Are you interested in Alphabet stock? Our system can help you determine if it deserves a spot in your portfolio.

Alphabet Inc., the parent company of Google, is one of the largest tech companies in the world with a market cap just under $1.2 trillion.

As such, it is no surprise that investors around the world are keen to get insights into what this powerhouse has in store for 2023 and beyond.

Let’s take a look at some of Alphabet’s most important businesses, as well as its outlook for the upcoming year.

Finally, we’ll run GOOGL through our proprietary Stock Power Ratings system to see how its set to perform over the next 12 months.

Google Search and Ads

Google Search and advertising remain the backbone of Alphabet.

The company has been able to maintain its dominant position by continually improving its search algorithms and expanding its portfolio of online advertising products.

Additionally, Google has been able to capitalize on emerging trends such as voice search, mobile search, and image search — allowing it to stay ahead of the competition and increase revenue from ads.

Other Google Divisions Help Alphabet Stock

But Alphabet hasn’t stopped there.

Google owns a portfolio of top tech properties including YouTube, Android, Gmail, Maps and more.

This division also includes hardware products such as Pixel phones and Chromebooks which grown in recent years.

These divisions and other products contributed nearly 34% to Alphabet’s total revenue in 2020, and it’s helped boost Alphabet stock. But now it’s costing more to keep everything running.

Alphabet Cloud Services

Alphabet Cloud Services (GCP) provides cloud computing services to customers around the world. This business accounted for 10% of Alphabet’s total revenue in 2020 and is expected to continue growing at an impressive rate due to increasing demand from businesses who are looking to move their IT infrastructure off-site or into “the cloud”.

Alphabet’s cloud business brought in $6.86 billion in revenue for the third quarter of 2022, up 37% from the same quarter in 2021!

GCP has become an increasingly important part of Alphabet’s strategy with investments in data centers across multiple countries.

But with everything costing more to keep running, Alphabet stock has struggled.

Alphabet Stock Power Ratings

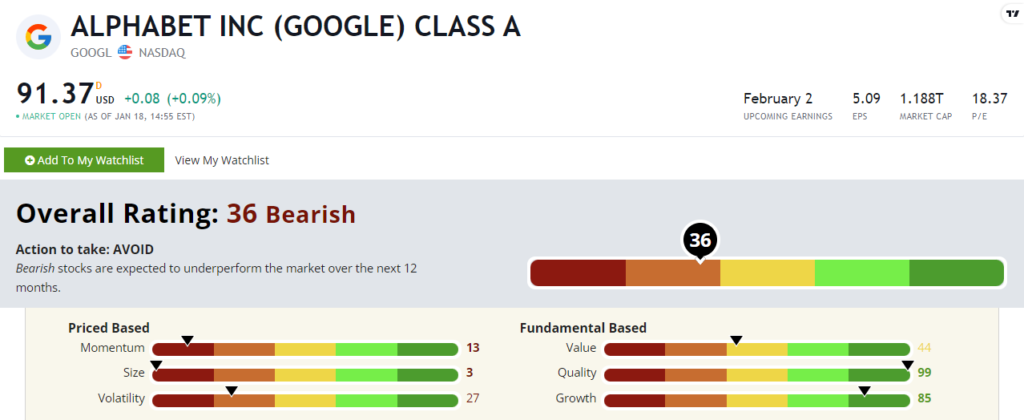

Alphabet stock rates a “Bearish” 36 out of 100. That means our system expects the stock to underperform the broader market over the next 12 months!

I want to focus on GOOGL’s price-based factors (momentum, size and volatility).

Over the last year, Alphabet stock has lost more than 32% of its value after investors bid it up post-COVID. That explains its lowly 13 out of 100 on our momentum factor.

And with a $1.2 trillion market cap, GOOGL is still one of the largest companies around. You won’t see a small-cap bump investing in Alphabet stock!

Bottom Line: Overall, Alphabet remains one of the most powerful companies in technology today with a wide range of products that span across multiple industries.

But 2023 looks like it could be a rough year for Alphabet stock, according to our Stock Power Ratings system.

Do you own GOOGL, or is it on your watchlist? Let us know by emailing StockPower@MoneyandMarkets.com.