Welcome to Friday’s earnings edition of What My System Says Today.

Today, I’m going to revisit an earnings call I made last week before I get into “bullish” and “bearish” earnings for next week.

First, I would like to discuss the government shutdown.

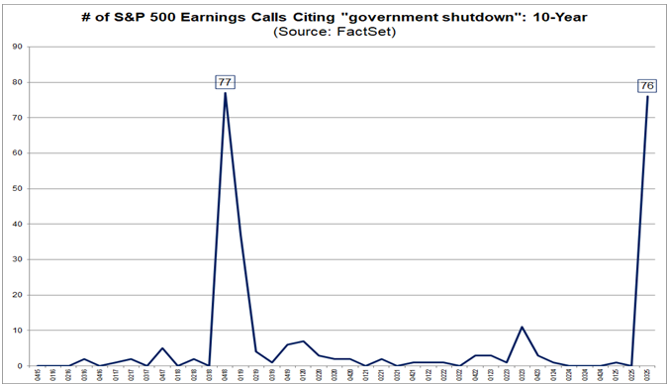

Yes, it mercifully came to an end this week, but it’s interesting to see how companies have responded to the longest shutdown in U.S. history during their earnings calls.

According to data firm FactSet, 76 S&P 500 companies have cited “government shutdown” in their earnings reports. That’s only slightly lower than the 77 who mentioned it during the last shutdown (2018-2019).

Of those 76, 29 reported seeing little to no impact from the shutdown, while 22 companies stated that they had included potential implications of the shutdown in their quarterly and full-year guidance.

At the sector level, industrials led the way, with 25 companies mentioning the shutdown, followed by information technology with 13, and financials with 12.

It will be interesting to see how the longest shutdown in U.S. history impacts earnings for the rest of the year.

Now, I’d like to turn your attention to an earnings call I made last week and how it played out…

The Pain For Disney

In last week’s “bearish” earnings analysis, I zeroed in on The Walt Disney Co. (DIS) as the company was projected to see its EPS fall nearly $2 quarter over quarter.

I mentioned the two key metrics to watch in the earnings report were revenue from its entertainment and experiences segments, as well as the subscriber count for its streaming services.

Both its entertainment and experiences segments fell short of analysts’ expectations. Disney reported entertainment revenue of $42.4 billion for the quarter, while Wall Street expected $42.7 billion.

The experiences division earned $36.1 billion for the quarter; however, consensus expectations were slightly higher at $36.2 billion.

As for subscribers, Disney reported increases for its Disney+ and Hulu services, but the total figure ($195.7 billion) came in well below estimates of $218.4 billion.

Wall Street was expecting a slight downturn, and I agreed. That’s what happened.

For what it’s worth, Disney’s EPS came in at $1.11, beating expectations of $1.05.

Turns out, revenue issues for the entertainment division won’t stop with this quarter. The company estimates that big-budget movie releases will reduce earnings for the next quarter by $400 million.

The result of this latest mixed earnings report was a 9% drop in DIS in early Thursday trading.

Now, let’s focus on next week’s potential “bullish” earnings…

“Bullish” Earnings to Watch

These stocks are expected to beat their previous quarter’s earnings per share (EPS), and thus, if those expectations are met or exceeded, they could potentially trade higher.

For this screen, stocks must meet four criteria:

- 10 or more analysts cover the stock.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

Here are six companies that made this week’s list:

Obviously, the first name that should stand out on the list is NVIDIA Corp. (NVDA).

The AI trade darling is projected to beat its previous quarter’s earnings by $0.17.

If that holds, it would be the second consecutive quarter of EPS increases. First-quarter earnings halted a 10-quarter run of increases.

NVIDIA earnings have been among the most-watched earnings calls on the market due to their connection to artificial intelligence.

Wall Street will be watching to see if there is more steam in the AI trade, and they’ll be using NVDA’s earnings as a barometer.

NVIDIA will top the EPS estimate, but not by a significant margin.

That will not only maintain excitement over the AI trade but could lift NVDA out of the “Neutral” zone of Adam’s Green Zone Power Ratings system.

Now, let’s switch gears and look at potentially “bearish” earnings for next week.

“Bearish” Earnings to Watch

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

Here are six companies that passed this screen:

The most notable aspect is the presence of numerous major retailers on the list.

Target Corp. (TGT), Walmart Inc. (WMT) and discount retailer Ross Stores Inc. (ROST) are all projected to report EPS lower than the previous quarter.

Deere & Co. (DE) and Lowe’s Companies Inc. (LOW) also make the list.

One reason is that tariffs have significantly increased the costs these retailers incur when importing products from overseas.

These increased costs have impacted bottom-line profits and earnings per share.

The interesting thing to watch from all of these companies is their guidance for the rest of the year and into 2026.

I want to see how management plans to contend with these increased costs.

Some interesting earnings to watch for next week.

That’s all from me today.

I hope you all have a great weekend.

Until next week…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets