The other night I was awakened from my slumber with an overwhelming realization.

I forgot my sister’s birthday.

It was almost three in the morning, and I had plans to meet with her the next day for lunch.

There were a few issues:

- I didn’t have time to rush to the store and pick out something she would hate.

- My sister is incredibly picky.

Then I remembered her Amazon Wishlist.

I found exactly what she wanted … and it was delivered before her birthday lunch.

And she loved it.

This is not the first time Amazon bailed me out — I know it will not be the last.

However, its second Prime Day performance shows even a massive company like Amazon isn’t immune to inflation … and may need saving of its own.

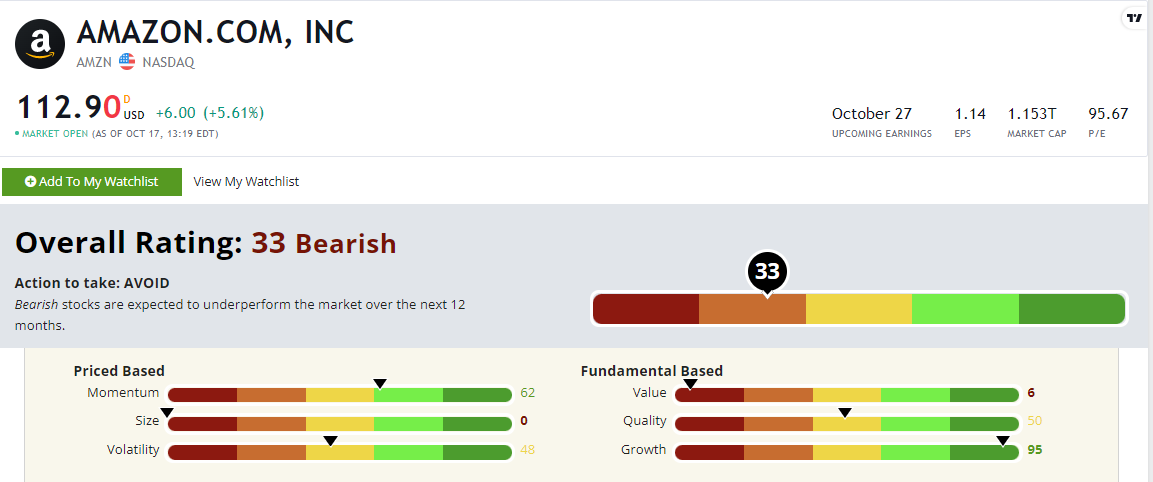

Amazon rates a “Bearish” 33 out of 100 on our proprietary Stock Power Ratings system, and we’ll get to its breakdown in a second.

First, let’s take a closer look at Amazon’s latest promotional flop.

Amazon’s Second Prime Day Flop

Amazon’s Prime Day in July offers discounted deals for its premium subscription members.

This year’s July sale brought in an estimated $7.5 billion in revenue.

Amazon executives wanted to repeat this process to see if subscribers would enjoy two sales a year and fight off some inflationary pressures.

Last week, Amazon announced a 48-hour Prime Early Access sale.

And it flopped.

Compared to July sales, Bank of America analysts estimate that the two-day event only made $5.7 billion.

Klover, a commerce data company, reported that transaction frequency was down 30% between this and July’s event.

Most categories in Amazon’s catalog saw declines as well.

This is detrimental to the company as it tries to confront its slowing revenue growth, due in part to inflationary pressures.

Let’s take a closer look at our Stock Power Ratings system to see how its stock is holding up.

Amazon Stock Power Ratings and Value

No company can escape inflation.

Amazon is no exception, as shown by its recent Prime Early Access sale’s flop.

AMZN’s Stock Power Ratings in October 2022.

Amazon rates a “Bearish” 33 out of 100 on our Stock Power Ratings system.

Let’s get into some numbers here and take a closer look at Amazon’s poor value rating.

Its price-to-earnings ratio is 101.83, while the industry average is 22.24.

Amazon’s price-to-book value is nearly double the industry average.

This all means that compared to its peers, Amazon is significantly overvalued!

That’s why Amazon earns a 6 on our value factor.

The Bottom Line

Amazon scores a “Bearish” 33 out of 100 on our Stock Power Ratings system. We expect it to underperform the broader market for the next 12 months.

But that’s the power of our Stock Power Ratings system. There are thousands of other stocks you can find ratings for.

With that in mind, “Strong Bullish” stocks are no anomaly.

We expect those stocks to beat the broader market by 3X in the next 12 months!

To get one highly rated stock you should consider investing in, check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock to buy or avoid on our system and tells you why — for free!