Wednesday.

To good profits,

Adam O’Dell

Editor, What My System Says Today